Chapter 5

The Accounting Cycle: Adjustments

119

depreciation =

$10,000 – $1,000

5 years

= $1,800 per year

The cost we are allocating over 5 years is $9,000, which is the original purchase price minus the

estimated residual value. Each year we will record $1,800 as a depreciation expense and each year

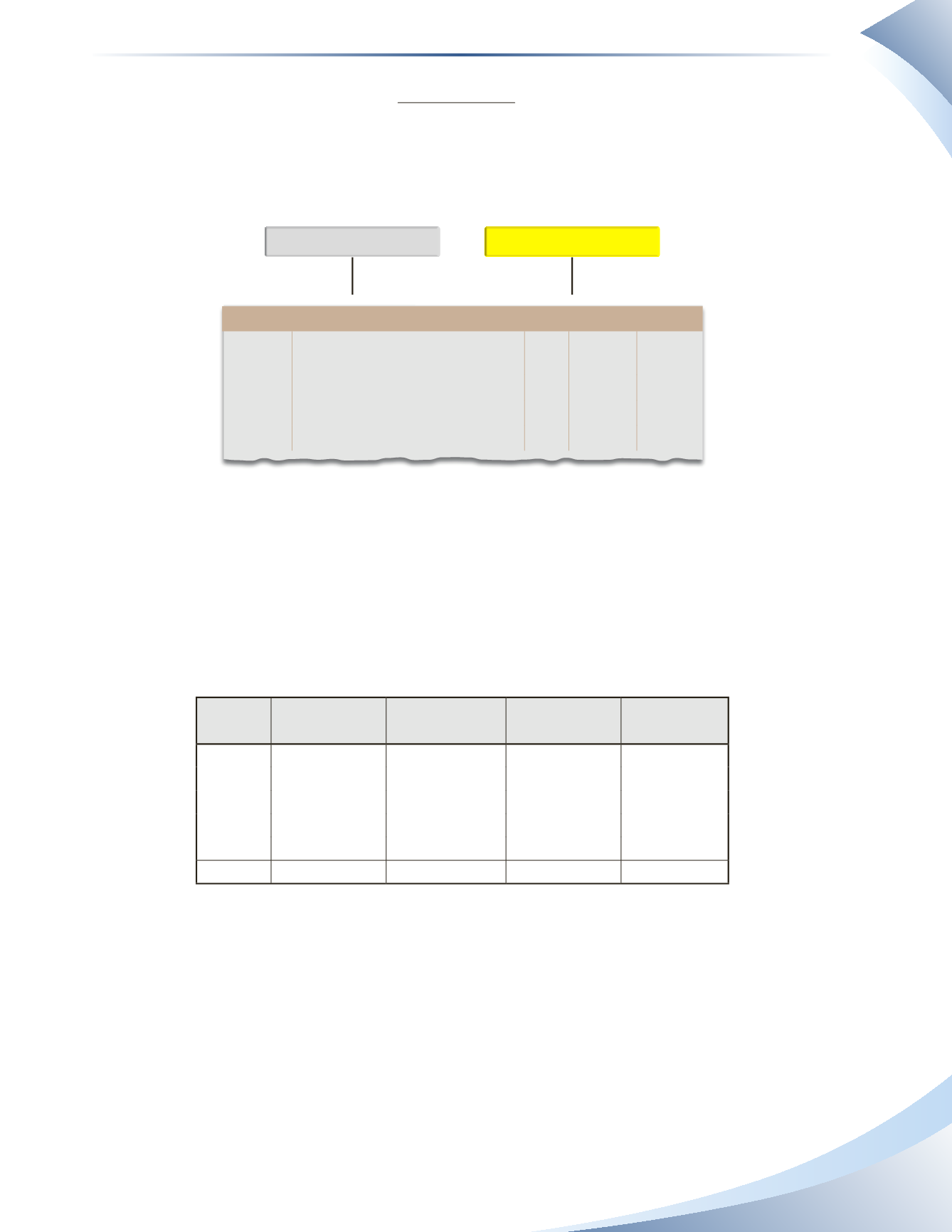

we will add $1,800 to accumulated depreciation.The journal entry is shown in Figure 5.19.

ACCUMULATED DEPRECIATION

DEPRECIATION EXPENSE

+

-

+

-

1,800

1,800

journal Page 1

date

2016

account title and explanation Pr debit credit

Dec 31 Depreciation Expense

1,800

Accumulated Depreciation

1,800

To adjust for depreciation

______________

FIGURE 5.19

Since each year the income statement resets and starts from scratch, depreciation expense of $1,800

will be recorded each year.The accumulated depreciation account, on the other hand, will increase

by $1,800 each year. As the accumulated depreciation account increases, the net book value of the

machine will decrease.Net book value is the original cost of the asset less accumulated depreciation.

