Chapter 5

The Accounting Cycle: Adjustments

123

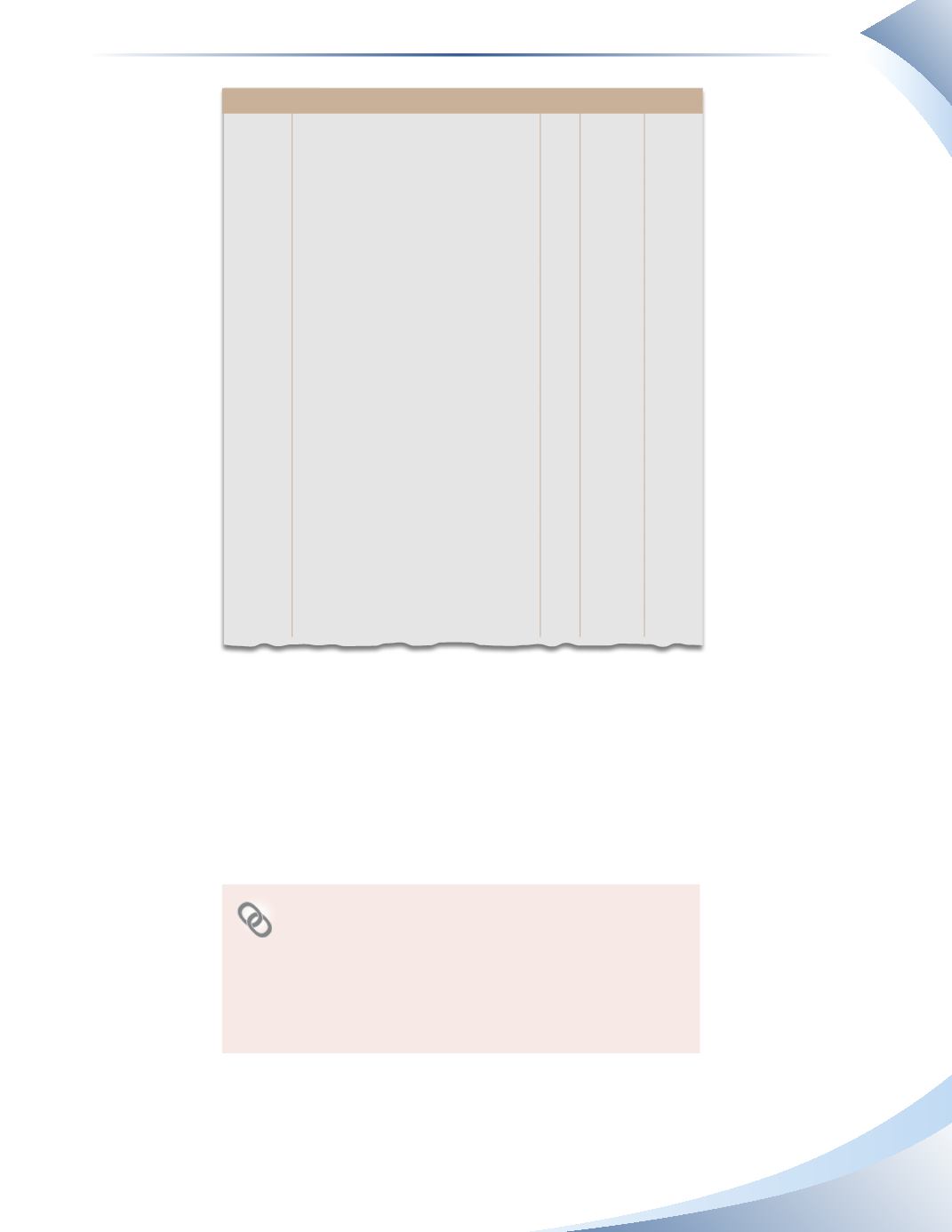

journal Page 1

date

2016

account title and explanation Pr debit credit

Jan 31 Interest Expense

25

Interest Payable

25

Record one month of accrued interest

Jan 31 Insurance Expense

100

Prepaid Insurance

100

Record one month of insurance used

Jan 31 Unearned Revenue

200

Service Revenue

200

Record revenue now earned

Jan 31 Depreciation Expense

150

Accumulated Depreciation

150

Record depreciation for one month

Jan 31 Accounts Receivable

1,000

Service Revenue

1,000

Record accrued revenue

______________

FIGURE 5.23

The preparation of the worksheet is optional. It is possible to simply prepare the journal entries as

shown in Figure 5.23 and post them to the general ledger, then create the adjusted trial balance

without preparing a worksheet. However, in a manual accounting system, it is a good idea to

constantly check to ensure all accounts remain in balance because going back to find errors can be

a difficult process.

ASPE states that private companies must prepare financial

statements at least once per year. Therefore, the adjustments

process must be completed just as often.

On the other hand, IFRS requires companies to prepare financial

statements at least once per quarter. This means that the accounts

will be adjusted at least four times per year.

ASPE vs IFRS