Chapter 5

The Accounting Cycle: Adjustments

118

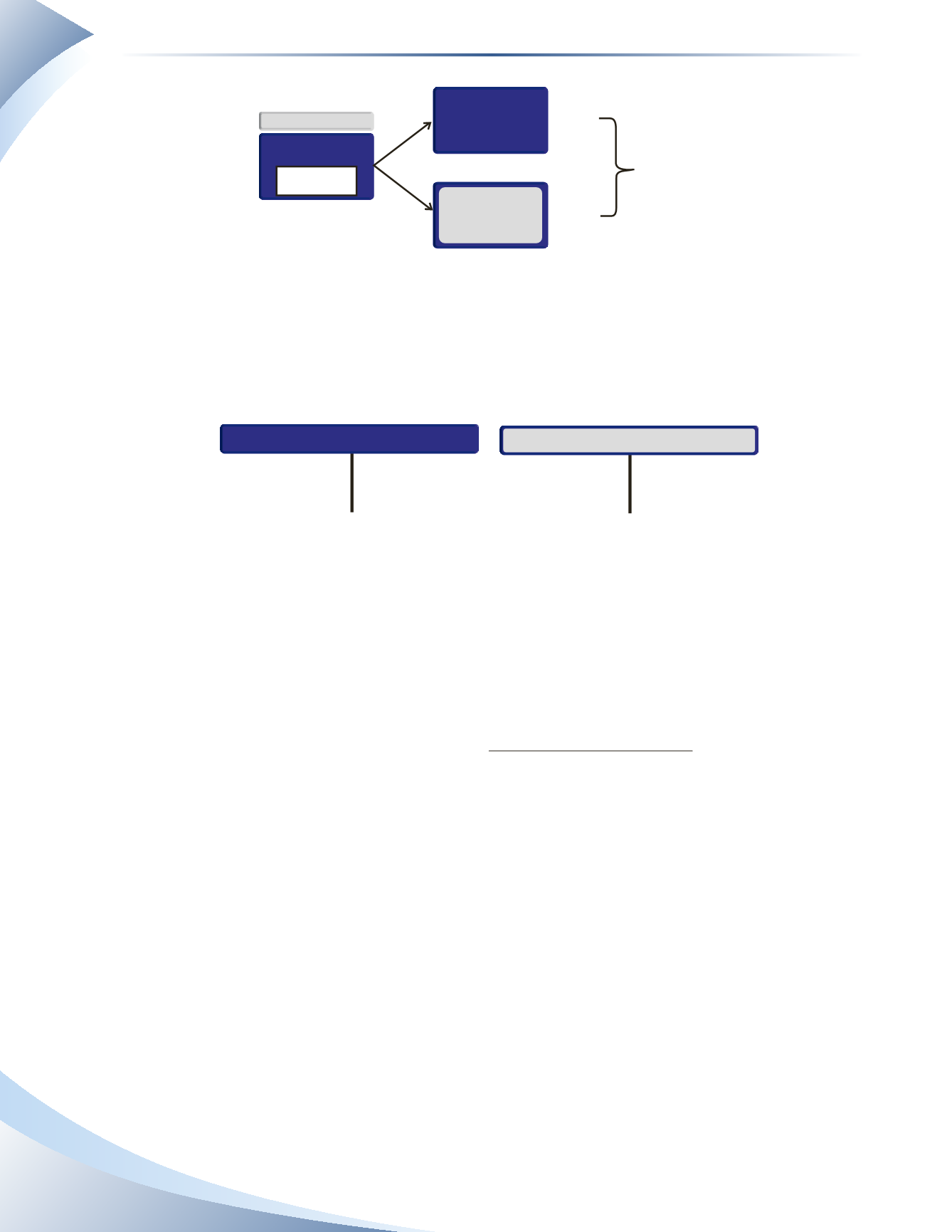

ASSETS

$10,000

Net Book Value

$8,000

- $2,000

Less

PPE

(ORIGINAL COST)

PROPERTY, PLANT &

EQUIPMENT (PPE)

ACCUMULATED

DEPRECIATION

Balance

$8,000

______________

FIGURE 5.17

The contra asset account behaves in a manner opposite to the way a regular asset account behaves.

