Chapter 5

The Accounting Cycle: Adjustments

116

At the end of the period, a count is made to determine the value of the remaining office supplies and

an adjusting entry is created to record the amount of office supplies used as an expense.

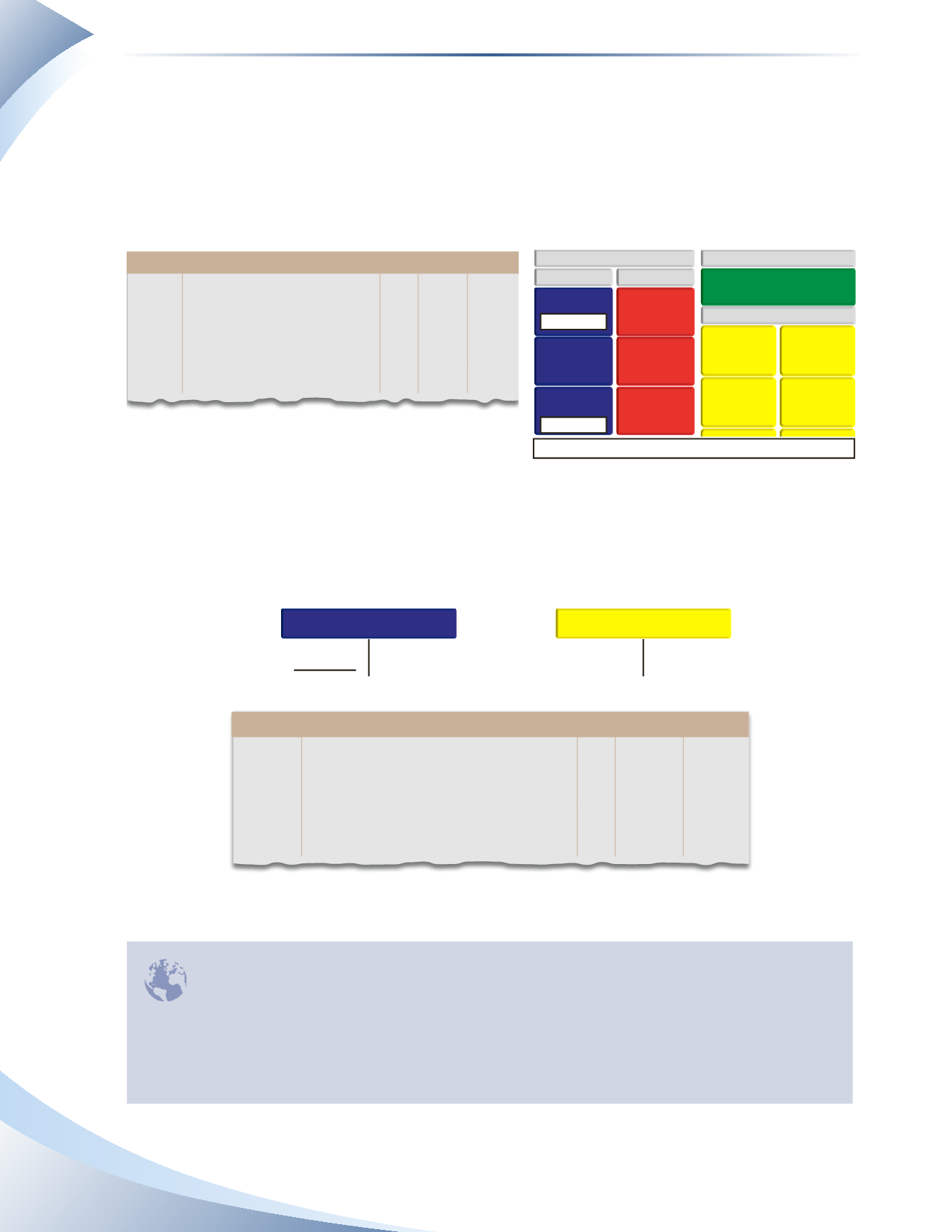

To illustrate, suppose a business paid $1,200 cash for office supplies on September 4. This initial

purchase of office supplies is just a transfer of one asset (cash) for another (office supplies) and is

shown in Figure 5.15.

