216

Closing entries

Closing entries and Inventory in a Periodic system

Although there are a few

variations of how inventory

is adjusted through the

closing entries when a

periodic system is used, the

main objective is the same—

to remove the beginning

inventory balance and add

the new ending inventory

balance.

One approach that is

frequently used is shown in

Figure 7A.18.

When closing the accounts with a credit balance on the income statement, the new ending inventory

balance of $22,856 is debited to the inventory account. To understand the logic of this entry,

refer to the detailed cost of

goods sold section previously

discussed.

The

ending

inventory is deducted from

the cost of goods available

for sale to determine the

amount of cost of goods sold

because ending inventory

represents the amount a

company still has on hand

at the end of the accounting

period. It is available for sale

at the beginning of the next

accounting period.

In closing the expense

accounts, notice that the

beginning inventory balance

of $20,000 is credited. Refer to Figure 7A.14, the detailed cost of goods sold section is shown.What

effect does the beginning inventory have on the cost of goods available for sale? It is added together

with purchases and therefore represents an expense of the period.The logic is: expenses are credited

through the closing entries; therefore, the beginning inventory balance of $20,000 must be credited.

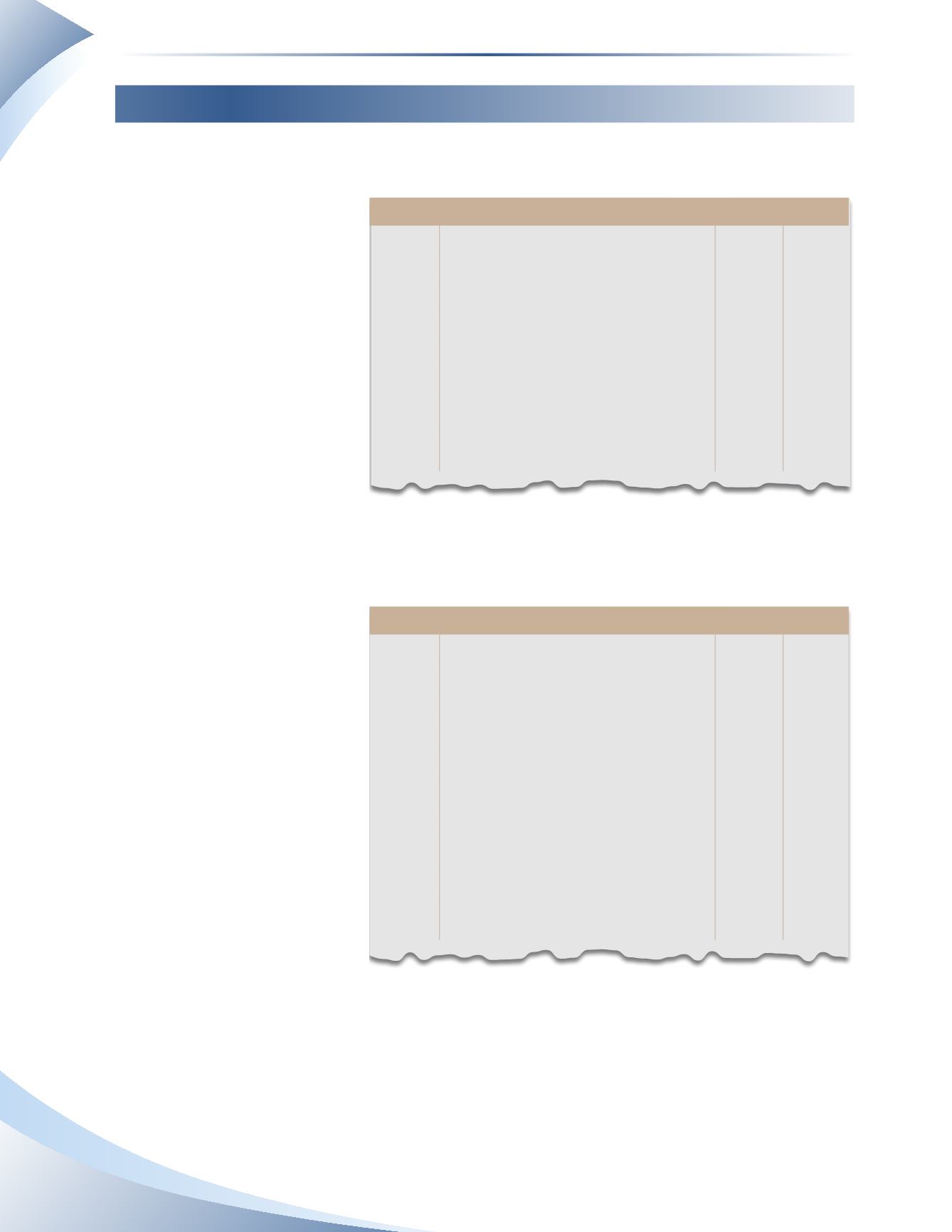

Journal

Page 1

date

account title and explanation

debit Credit

2016

Dec 31 Sales Revenue

20,000

Inventory

22,856

Purchase Returns & Allowances

360

Purchase Discounts

84

Income Summary

43,300

Close revenue and credit balances and

update inventory

________________

fIGuRe 7A.18

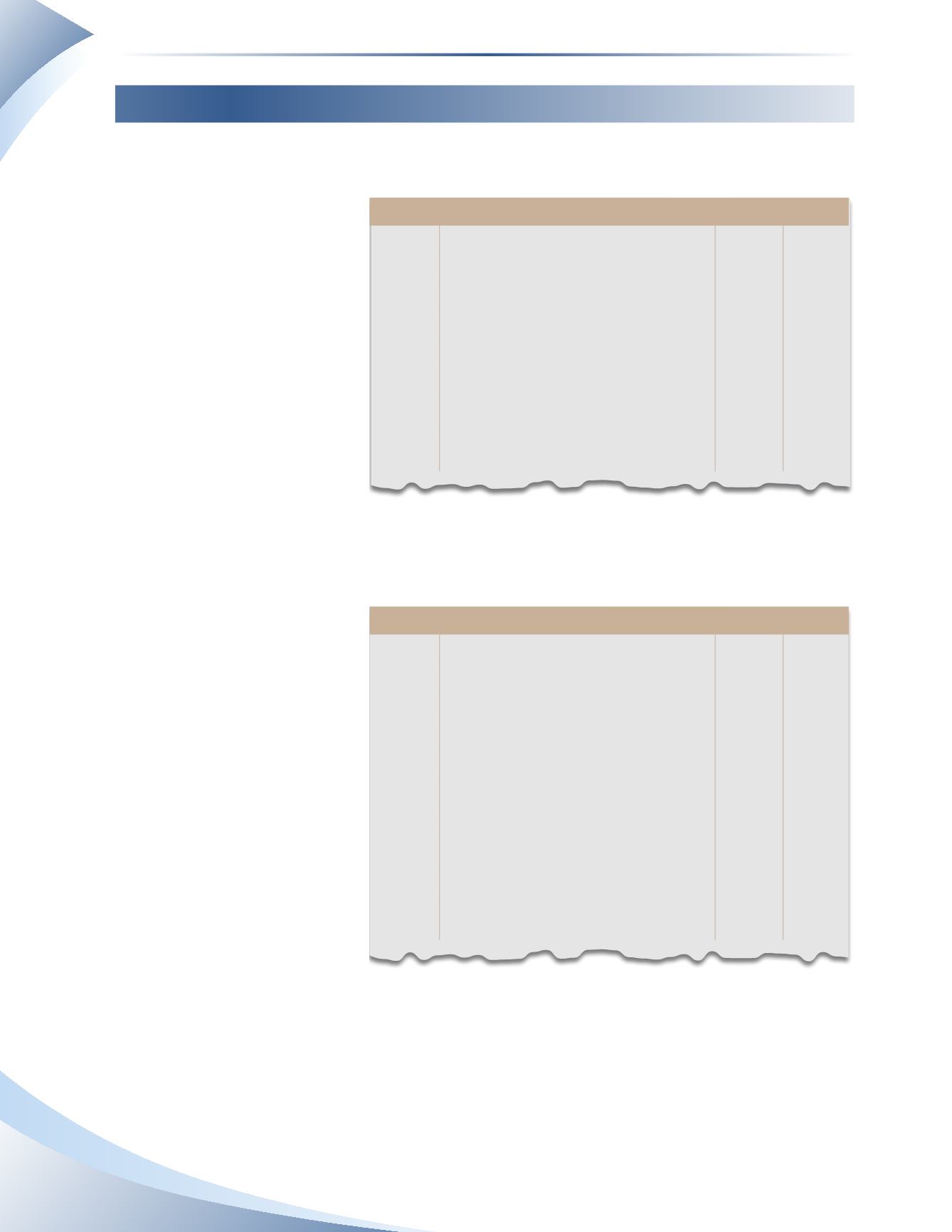

Journal

Page 1

date

account title and explanation

debit Credit

2016

Dec 31 Income Summary

40,360

Inventory

20,000

Sales Returns & Allowances

4,300

Sales Discounts

250

Purchases

14,200

freight-in

100

Operating expenses

1,510

Close expenses and debit balances and

update inventory

________________

fIGuRe 7A.19

Inventory: Merchandising Transactions

Chapter 7

Appendix