211

Reporting the Cost of Goods Sold

In a periodic system, the cost of goods sold is not known until the end of the period,when the ending

inventory is known.This is because, unlike the perpetual system where all costs flowed through the

inventory account, the costs that make up the cost of goods available for sale are kept in separate

accounts (beginning inventory, purchases, and freight-in). Once ending inventory is determined, it

is subtracted from the cost of goods available for sale to determine the cost of goods sold.

Cost of Goods Sold=Beginning Inventory +Net Purchases + Freight-In

-

Ending Inventory

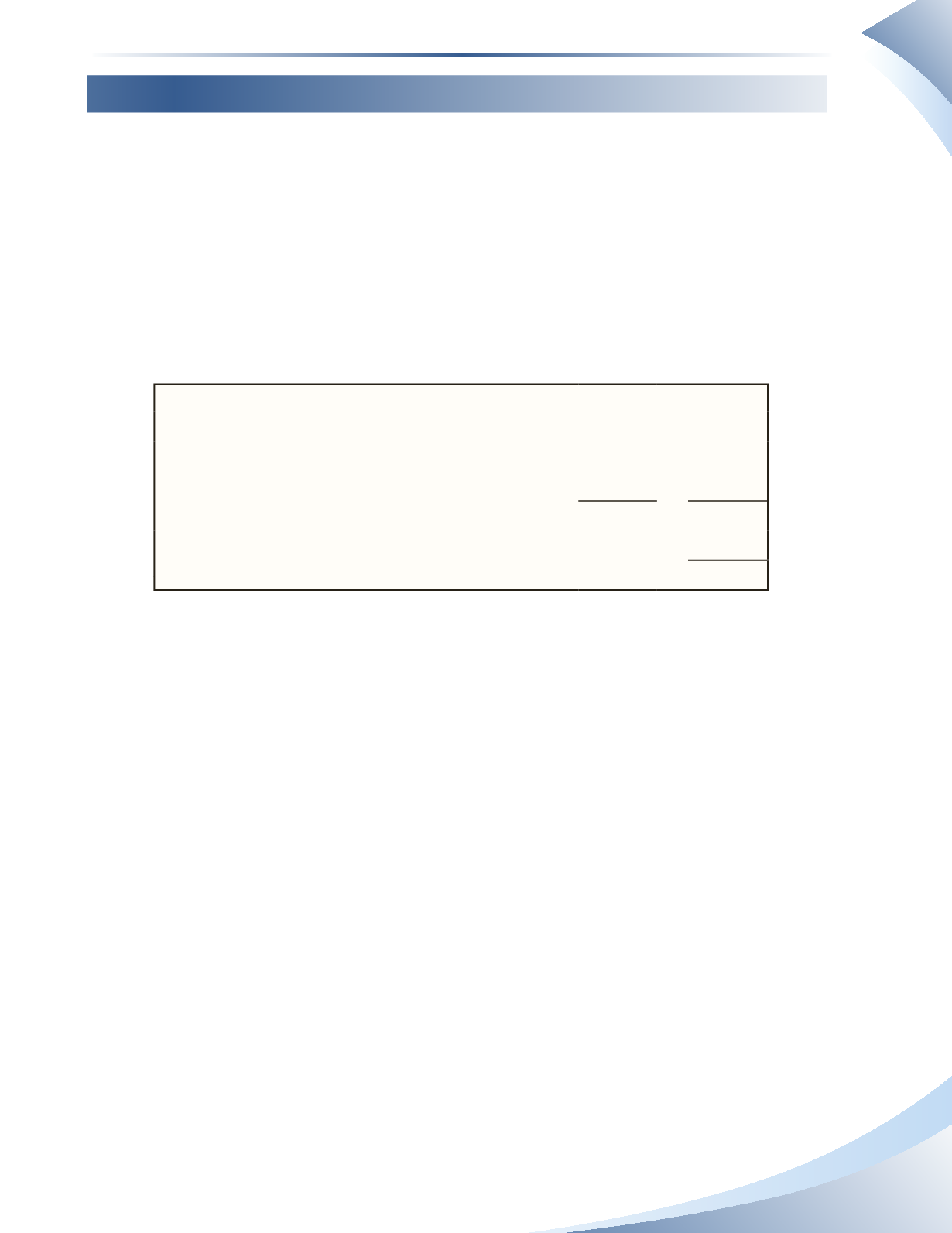

Assuming the beginning inventory in our example is $20,000 and the ending inventory is $22,856,

the cost of goods sold is determined on the income statement as shown in Figure 7A.14.

The freight-in is added to net purchases to determine cost of goods available for sale.The value of

ending inventory is determined by a physical count and subtracted from cost of goods available

for sale to determine cost of goods sold.The amounts included in the inventory and cost of goods

sold is no different from the example under the perpetual inventory system. It is mainly a timing

difference regarding when these amounts are updated.

FOB and Inventory Counts

The terms of shipping items will have an impact on period end inventory counts. An inventory

count is supposed to include all inventory that is owned by the company, and this can include items

that are not physically at the place of business. All companies must pay careful attention to items

in the process of being shipped when counting inventory.

For example, suppose Company A purchases items with a cost of $10,000 with terms of FOB

shipping point. This means that Company A takes ownership of the goods as soon as they are

loaded onto the carrier, and should include these as part of its inventory. While these goods are in

transit, Company A performs an inventory count and does not include the inventory that they just

purchased. This means that the value of ending inventory on the balance sheet will be too low, or

understated by $10,000. If Company A uses the periodic inventory system, an understated ending

inventory will cause COGS to be overstated and net income to be understated. This is shown in

Figure 7A.15.

Cost of Goods Sold = Beginning Inventory + Net Purchases + Freight-In − Ending Inventory

Beginning Inventory

$20,000

Net Purchases

$13,756

Freight-In

100

13,856

Cost of Goods Available for Sale

$33,856

Less: Ending Inventory

22,856

Cost of Goods Sold

$11,000

______________

Figure 7A.14

Inventory: Merchandising Transactions

Chapter 7 Appendix