217

After the closing entries are posted to the accounts, the inventory account will be updated to reflect

the actual amount of inventory on hand, $22,856.

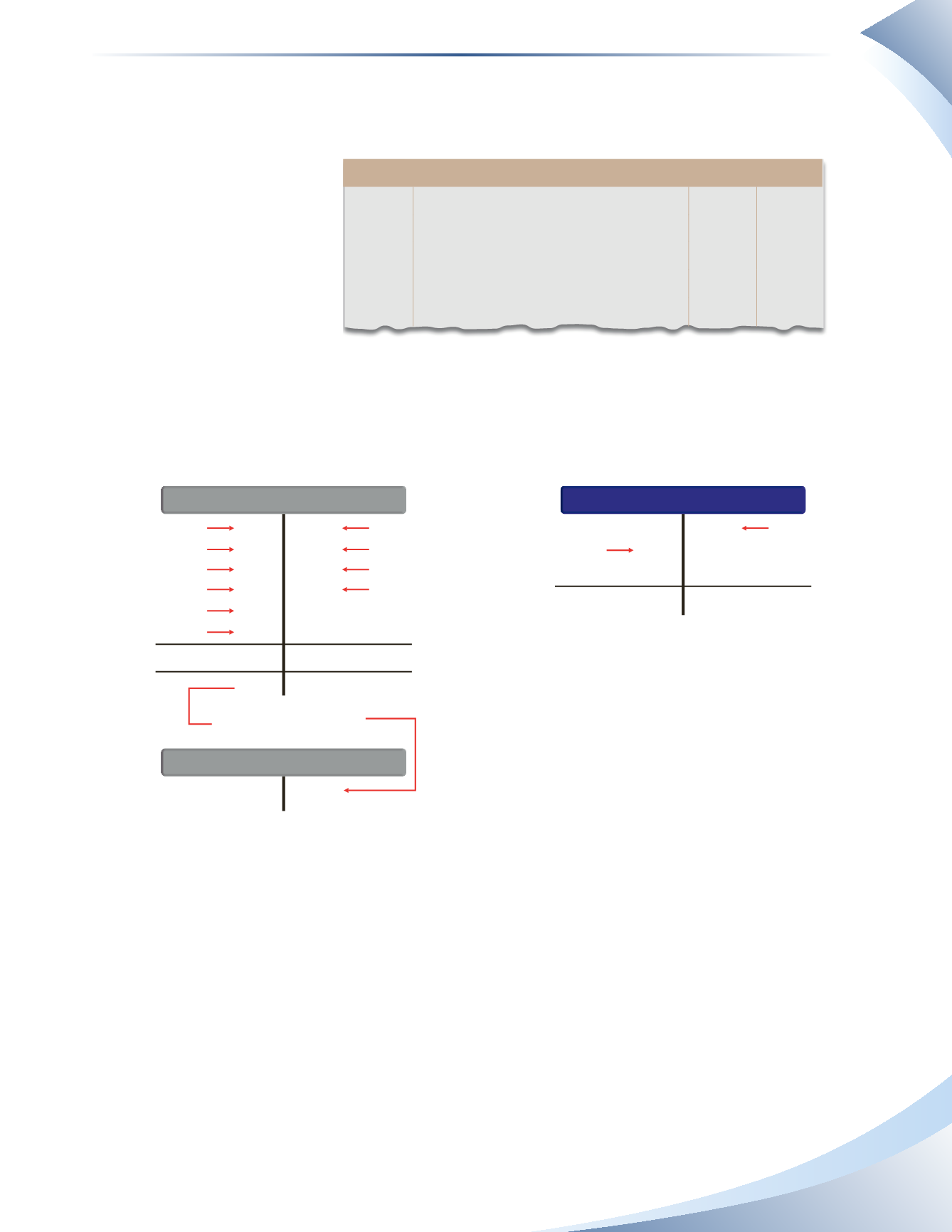

The final step of the closing

entry process is to close the

income summary account to

the owners’ capital account.

The journal entry on January

31 is shown in Figure 7A.20.

