Chapter 6

The Accounting Cycle: Statements and Closing Entries

144

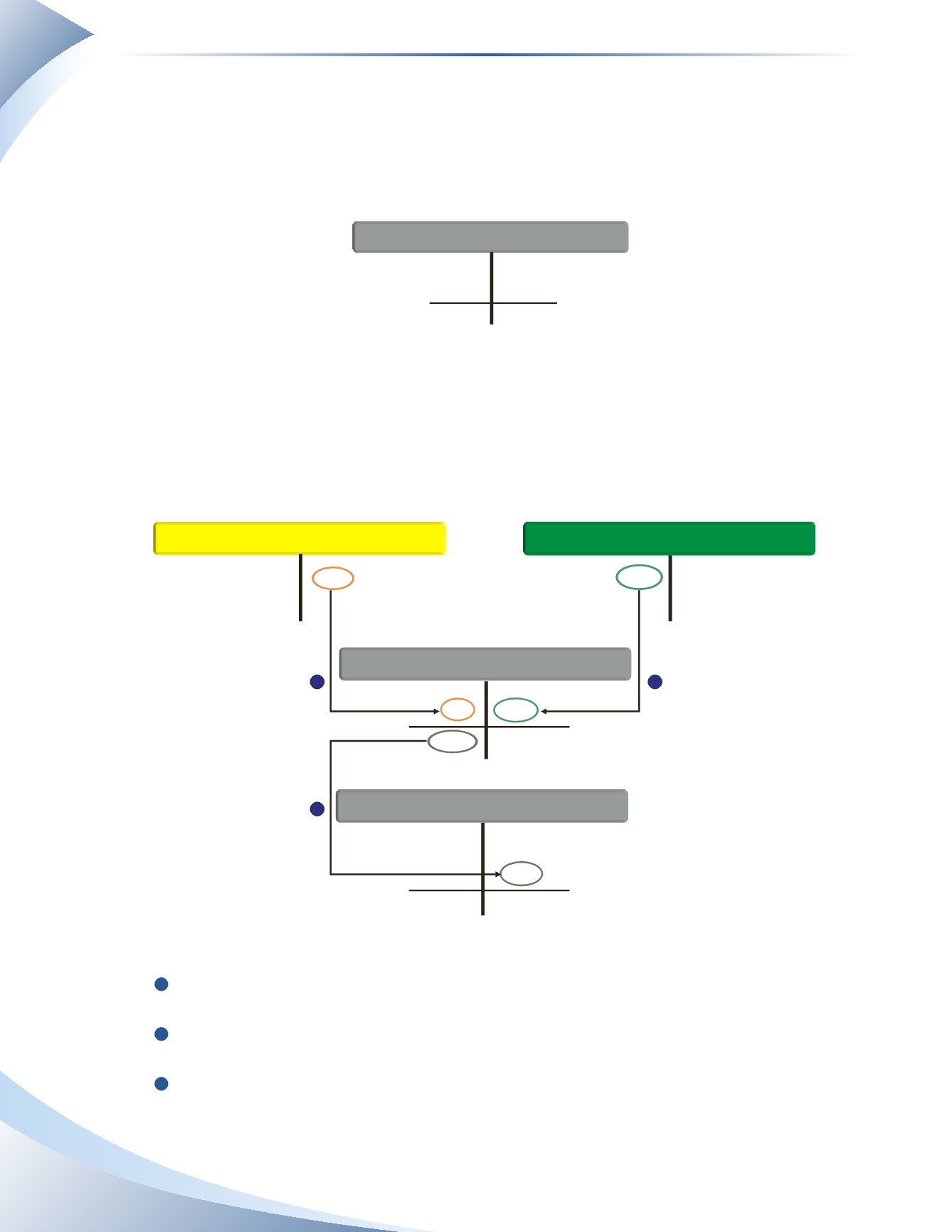

Net Result

Owner’s capital has increased by the total revenue and decreased by the total expenses and owner’s

drawings. Figure 6.15 shows the new balance is $11,475. This is the same figure shown as the

ending value on the statement of owner’s equity from Figure 6.5.

