269

Chapter 9

Accounting Information Systems

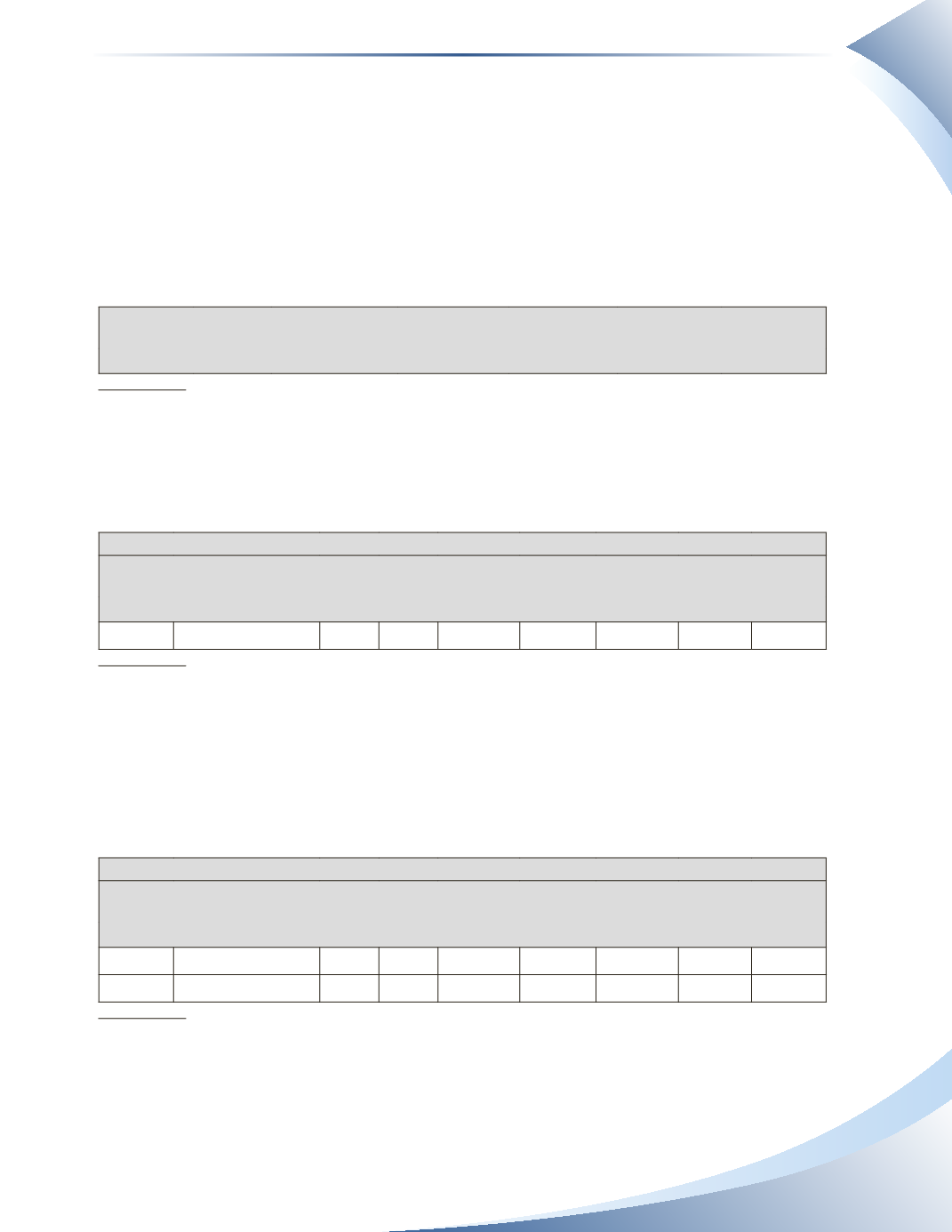

The Cash Payments Journal

The cash payments journal records all cash payments made by the company. There is a column to

record the cheque number, since a good control is to have all payments made by a cheque. Various

columns are provided for the most common reasons for paying with cash, and an Other column

is used to record cash payments for items that do not fall under one of the given columns. Notice

that Inventory appears with both a debit and credit column. The debit side is used if inventory is

purchased with cash (cheque) and the credit side is used if the company pays a supplier of inventory

early and receives a discount.

