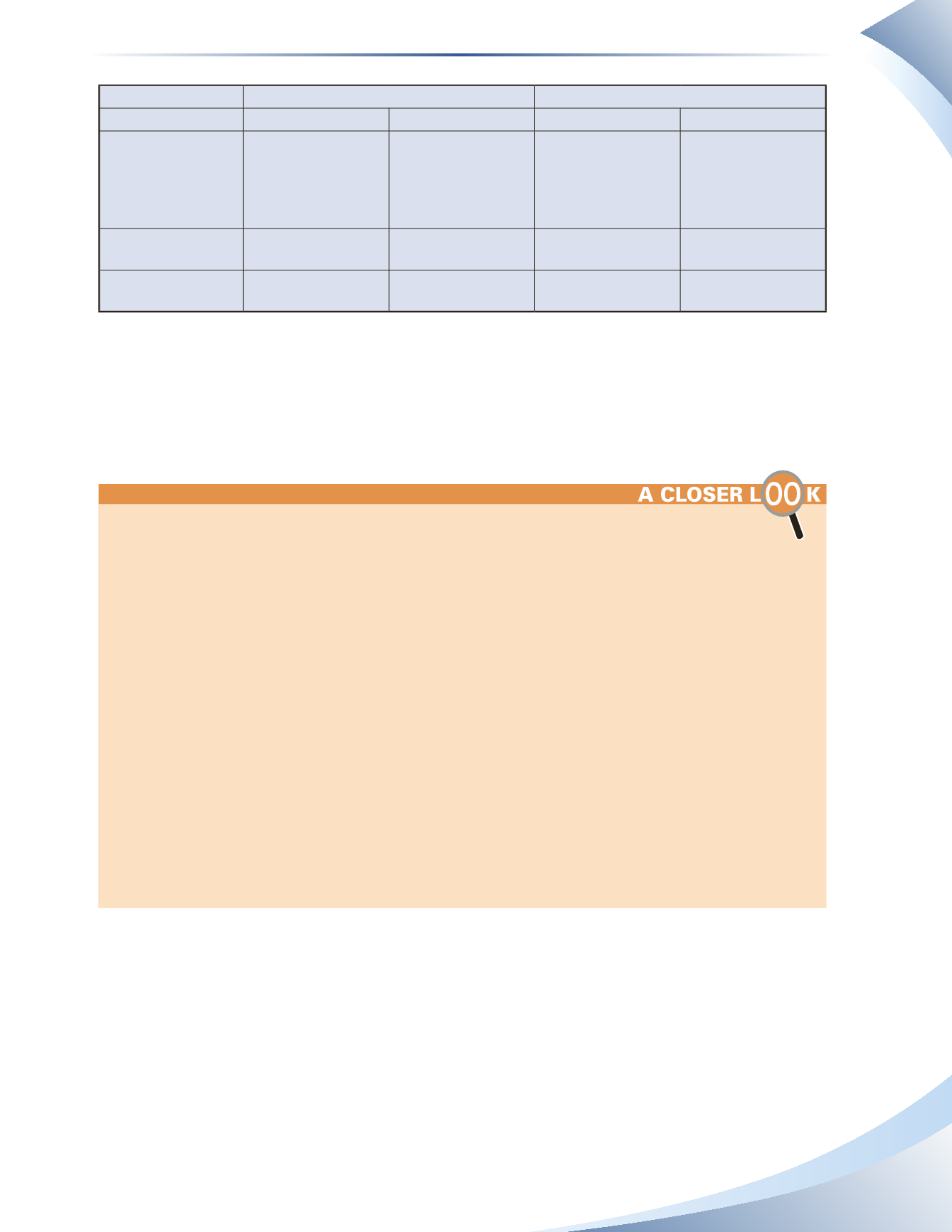

213

Transaction

Perpetual*

Periodic*

Debit

Credit

Debit

Credit

Sales Returns

Sales Returns &

Allowances (I/S)

Inventory (B/S)

Cash or Accounts

Receivable

Cost of Goods Sold

(I/S)

Sales Returns &

Allowances (I/S)

Cash or Accounts

Receivable

Sales Allowance

Sales Returns &

Allowances (I/S)

Cash or Accounts

Receivable

Sales Returns &

Allowances (I/S)

Cash or Accounts

Receivable

Receipt with

Discount

Cash

Sales Discounts (I/S)

Accounts

Receivable

Cash

Sales Discounts (I/S)

Accounts

Receivable

*B/S = Balance Sheet and I/S = Income Statement

____________

figure 7A.16

In essence, the mechanisms behind recording these transactions under both inventory tracking

methods are the same.They only differ in the way that no “inventory” and “cost of goods sold”

accounts are present under the periodic inventory transactions.

The accurate financial performance of a company that uses the periodic system can only be

calculated when an inventory count is performed and the cost of goods sold is calculated. If a business

wanted to see how it was performing between inventory counts, it may have to make some adjustments to

the reports before the numbers are useful for decision making.

For example, a nursery selling flowers and other plants may operate from May to October. After closing in

October, it performs a physical count of inventory and prepares formal financial statements.

Before it opens in May, it has to purchase soil and seeds and start growing plants in the greenhouses in

preparation for spring. These purchases are made before any sales are made. Recall that under a periodic

inventory system, cost of goods sold = beginning inventory + purchases − ending inventory. If the company

uses the periodic inventory system and wanted to see its performance after one month of operations (May),

without counting inventory, only the beginning inventory and purchases amount would be available for the

purposes of calculating cost of goods sold. That is, ending inventory would be missing. By not deducting

ending inventory, the information presented would be distorted and it would appear the company is

operating at a loss.

To prevent the distortion of the financial statements, management can instead estimate what cost of goods

sold was using the gross profit method which will be discussed in a later chapter.

For example, if the nursery typically operates at 40% gross profit during the sales season, the following

figure illustrates how the income statement could be estimated without doing a physical inventory count.

Inventory: Merchandising Transactions

Chapter 7 Appendix