Chapter 5

The Accounting Cycle: Adjustments

120

Depreciation =

$10,000 – $1,000

5 Years

×

4

12

= $600 for 4 months

The same accounts would be used as the ones in the journal entry in Figure 5.19, but the amount

of depreciation would only be $600.

Adjusted Trial Balance

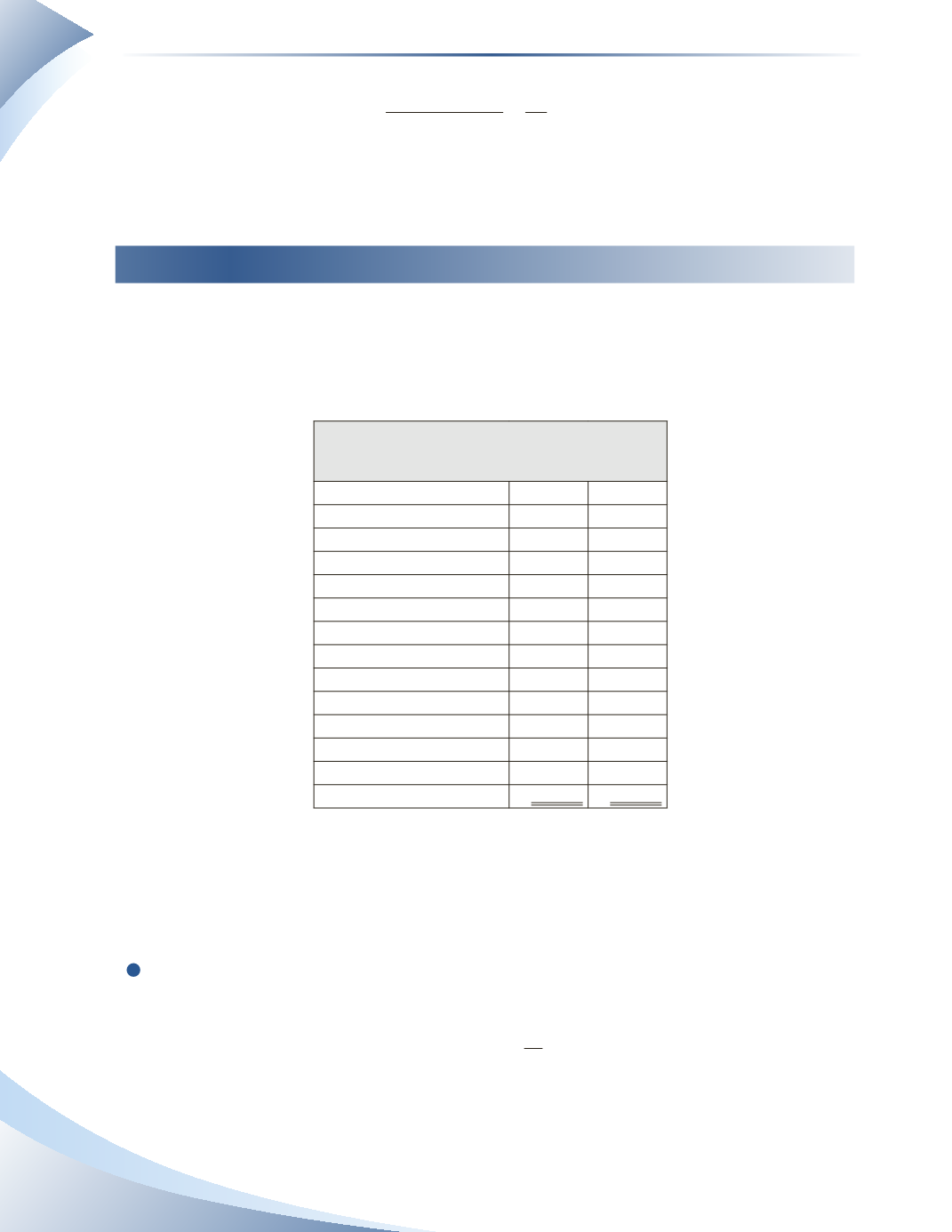

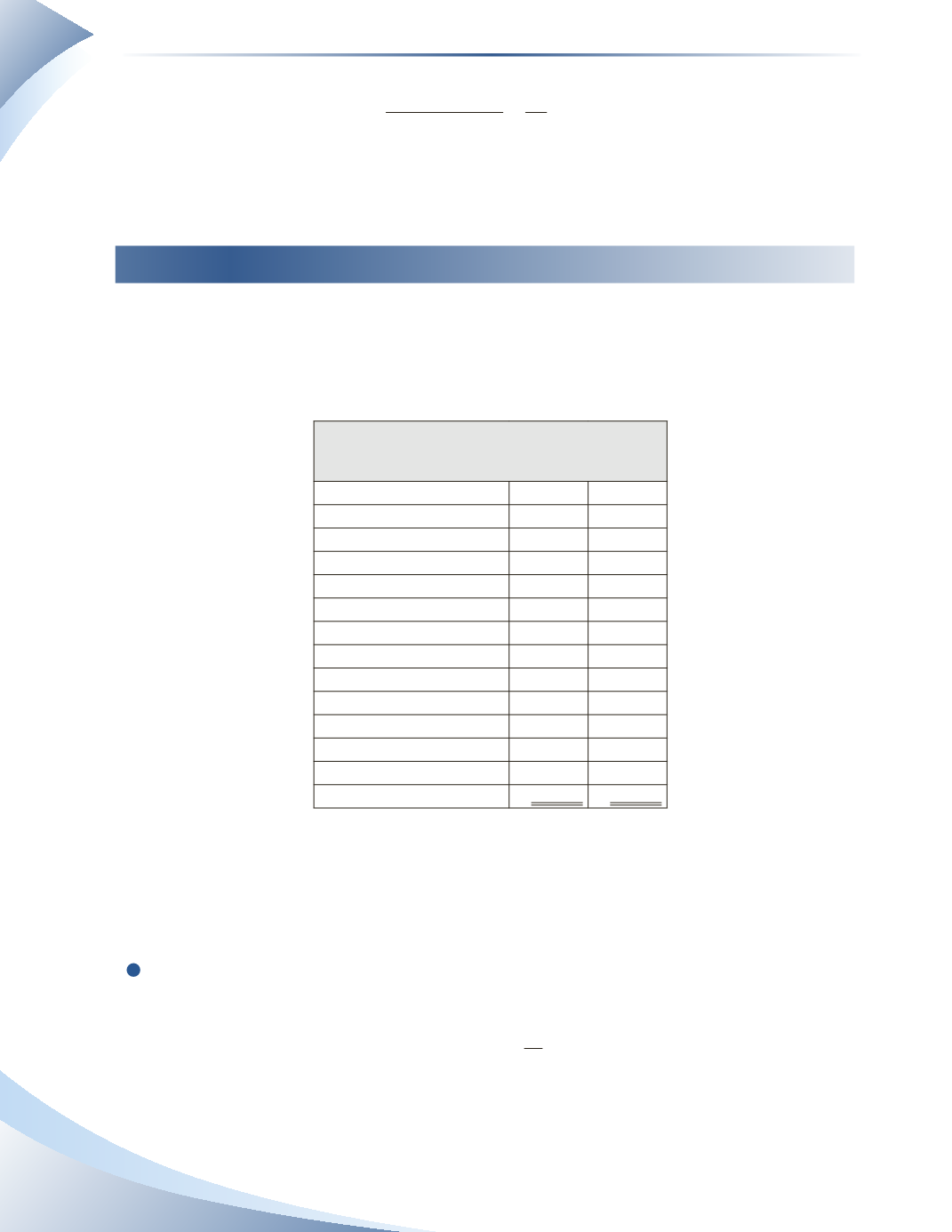

The sixth step of the accounting cycle is to prepare the adjusted trial balance.To help illustrate this

step, return to the sample company MP Consulting introduced in the previous chapter. At the end

of the fourth step of the accounting cycle, we had prepared the trial balance for the business, shown

in Figure 5.21.

MP Consulting

Trial Balance

January 31, 2016

Account Titles

DR

CR

Cash

$3,800

Accounts Receivable

3,000

Prepaid Insurance

1,200

Equipment

8,300

Accounts Payable

$1,250

Unearned Revenue

2,000

Bank Loan

2,500

Parish, Capital

10,300

Parish, Drawings

2,000

Service Revenue

3,300

Rent Expense

800

Telephone Expense

250

Total

$19,350 $19,350

______________

FIGURE 5.21

This trial balance is the balance of the general ledger accounts after all the regular day-to-day

transactions have been recorded in the general journal and posted to the general ledger. It is from

these balances that MP Consulting will make adjusting entries. Suppose the company has the

following adjustments to make at the end of the month

1

The company borrowed cash from the bank at a 12% rate of interest. Using the interest

calculation introduced earlier in the chapter, accrued interest for the month is calculated as

Interest = $2,500 × 12% × 1

12 = $25 per month