265

Chapter 9

Accounting Information Systems

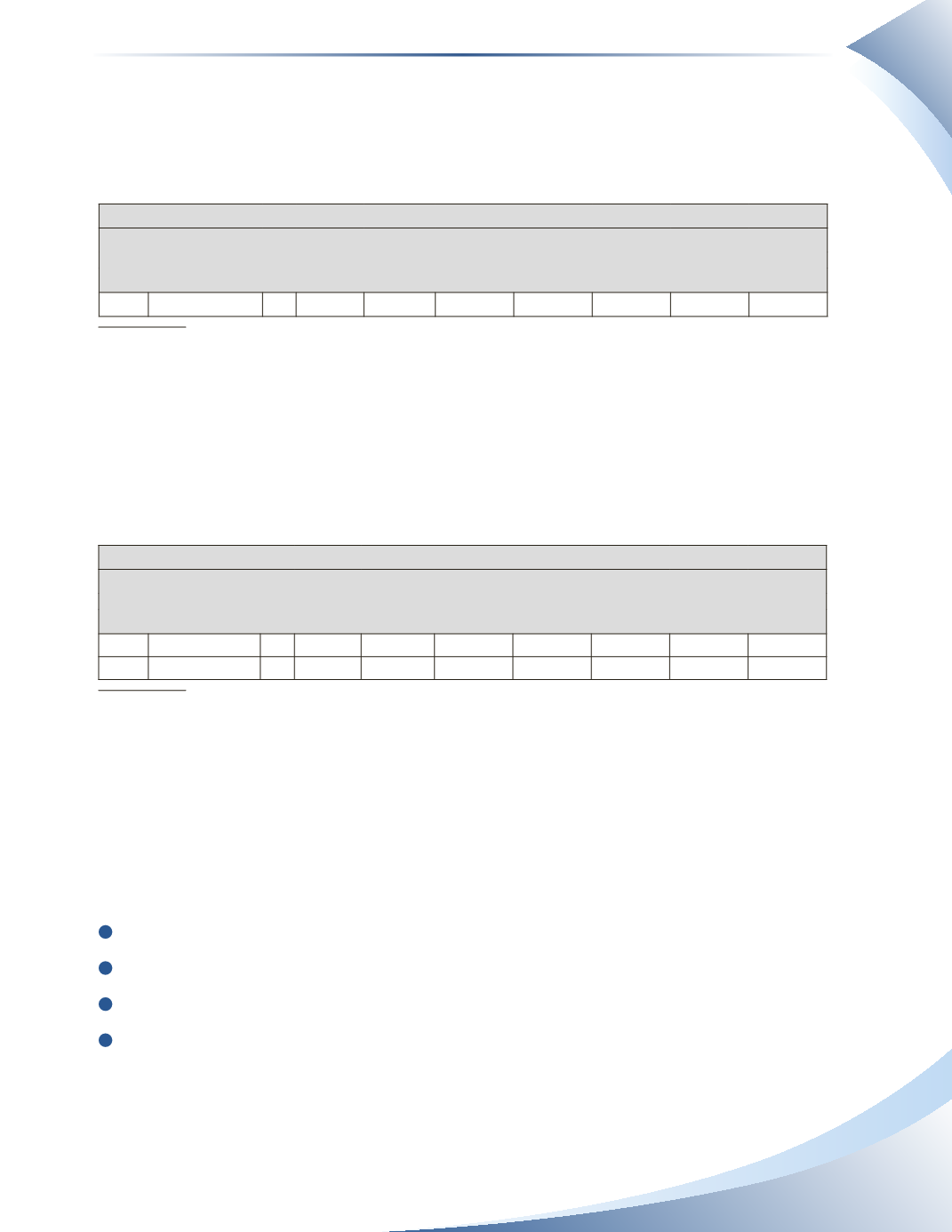

Cash sales are recorded in the cash receipts journal, as shown in Figure 9.8. Because accounts

receivable is not affected, nothing is posted to the subledger accounts. Because the Other column

was not used, no entry is posted to the general ledger at this time. The general ledger is only

updated at the end of the month when the columns are totalled.