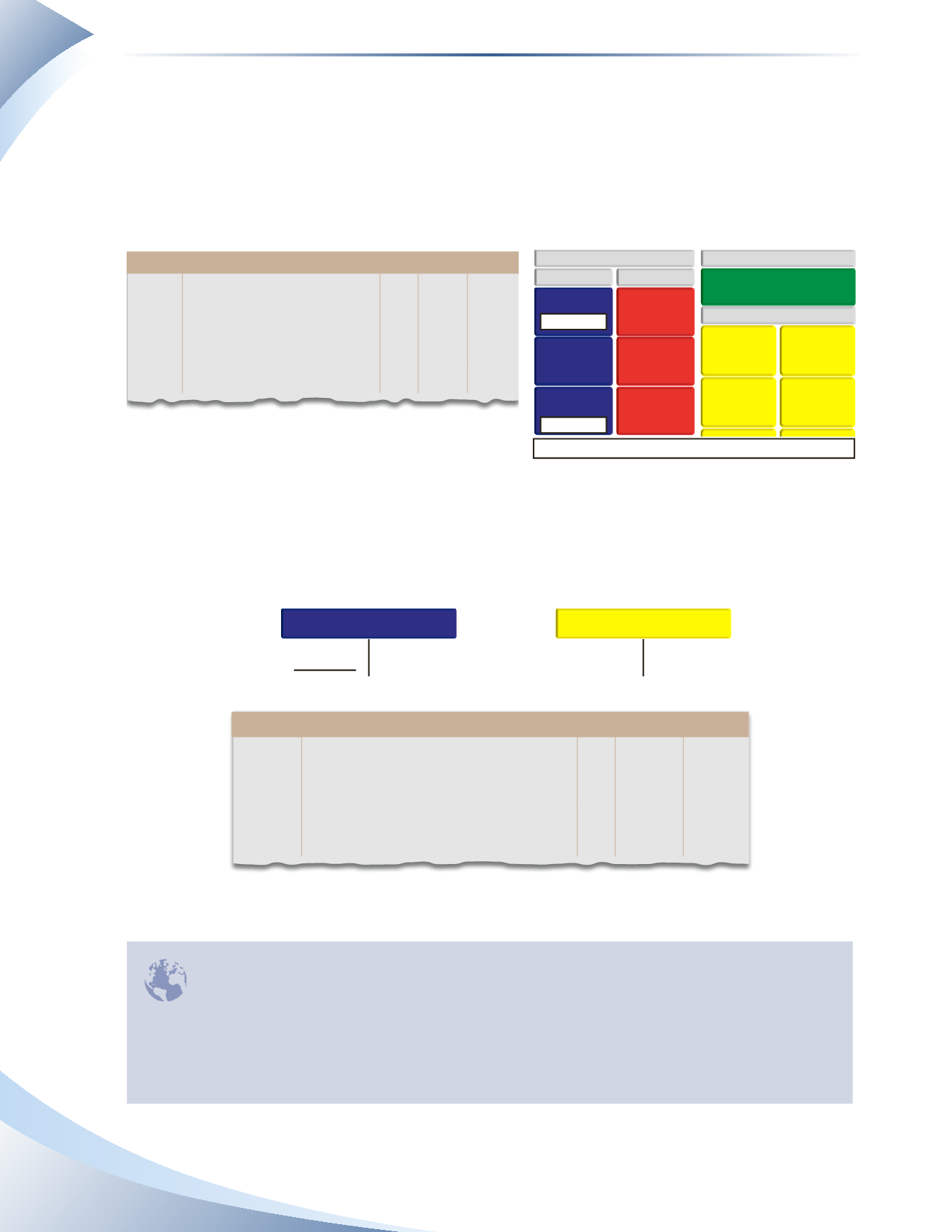

At the end of the month, a count shows that only $700 worth of office supplies remain on hand.

This means that office supplies of $500 ($1,200 – $700) must have been used and must be recorded

as an expense.The adjustment is shown in Figure 5.16. Notice that the ending balance of the office

supplies account is equal to $700, matching the count that was taken.

OFFICE SUPPLIES

OFFICE SUPPLIES EXPENSE

+

+

-

-

1,200

700

Count

500

Adjustment

500

journal

Page 1

date

2016

account title and explanation Pr debit credit

Sep 30 Office Supplies Expense

500

Office Supplies

500

To adjust office supplies used

______________

FIGURE 5.16

Office supplies are often low-value items, such as paper and pens. In many businesses, keeping

track of these small amounts as an asset, then counting them to see what was used is not viewed

as an important procedure. The materiality principle introduced earlier indicates that if a piece of

information could influence a user’s decision, it is material and must be accounted for properly according

to ASPE. For many businesses, it is easier to simply record office supplies as an expense immediately instead

of as an asset first. This is done when the amount is not material, since the extra work and detail would not

affect the users’ decisions.

INTHE REAL WORLD

BALANCE SHEET

LIABILITIES

ACCOUNTS

PAYABLE

UNEARNED

REVENUE

BANK LOAN

INCOME STATEMENT

EXPENSES

SERVICE REVENUE

DEPRECIATION

INSURANCE

SALARIES

RENT

No change in owner’s equity

ASSETS

CASH

OFFICE

SUPPLIES

ACCOUNTS

RECEIVABLE

+$1,200 DR

- $1,200 CR

journal

Page 1

date

2016

account title and explanation Pr debit credit

Mar 1 Office Supplies

1,200

Cash

1,200

Purchased office supplies

____________

FIGURE 5.15