Chapter 6

The Accounting Cycle: Statements and Closing Entries

137

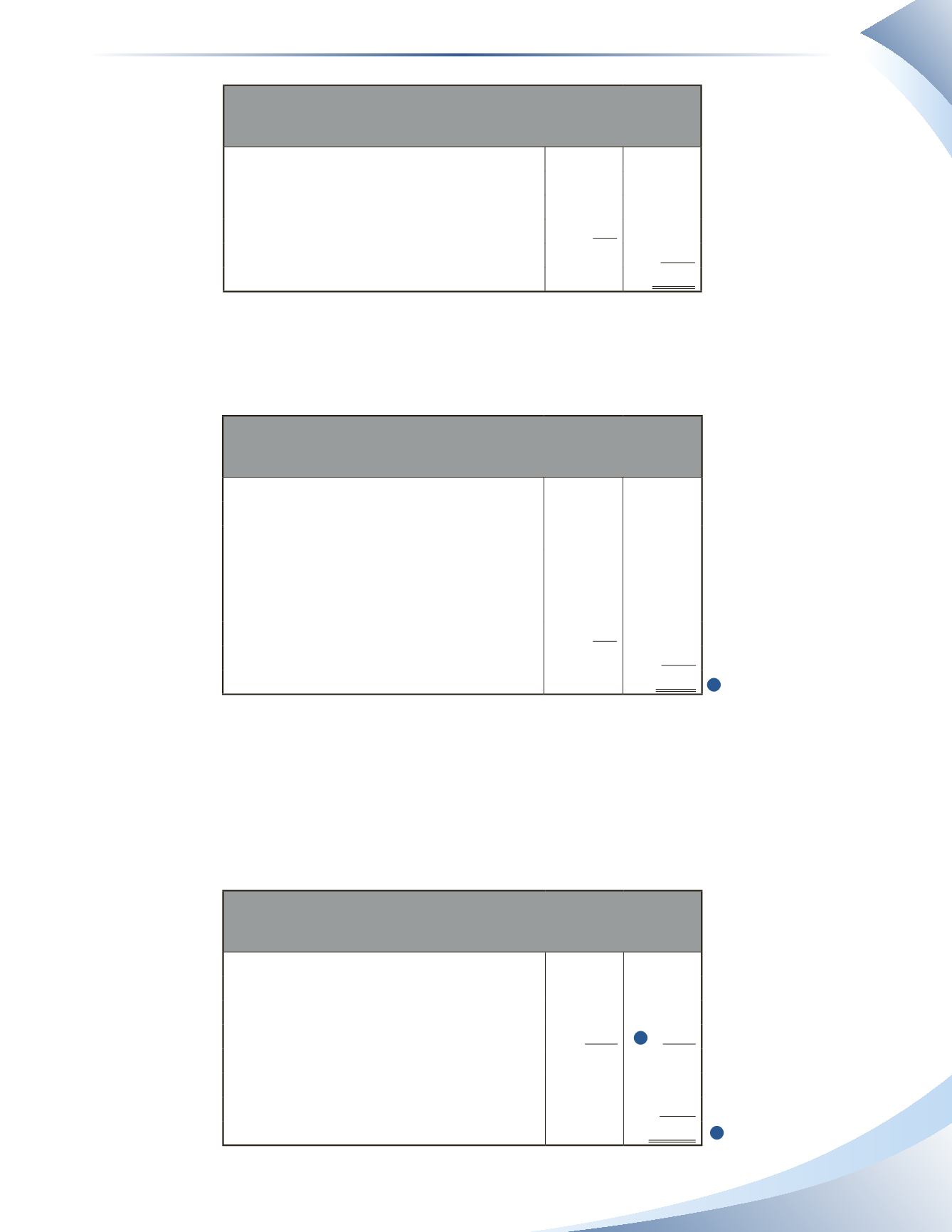

MP Consulting

Income Statement (Pre-Adjustment)

For the Month Ended January 31, 2016

Service Revenue

$3,300

Expenses

Rent Expense

$800

Telephone Expense

250

Total Expenses

1,050

Net Income (Loss)