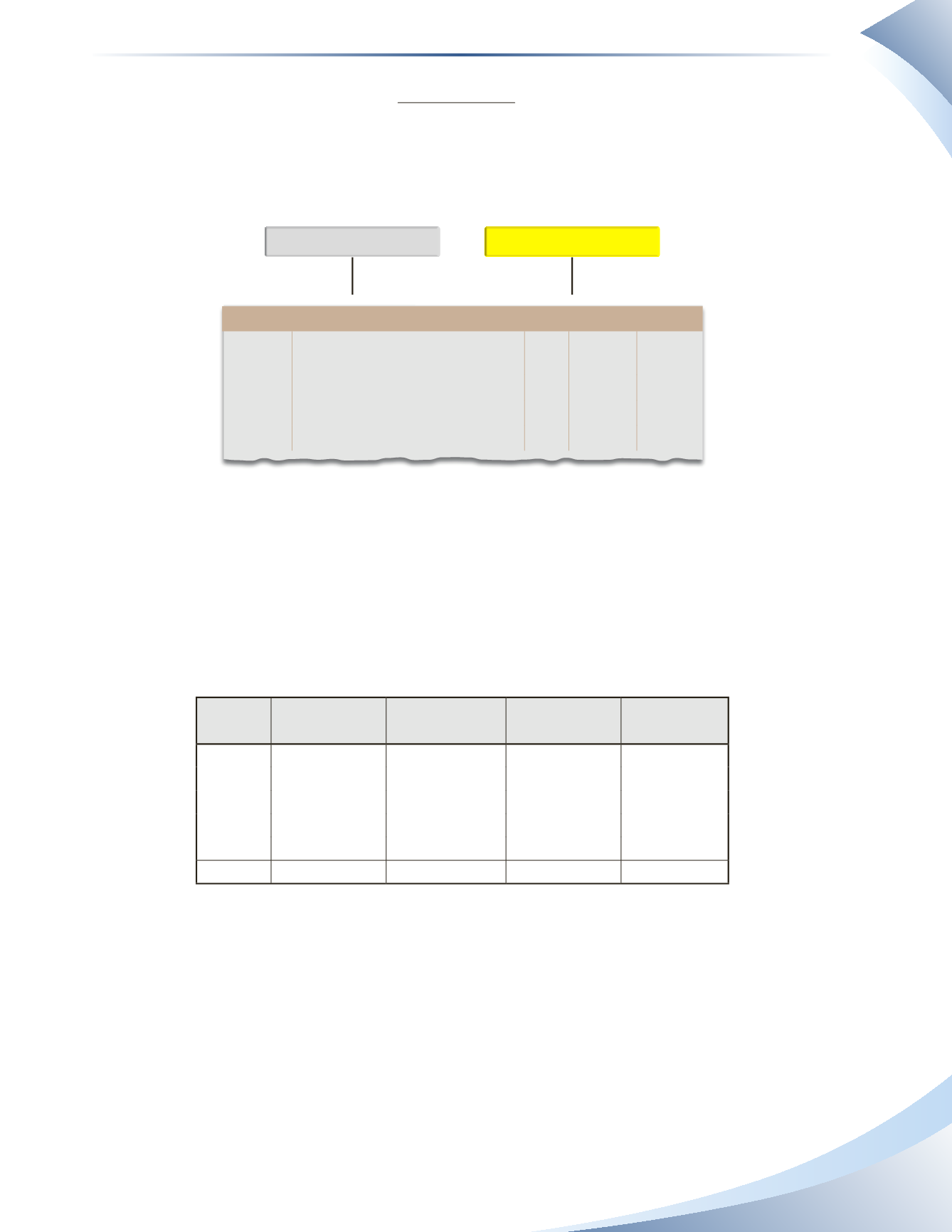

The above transaction will be recorded at the end of each year. The amount of accumulated

depreciation and the net book value of the machine over the five-year useful life are shown in the

table in Figure 5.20.

year

original cost

of machine

depreciation

expense

accumulated

depreciation

net Book

Value

2016

10,000

1,800

1,800

8,200

2017

10,000

1,800

3,600

6,400

2018

10,000

1,800

5,400

4,600

2019

10,000

1,800

7,200

2,800

2020

10,000

1,800

9,000

1,000

total

$10,000

$9,000

$9,000

$1,000

______________

FIGURE 5.20

The net book value at the end of 2020 is equal to $1,000, which is the estimated residual value of

the machine.This means that $9,000 of the cost of the machine was allocated over 5 years.

In addition to the above example, it is possible that depreciation may be recorded for periods of time

that are less than one year. For example, suppose the machine was purchased on September 1, 2016

and the business records adjustments at year end, December 31, 2016. In this case, depreciation

should only be recorded for four months.The calculation of depreciation in this example is shown

below.