Chapter 6

The Accounting Cycle: Statements and Closing Entries

146

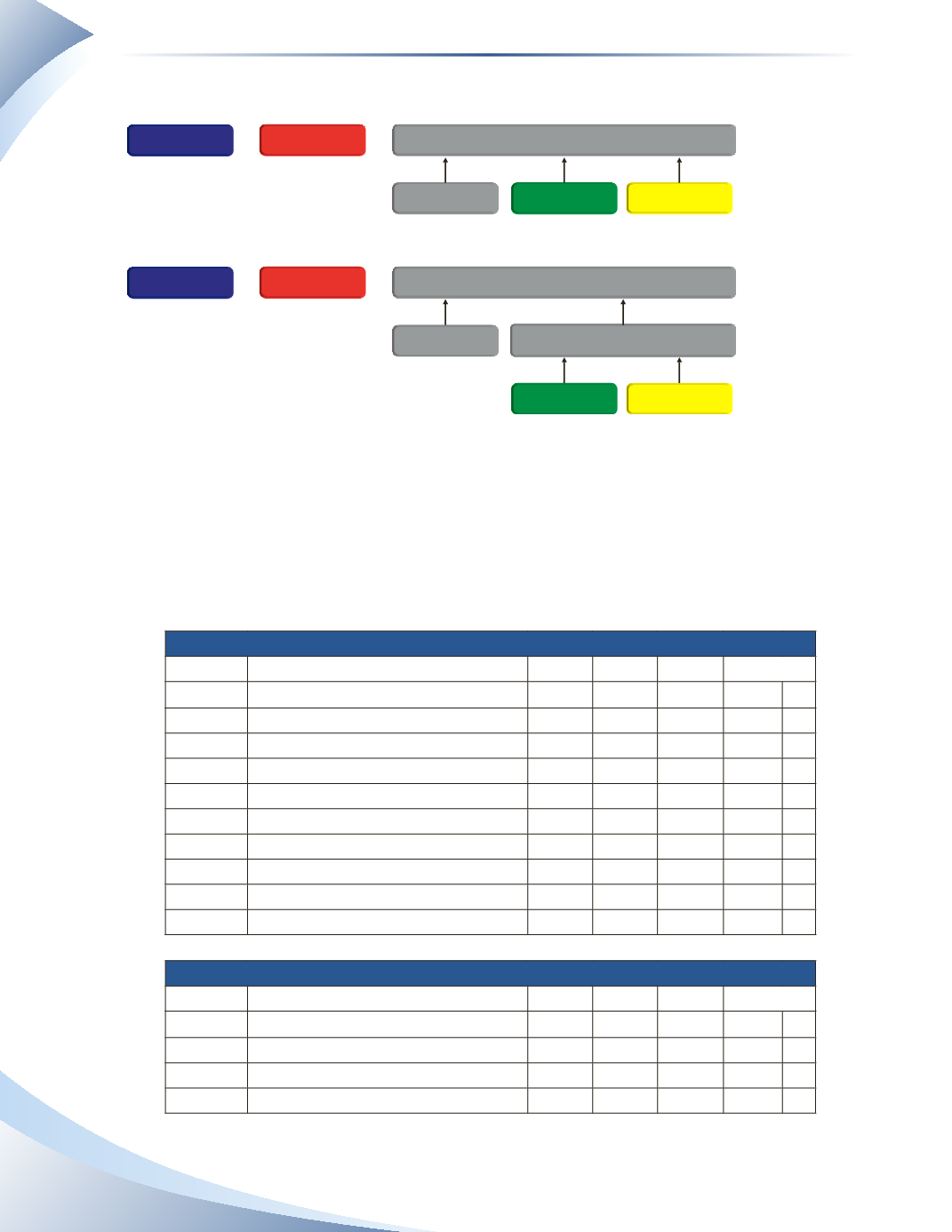

Direct Method

LIABILITIES

LIABILITIES

OWNER’S CAPITAL

OWNER’S CAPITAL

=

=

+

+

ASSETS

ASSETS

OWNER’S DRAWINGS

OWNER’S DRAWINGS

INCOME SUMMARY

REVENUES

REVENUES

EXPENSES

EXPENSES

Income Summary Method

________________

Figure 6.18

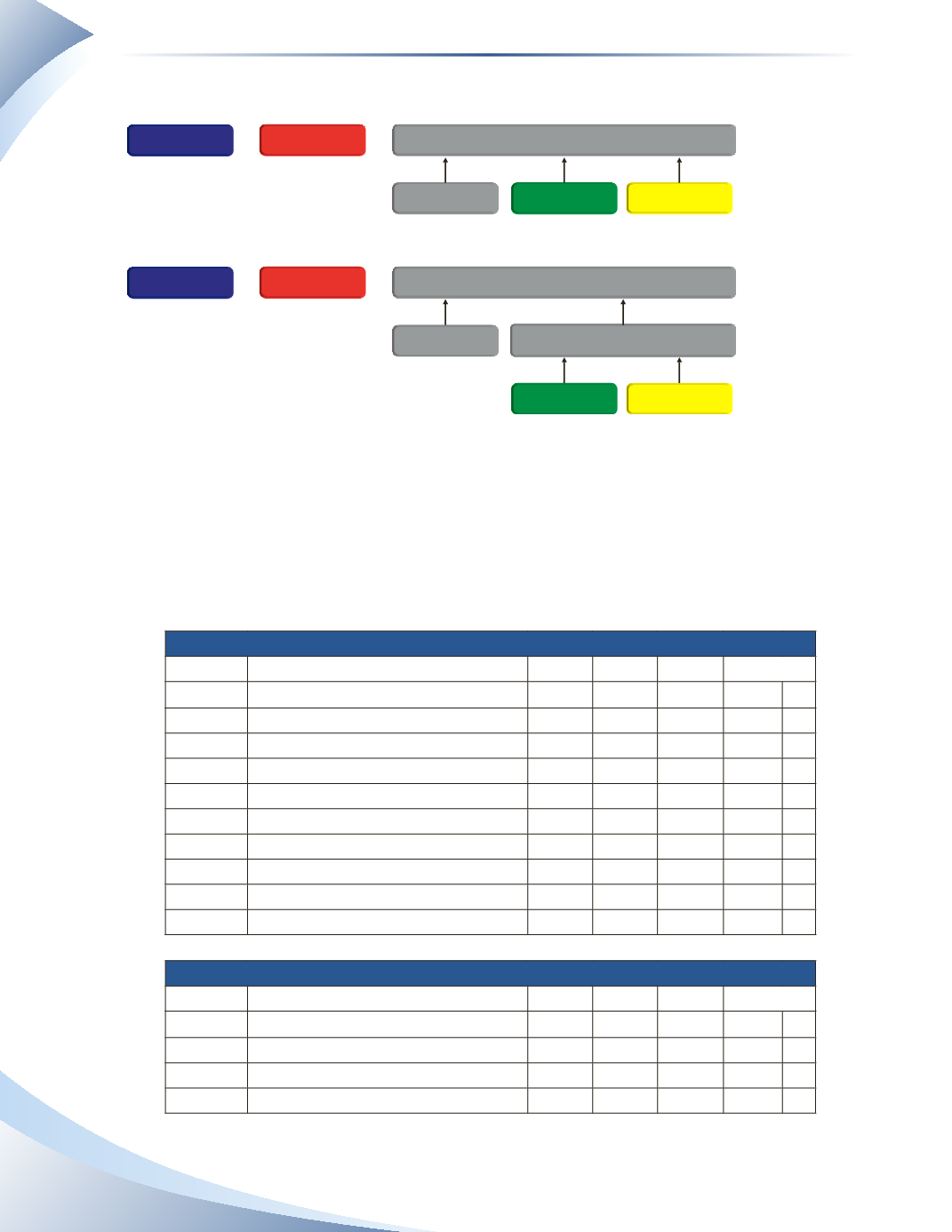

Remember, all journal entries must be posted to the general ledger. Assuming MP Consulting uses

the income summary method to close its books, Figure 6.19 shows how the ledger accounts would

look at the end of the period. All journal entries from the two previous chapters and the closing

entries from this chapter are reflected here. Notice that adjustments and closing entries include a

description to make them stand out in the ledger.

GENERAL LEDGER

Account: Cash

GL. No. 101

Date

Description

PR DR CR Balance

2016

Jan 1 Opening Balance

3,000 DR

Jan 2

J1

1,500

4,500 DR

Jan 3

J1

800 3,700 DR

Jan 4

J1

1,200 2,500 DR

Jan 5

J1

5,000

7,500 DR

Jan 7

J1

2,300 5,200 DR

Jan 16

J1

500 4,700 DR

Jan 19

J1

1,100

5,800 DR

Jan 30

J1

2,000 3,800 DR

Account: Accounts Receivable

GL. No. 105

Date

Description

PR DR CR Balance

2016

Jan 1 Opening Balance

1,200 DR

Jan 10

J1

1,800

3,000 DR

Jan 31 Adjustment

J2

1,000

4,000 DR