Chapter 6

The Accounting Cycle: Statements and Closing entries

145

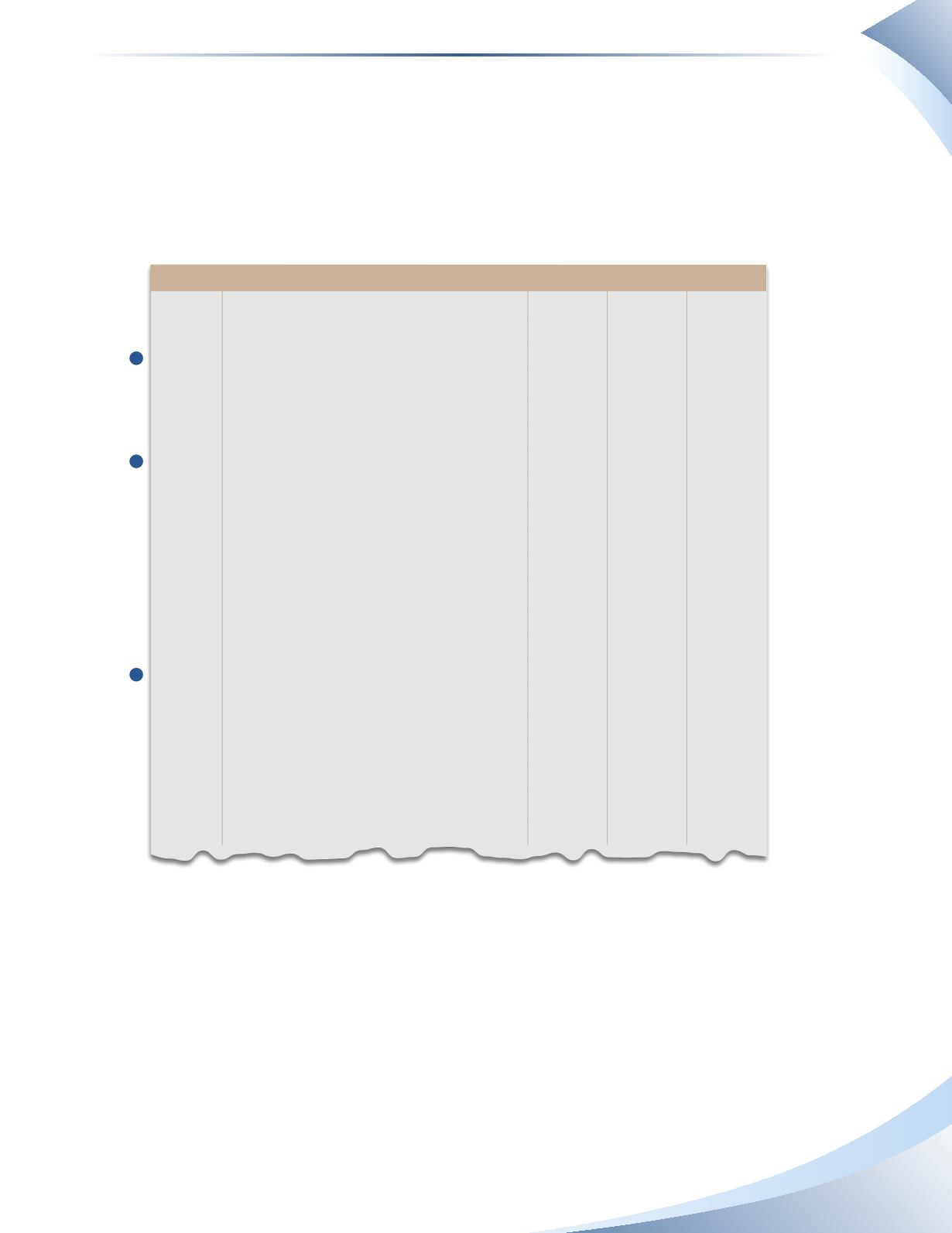

The income summary is only used to close the revenue and expense accounts.The owner’s drawings

account is not closed through the income summary account because owner’s withdrawals do not

affect the amount of net income or net loss.The owner’s drawings account is closed directly to the

owner’s capital account.

Using the adjusted trial balance amounts for our existing company (Figure 6.13), the closing entries

are presented as shown in the journal in Figure 6.17 below.

JournAl

Page 3

date

Account Title and explanation

Pr

debit

Credit

2016

Jan 31 Service revenue

400

4,500

income Summary

315

4,500

To close revenue

Jan 31 income Summary

315

1,325

Depreciation expense

510

150

insurance expense

515

100

interest expense

520

25

rent expense

540

800

Telephone expense

550

250

To close expenses

Jan 31 income Summary

315

3,175

Parish, Capital

300

3,175

To close Income Summary

Jan 31 Parish, Capital

300

2,000

Parish, Drawings

310

2,000

To close owner's drawings

________________

Figure 6.17

The first two transactions are nearly the same as shown in the direct method (Figure 6.14), except

that the income summary account is used instead of owner’s capital.

The third transaction is used to close the income summary to the capital account. The value of

$3,175 is the difference between the revenue and expenses accounts. Note that this value is the

same as the net income reported on the income statement in Figure 6.4.

The last transaction is identical to the one shown in the direct method (Figure 6.14).

Figure 6.18 summarizes how the temporary accounts are closed at the end of an accounting period

under each method.

1

2

3