Cash Receipts Journal

Page 3

Sales Accounts

Bank

COGS/

Cash Discount Receivable Sales

Loan Other Inventory

Date Account

PR (DR)

(DR)

(CR)

(CR)

(CR)

(CR)

(DR/CR)

Jan 2 Cash Sale

350

350

280

figure 9.8

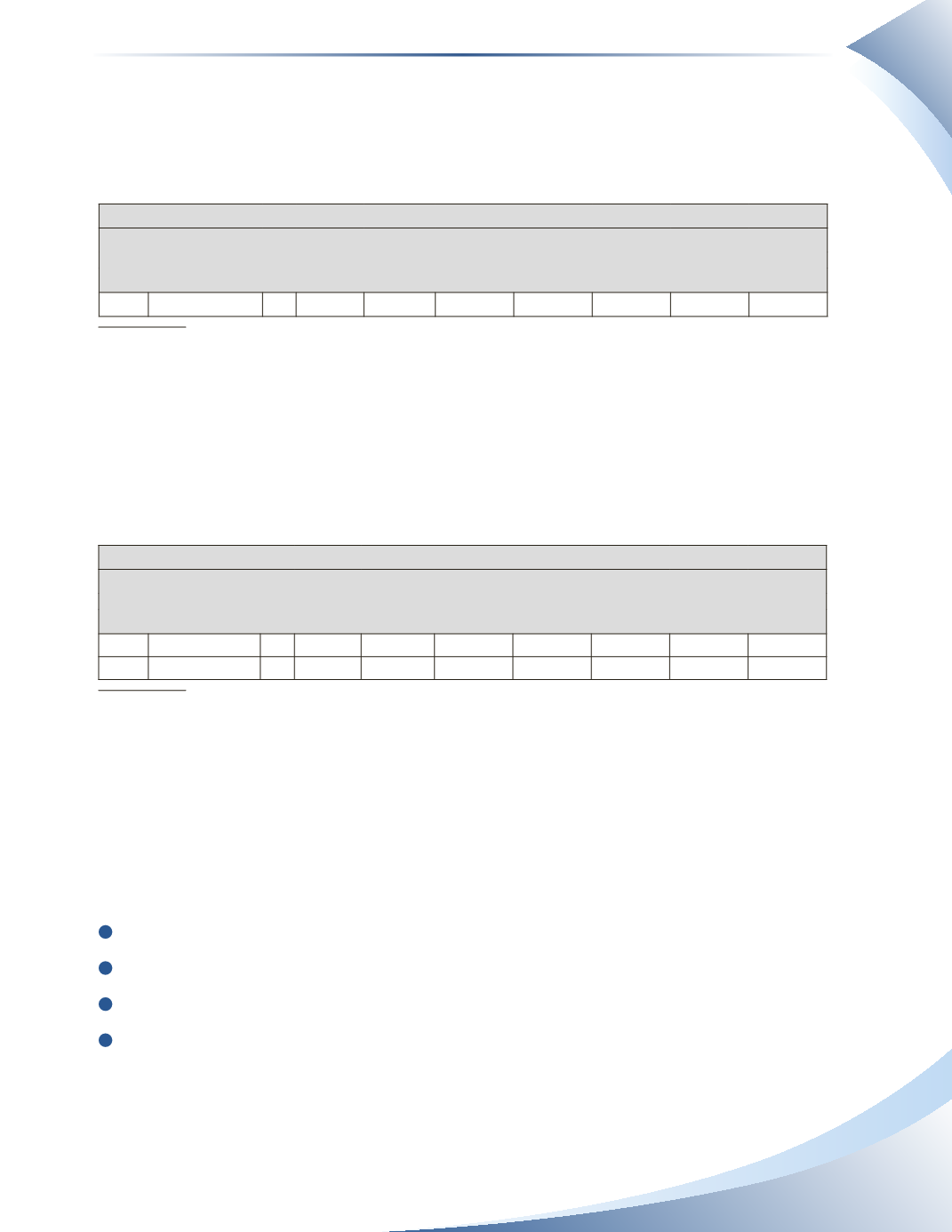

The transaction on January 4 in Figure 9.9 is an investment into the company by the owner. There

is no column with Owner’s Capital as a heading, so the amount is recorded in the Other column.

The post reference (300) indicates that the amount of the investment shown is immediately

updated to owner’s capital in the general ledger. At the end of the month, the total of the Other

column will not be posted because any amount in this column is posted immediately to the

appropriate ledger account.

Cash Receipts Journal

Page 3

Sales Accounts

Bank

COGS/

Cash Discount Receivable Sales

Loan Other Inventory

Date Account

PR (DR)

(DR)

(CR)

(CR)

(CR)

(CR)

(DR/CR)

Jan 2 Cash Sale

350

350

280

Jan 4 Hanlon, Capital 300 4,000

4,000

figure 9.9

The partial payment from a customer on January 10 shown in Figure 9.10 will immediately update

the subledger account because it affects the accounts receivable account. Since the payment is

made within 10 days of the original sale, the customer receives a 2% discount on the amount paid.

The discount therefore reduces the amount of cash received, but does not reduce the amount of

accounts receivable that is paid off.

Updating the subledger account follows these steps.

1

Transfer the date from the cash receipts journal to the date column in the subledger account.

2

Make a note of the journal and page number in the PR column of the subledger.

3

Transfer the amount of the accounts receivable column to the credit column in the subledger.

4

Indicate the posting is complete by entering a check mark in the PR column in the cash

receipts journal.