214

This estimation can only be used for management purposes and interim statements. Formal financial

statements can only be prepared after a physical count has been performed.

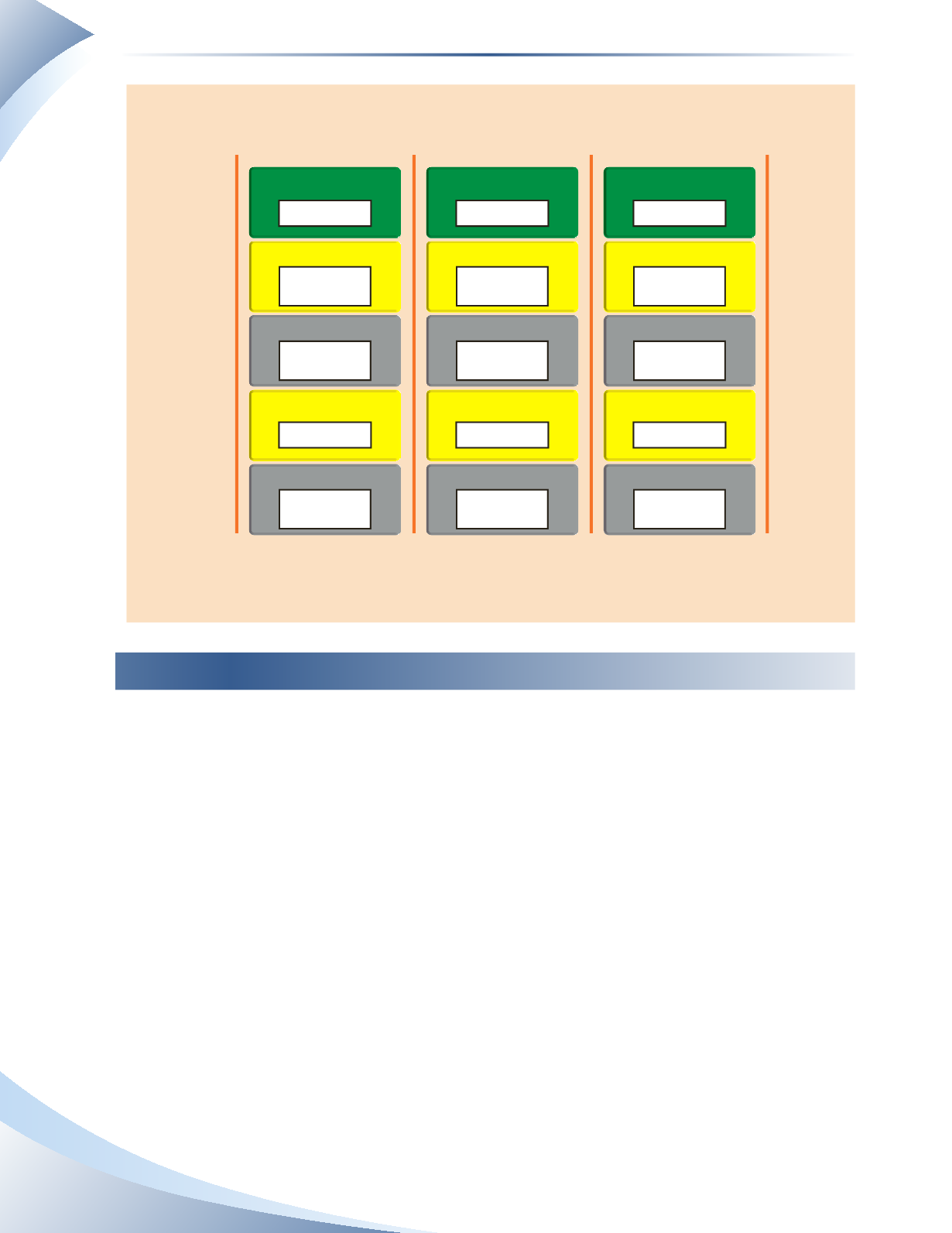

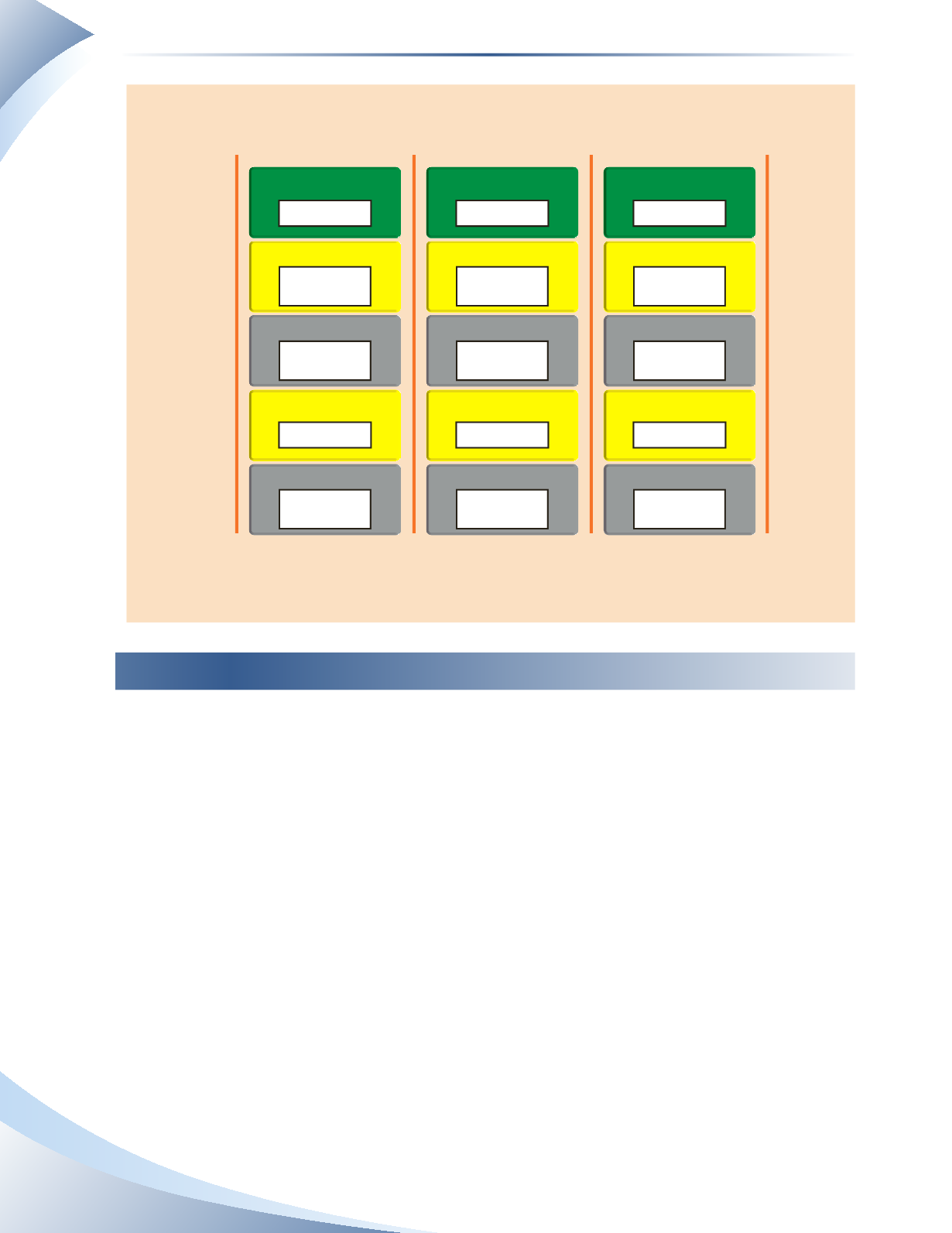

INCOME STATEMENT

COST OF GOODS SOLD COST OF GOODS SOLD COST OF GOODS SOLD

OPERATING EXPENSES

OPERATING EXPENSES

OPERATING EXPENSES

GROSS PROFIT

GROSS PROFIT

GROSS PROFIT

NET INCOME

NET INCOME

NET INCOME

SALES REVENUE

SALES REVENUE

SALES REVENUE

+ $20,000 CR

+ $10,000 CR

+ $30,000 CR

Estimated

$12,000

Estimated

$6,000

Estimated

$18,000

+ $6,000 DR

+ $6,000 DR

+ $6,000 DR

Estimated

$8,000

Estimated

$4,000

Estimated

$12,000

Estimated

$2,000

Estimated

($2,000)

Estimated

$6,000

MAY

JUNE

JULY

Multistep Income Statement

The multistep income under a periodic inventory system is much like that of a perpetual inventory

system, except when it comes to COGS. Recall that there is a single line for COGS on the income

statement for a perpetual inventory system. However, this line is replaced with a COGS section for

a periodic inventory system.The section is taken from the schedule of COGS introduced earlier.

Note that the periodic and perpetual inventory systems both produce the same values for COGS,

gross profit, and net income. The only difference is the way in which COGS is calculated. The

multistep income statement for Tools 4U is shown in Figure 7A.17 using the same values from the

perpetual inventory system.

Inventory: Merchandising Transactions

Chapter 7

Appendix