$2,250

________________

Figure 6.3

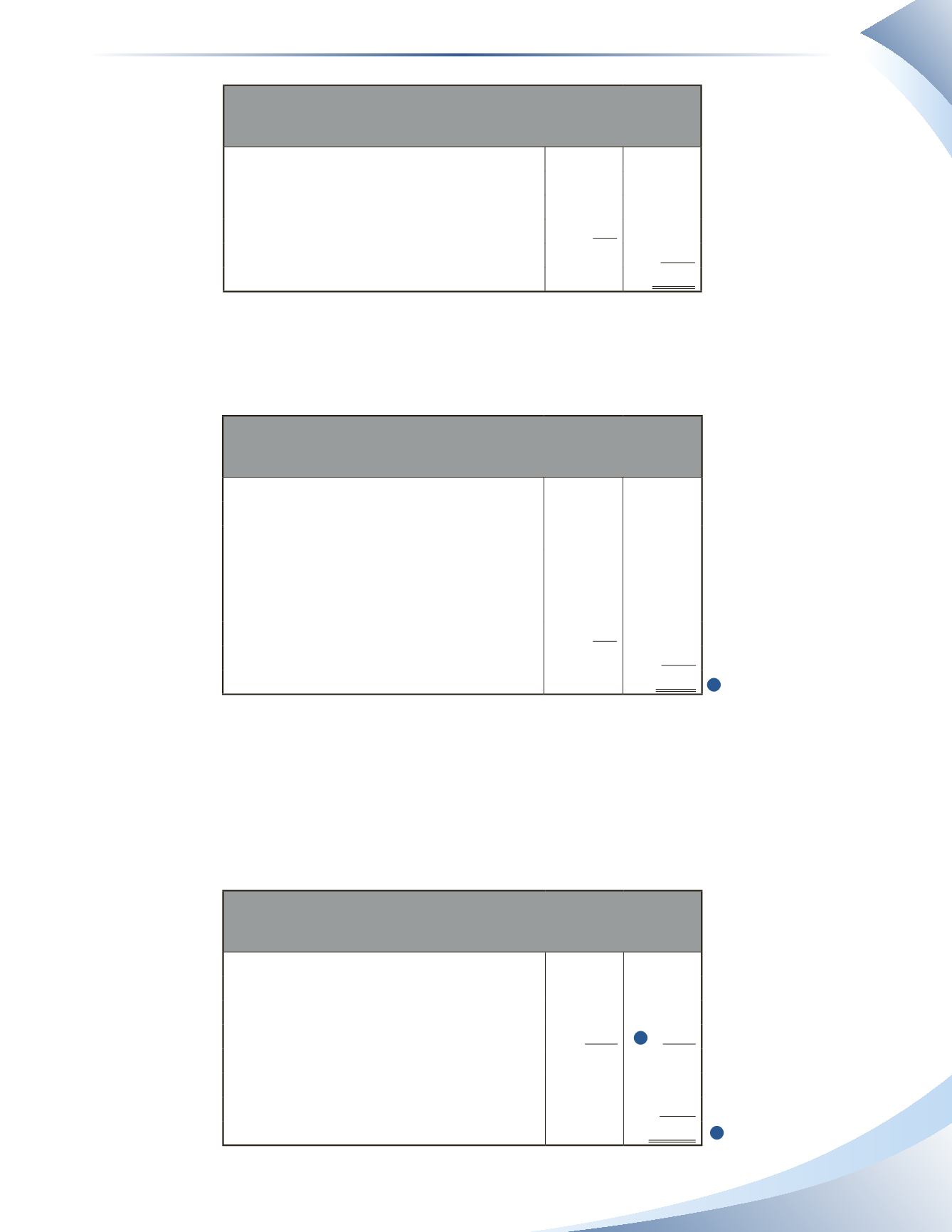

After the adjustments, the income statement can be prepared properly. In Figure 6.4, net income

is properly reported as $3,175. If no adjustments were made, net income would have been under-

stated, which would have caused owner’s equity to also be understated.

MP Consulting

Income Statement

For the Month Ended January 31, 2016

Service Revenue

$4,500

Expenses

Depreciation Expense

$150

Insurance Expense

100

Interest Expense

25

Rent Expense

800

Telephone Expense

250

Total Expenses

1,325

Net Income (Loss)

$3,175

________________

Figure 6.4

Statement of Owner’s Equity

The statement of owner’s equity reports any changes in equity during the reporting period. The

statement of owner’s equity for MP Consulting is shown in Figure 6.5. The statement of owner’s

equity represents the change to owner’s equity during the accounting period and is presented with

a date format of an elapsed time period similar to the income statement.

MP Consulting

Statement of Owner's Equity

For the Month Ended January 31, 2016

Parish, Capital at January 1

$5,300

Add:

Additional Investment

$5,000

Net Income

3,175

8,175

Subtotal

13,475

Less:

Parish, Drawings

2,000

Parish, Capital at January 31

$11,475

________________

Figure 6.5

1

1

2