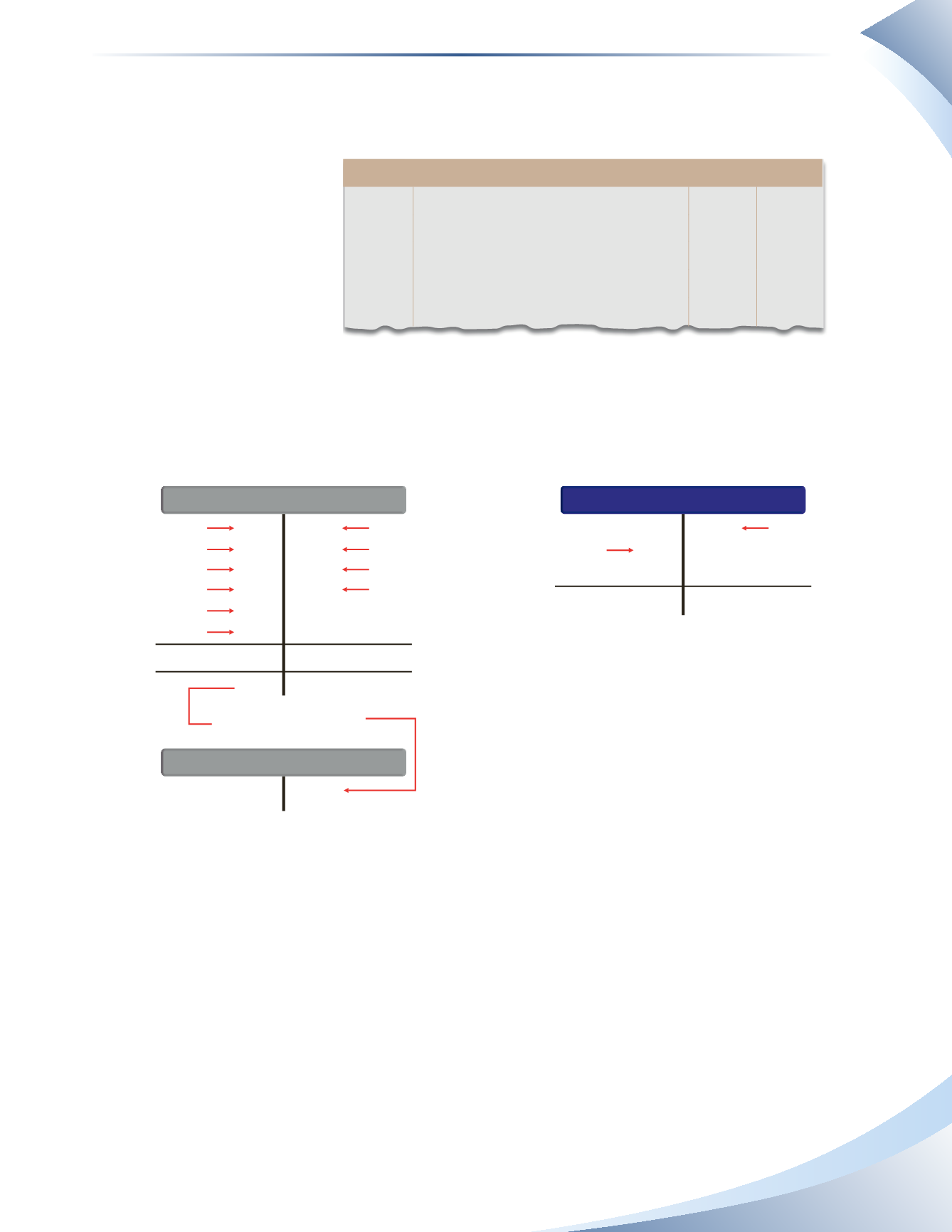

The T-accounts in Figure

7A.21 below summarize

the closing entries under

the periodic inventory system. Note how the inventory account is updated following the physical

inventory count. Each item that is closed to the income summary account is shown separately so

the opening and ending inventory amounts can be highlighted.

INCOME SUMMARY

+

INVENTORY

SANDERS, CAPITAL

20,000

22,856

360

84

20,000

2,940

Revenue

Ending Inventory

Purchase Returns

& Allowances

Purchase Discounts

Remove

beginning

inventory

Add

ending

inventory

20,000

4,300

250

14,200

100

1,510

20,000

22,856

22,856

Opening Inventory

Sales Returns

& Allowances

Sales Discounts

Purchases

Freight-in

Operating Expenses

Bal. 2,940

2,940

Close Income Summary and

update Owner’s Capital

FIGURE 7A.21

+

-

+

-

-

_______________

fIGuRe 7A.21

Journal

Page 1

date

account title and explanation

debit Credit

2016

Dec 31 Income Summary

2,940

Sanders, Capital

2,940

To close income summary account

_______________

fIGuRe 7A.20

Inventory: Merchandising Transactions

Chapter 7 Appendix