Chapter 5

The Accounting Cycle: Adjustments

127

At the end of June 2016, CG Accounting had to make the following adjustments.

Jun 30 The prepaid insurance represents a one-year policy that started in June. One month

has now been used.

Jun 30 When examining the balance of unearned revenue, Catherine determined that $450

has now been earned.

Jun 30 Interest has accrued on the balance of the bank loan for the month.The loan interest

rate is 10%. (For simplicity, round the interest to the nearest whole number.)

Jun 30 Depreciation on the equipment for the month must be recorded.The equipment is

depreciated using the straight-line method.The equipment is expected to last five

years and will have no residual value

Jun 30 Catherine started an audit for a new client.The contract is for 20 days of work

starting June 21. At the end of the contract, the client will pay CG Accounting

$1,800. Accrue the revenue earned for June.

Required

a) Complete the worksheet.

b) Complete the journal entries for the adjusting entries and post them to the general

ledger.

See Appendix I for solutions.

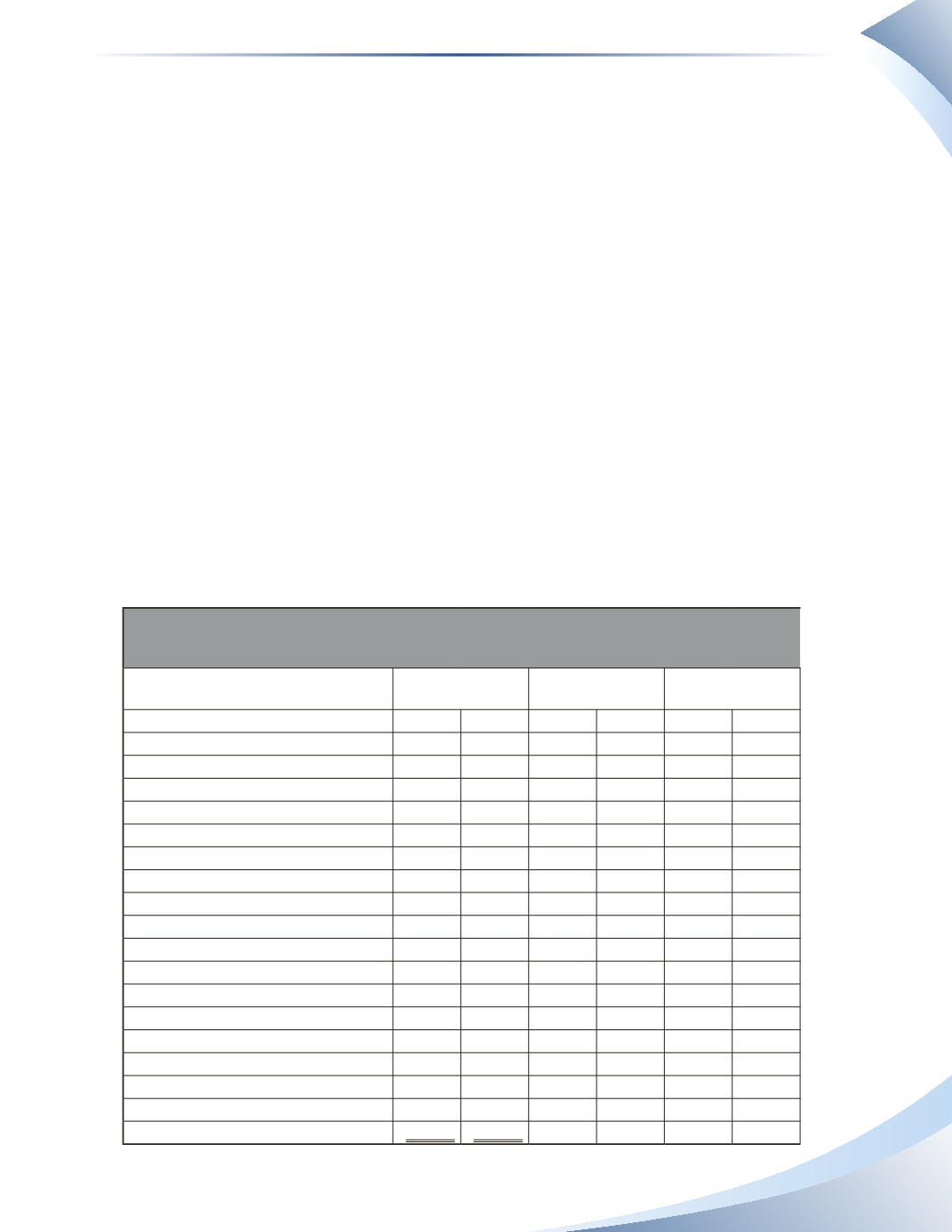

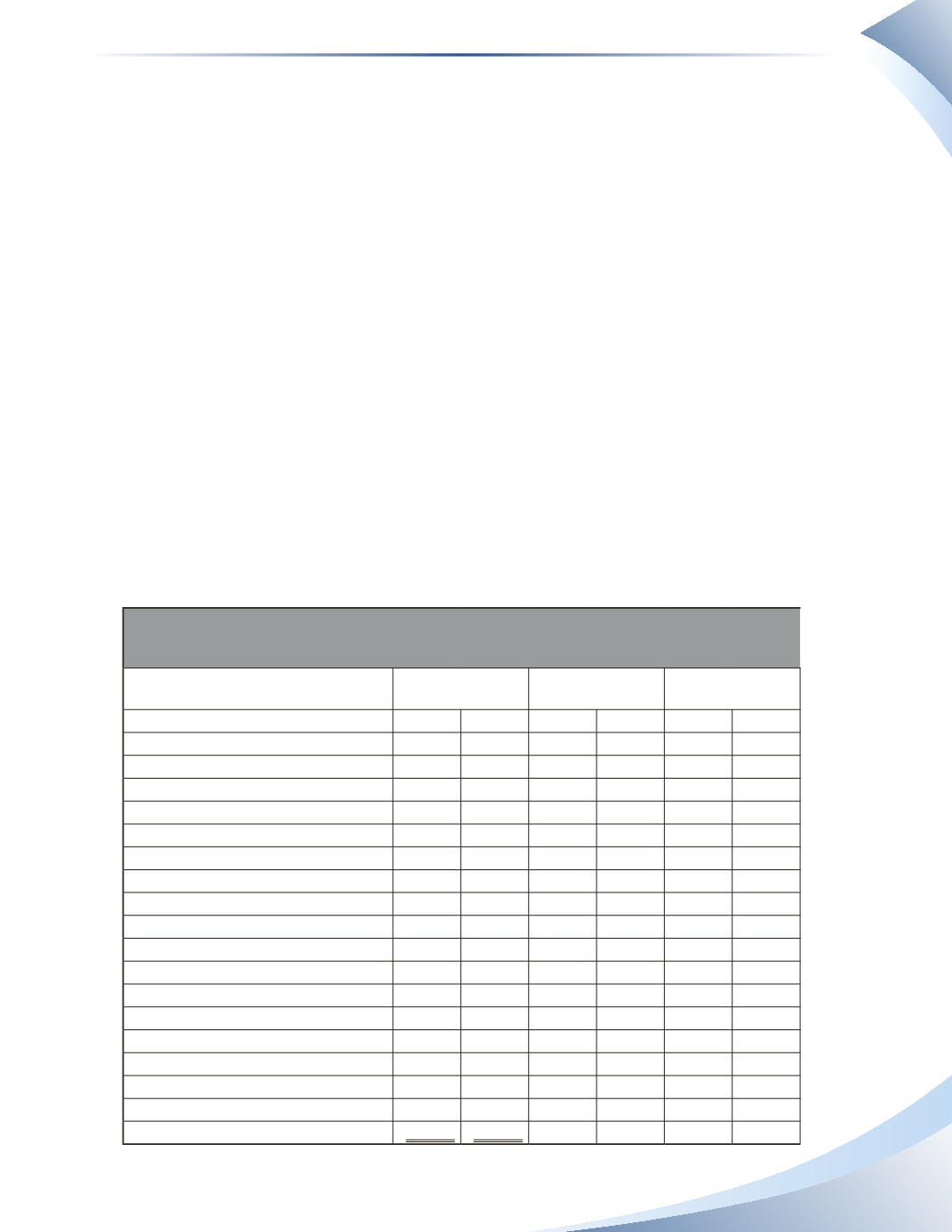

a) Complete the worksheet.

CG Accounting

Worksheet

June 30, 2016

Unadjusted

Trial Balance

Adjustments

Adjusted

Trial Balance

Account Titles

DR

CR

DR

CR

DR

CR

Cash

$5,550

Accounts Receivable

4,600

Prepaid Insurance

1,200

Equipment

6,000

Accumulated Depreciation

$0

Accounts Payable

2,750

Interest Payable

0

Unearned Revenue

900

Bank Loan

3,050

Gordon, Capital

9,400

Gordon, Drawings

1,000

Service Revenue

3,600

Advertising Expense

450

Depreciation Expense

0

Insurance Expense

0

Interest Expense

0

Rent Expense

900

Total

$19,700 $19,700