Accounts

Payable

Other

Inventory

Cash

Chq #

PR

(DR)

(DR)

(DR)

(CR)

(CR)

figure 9.15

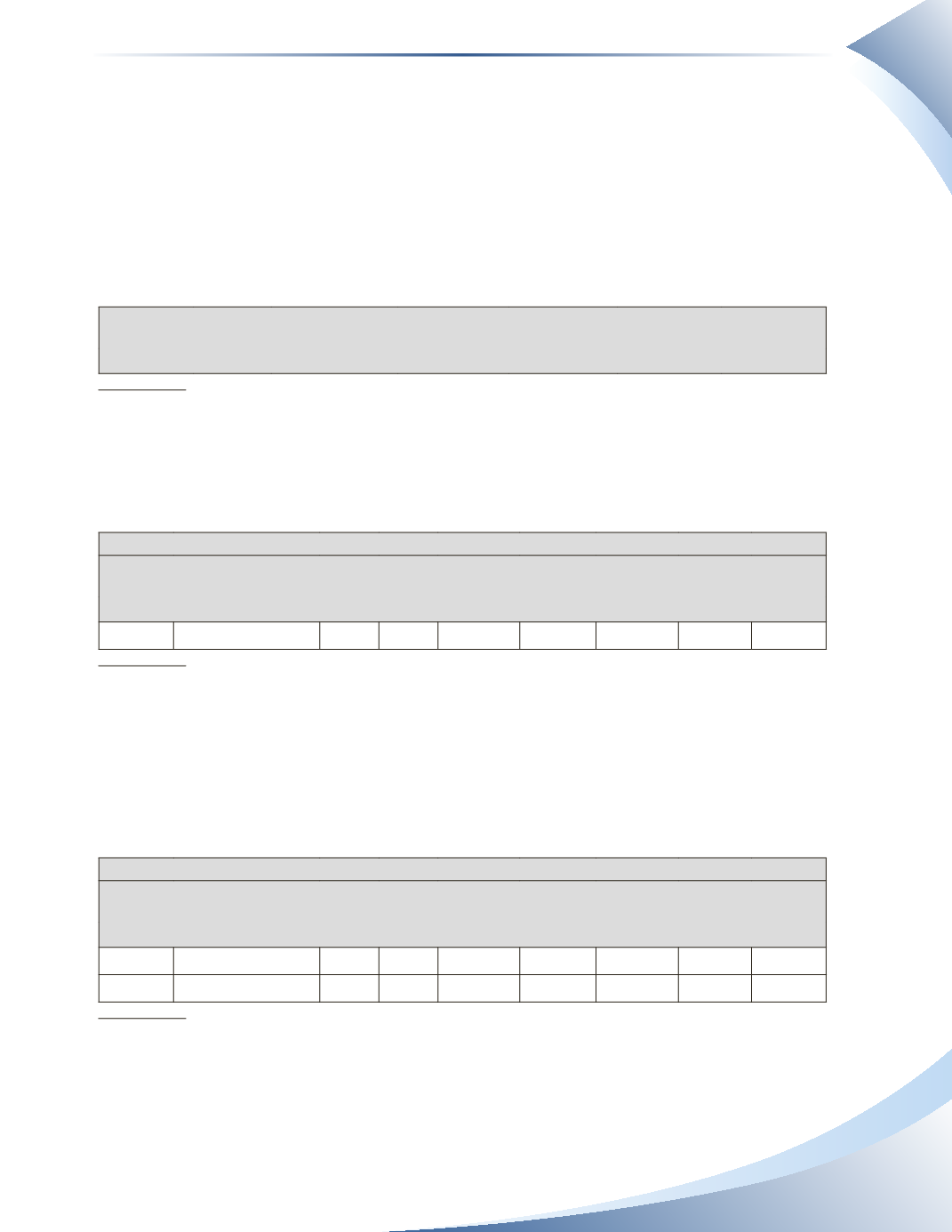

Cash purchases are recorded in the cash payments journal, as shown in Figure 9.16. Accounts

payable is not affected, so no entry should be posted to the subledger accounts.The Other column

was not used, so no entry should be posted to the general ledger at this time.The general ledger is

only updated at the end of the month when the columns are totalled.

Cash Payments Journal

Page 4

Accounts

Payable Other

Inventory

Cash

Date

Account

Chq # PR

(DR)

(DR)

(DR)

(CR)

(CR)

Jan 6 Electro Parts

748

1,500

1,500

figure 9.16

The transaction on January 15 in Figure 9.17 is a withdrawal from the company by the owner.

Since there is no column with Owner’s Drawings as a heading, the amount is recorded in the

Other column.The post reference (310) indicates that the amount of the withdrawal shown is

immediately updated to owner’s drawings in the general ledger. At the end of the month, the total

of the Other column will not be posted because any amount in this column is posted immediately

to the appropriate ledger account.

Cash Payments Journal

Page 4

Accounts

Payable Other

Inventory

Cash

Date

Account

Chq # PR

(DR)

(DR)

(DR)

(CR)

(CR)

Jan 6 Electro Parts

748

1,500

1,500

Jan 15 Hanlon, Drawings

749 310

500

500

figure 9.17

The payment to a supplier on January 18 immediately updates the subledger account since it affects

accounts payable. Similar to the other journals, the posting to the subledger is shown in the cash

payments journal with a checkmark. Since the terms of the purchase were 3/15, n/30, the company