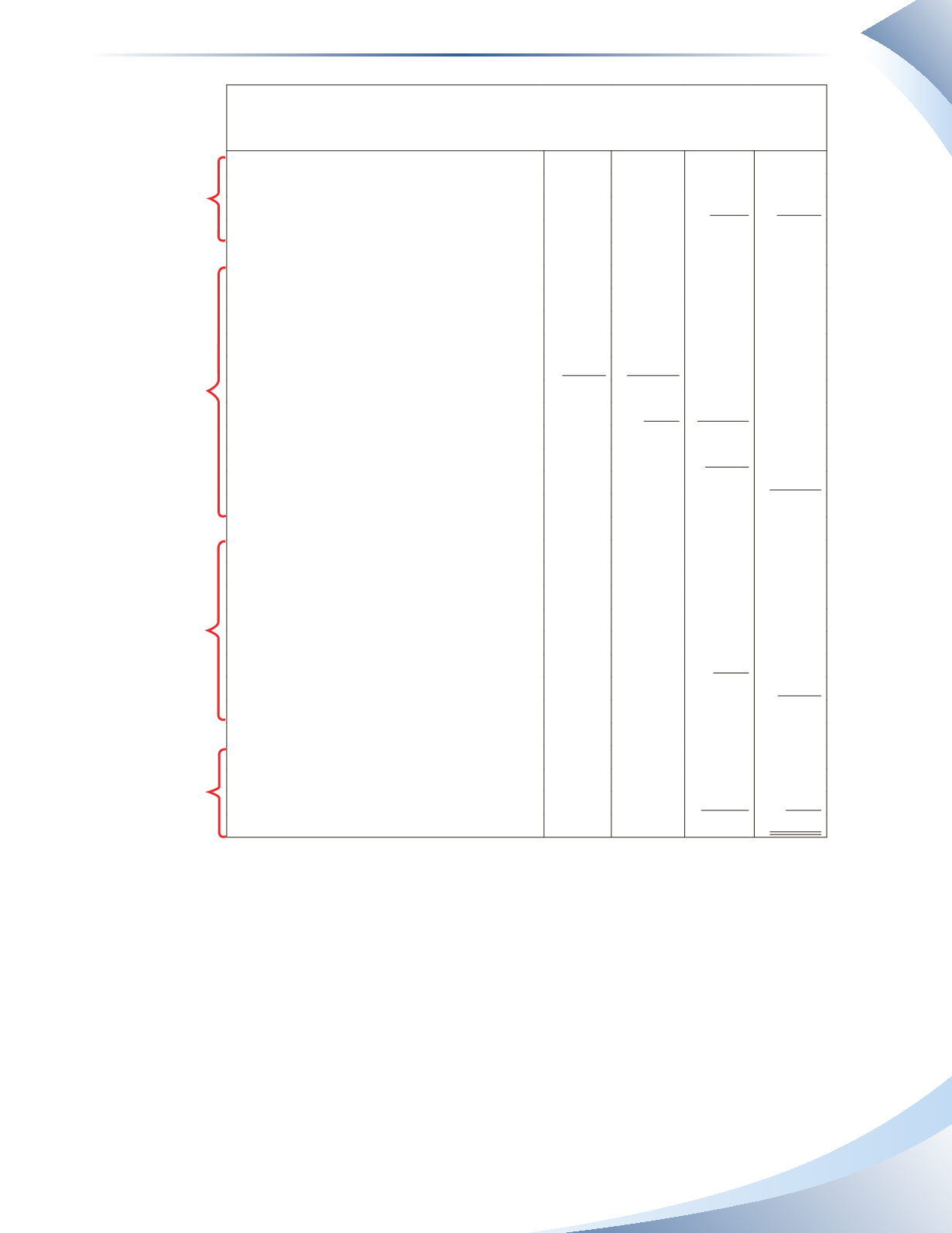

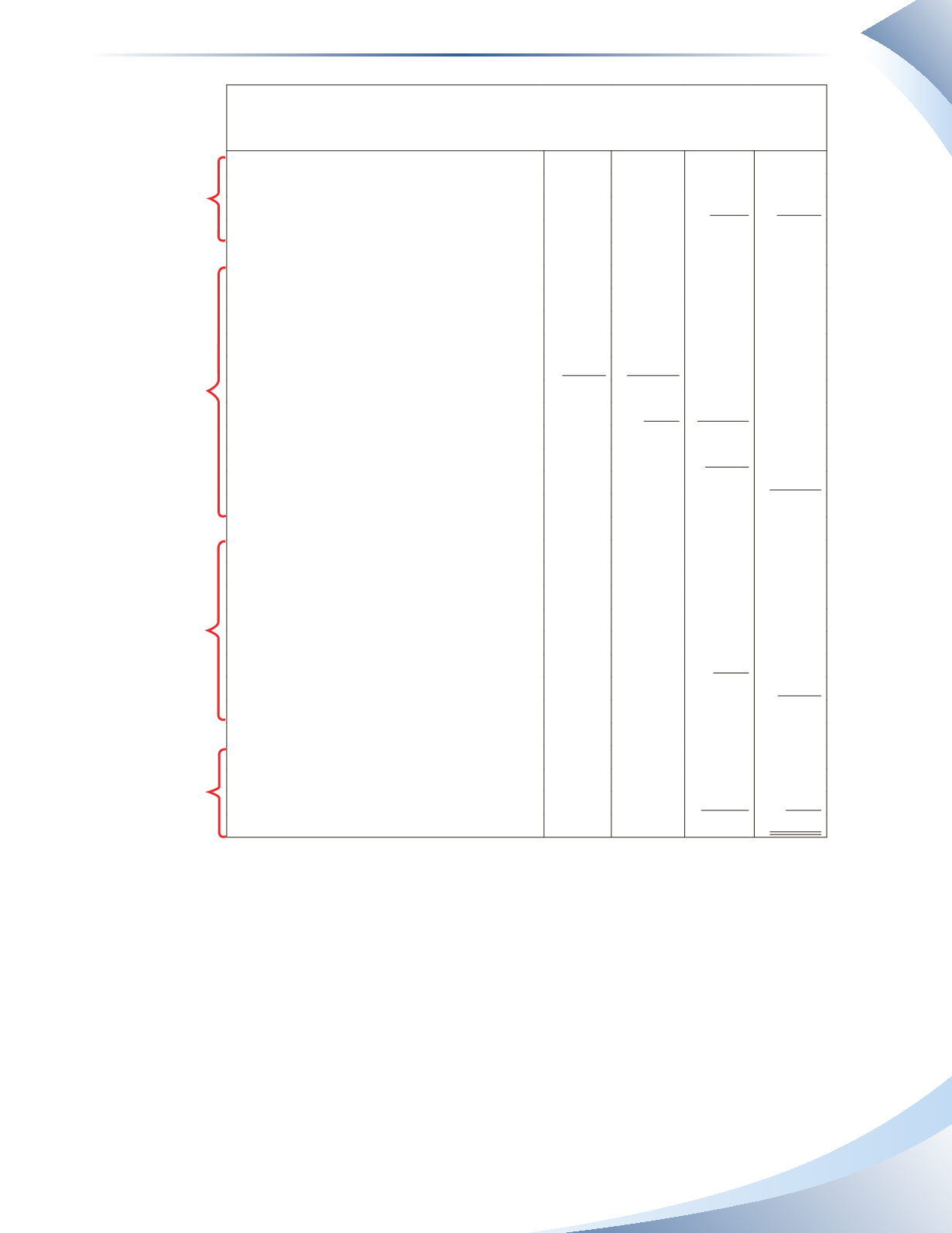

215

Tools 4U

Income Statement

For the Year Ended December 31, 2016

Sales Revenue

$200,000

Less:

Sales Returns and Allowances

$4,000

Sales Discounts

2,000 (6,000)

Net Sales

194,000

Cost of Goods Sold

Inventory, January 1, 2016

20,000

Purchases

$140,000

Less: Purchase Returns and Allowances $9,000

Purchase Discounts

13,000 (22,000)

Net Purchases

118,000

Freight-In

6,000 124,000

Cost of Goods Available for Sale

144,000

Inventory, December 31, 2016

44,000

Cost of Goods Sold

100,000

Gross Profit

94,000

Operating Expenses

Depreciation Expense

5,000

Rent Expense

10,000

Salaries Expense

40,000

Supplies Expense

7,000

Utilities Expense

6,000

Total Operating Expenses

68,000

Operating Income

26,000

Other Revenue and Expenses

Interest Revenue

8,000

Interest Expense

(4,000)

4,000

Net Income

$30,000

____________

figure 7A.17

1. Calculate Net

Sales

2. Calculate Cost

of Goods Sold

and Gross

Profit

3. Calculate

Operating

Income

4. Calculate non-

operating

activities and

Net Income

Inventory: Merchandising Transactions

Chapter 7 Appendix