+

PARISH, CAPITAL

DECREASE (DR)

INCREASE (CR)

-

10,300 Current balance

11,475 Ending balance

Expenses 1,325

Owner’s Drawings 2,000

4,500 Revenue

________________

Figure 6.15

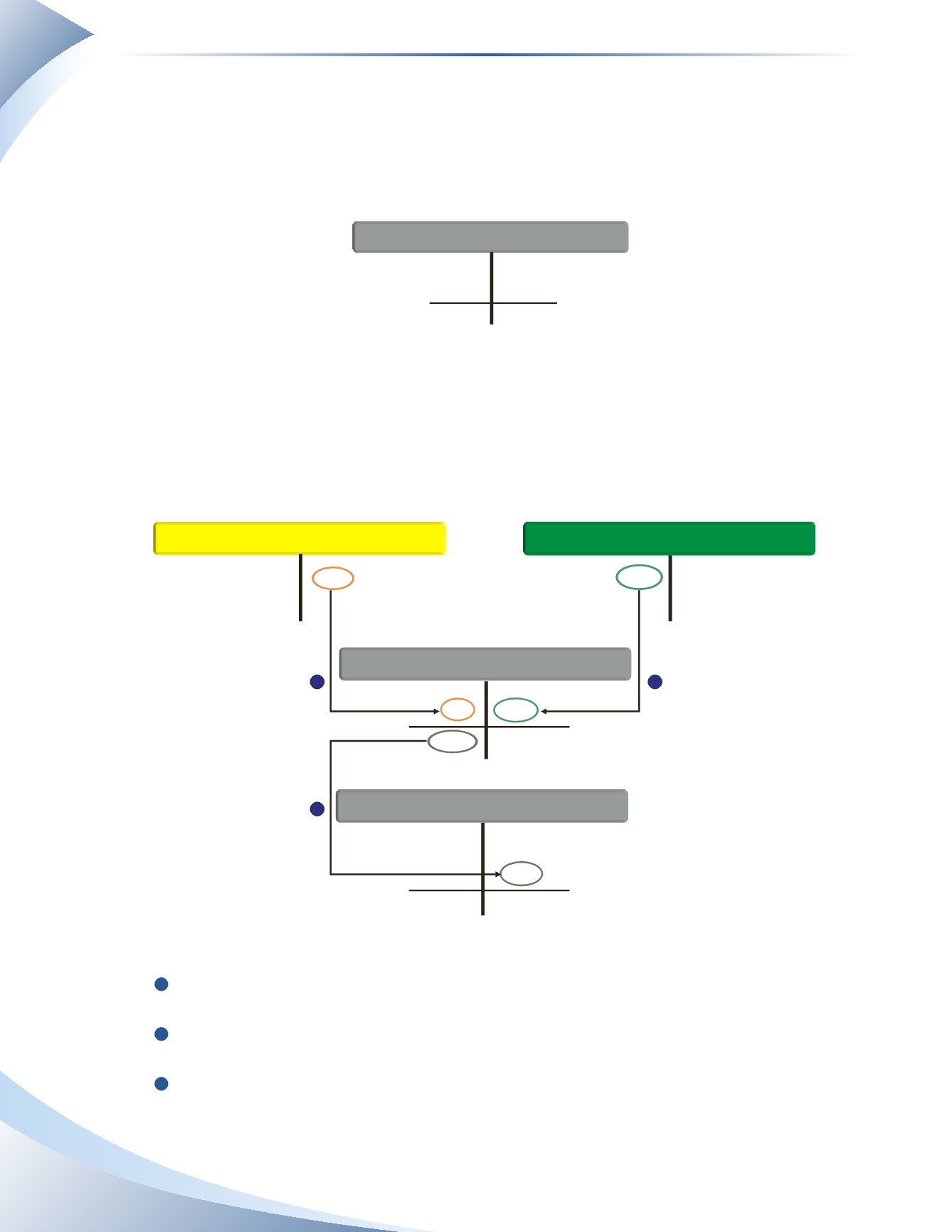

Income Summary Method: Close Using the Income Summary Account

Instead of debiting and crediting owner’s capital directly, it is common to use a temporary holding

account called

income summary

to close the revenue and expense accounts. Using our T-account

example, Figure 6.16 shows how the income summary account is used.

+

-

250

250

1,250

1,500

Current balance 250

+

+

INCOME SUMMARY

SERVICE REVENUE

DECREASE (DR)

DECREASE (DR)

INCREASE (CR)

INCREASE (CR)

-

-

5,300 Current balance

6,550 Ending balance

1,500

1,500 Current balance

1,250

1,250 Balance

TELEPHONE EXPENSE

INCREASE (DR)

DECREASE (CR)

+

PARISH, CAPITAL

DECREASE (DR)

INCREASE (CR)

-

1

2

3

________________

Figure 6.16

1

Debit each revenue account to clear it and credit the income summary account for the total

amount.

2

Credit each expense account to clear it and debit the income summary account for the total

amount.

3

Calculate the balance of the income summary account. This is equal to the net income or

loss for the period. Credit owner’s capital and debit income summary with the net income

amount, or debit owner’s capital and credit income summary with the net loss amount.