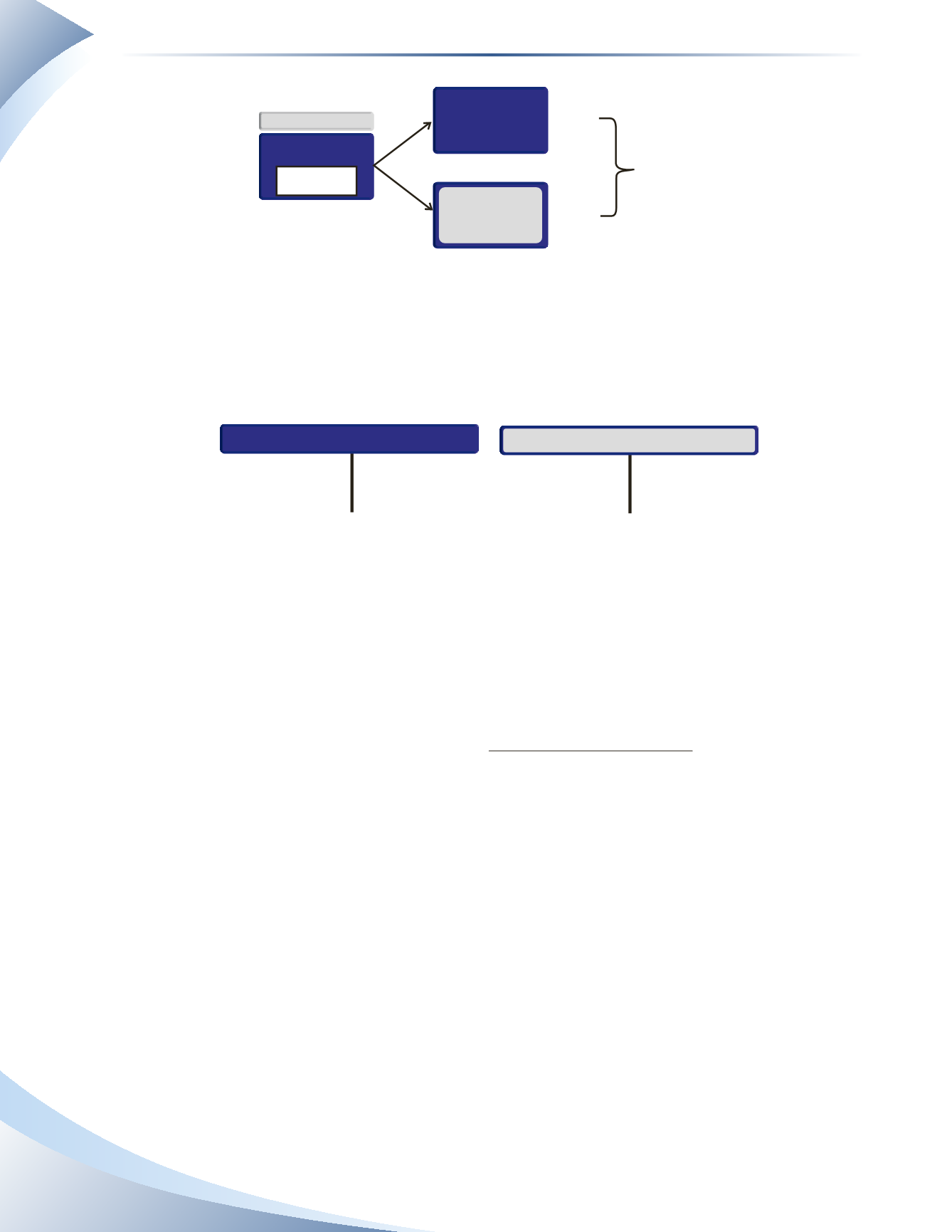

Recall that an asset account will increase with a debit and decrease with a credit.The contra asset

account (accumulated depreciation) will increase with a credit and decrease with a debit. Figure

5.18 illustrates the T-accounts for property, plant and equipment and accumulated depreciation.

+

-

-

+

PROPERTY, PLANT AND EQUIPMENT

ACCUMULATED DEPRECIATION

INCREASE (DR)

DECREASE (DR)

DECREASE (CR)

INCREASE (CR)

______________

FIGURE 5.18

Calculation of Depreciation

There are a number of ways to calculate depreciation for the period. We are going to use a simple

method called straight-line depreciation.

Straight-line depreciation

is a method to allocate the

cost of the asset evenly over the life of the asset. The calculation for straight-line depreciation is

shown below.

Straight-Line Depreciation =

Cost of Asset – Residual Value

Useful Life

There are three parts of this calculation that must be explained.

1. The cost of the asset is the original purchase price of the asset.This is the value shown on the

balance sheet in the asset account.

2.

Residual value

is the estimated value of the asset at the end of its useful life. By subtracting the

residual value from the original cost of the asset, we determine the cost that will be allocated over

the life of the asset. It is possible for an asset to have a residual value of $0, meaning the asset will

be fully depreciated and worthless at the end of its useful life.

3. The useful life is how long the asset is expected to be used by the business. Like residual value,

this is also an estimate.The useful life can be expressed in years or months, depending on how

often depreciation will be recorded.

For example, suppose a machine was purchased on January 1, 2016 for $10,000. The machine is

expected to last for five years, and after five years the machine is expected to have a residual value

of $1,000.The calculation for yearly depreciation under the straight-line method is shown below.