264

Chapter 9

Accounting Information Systems

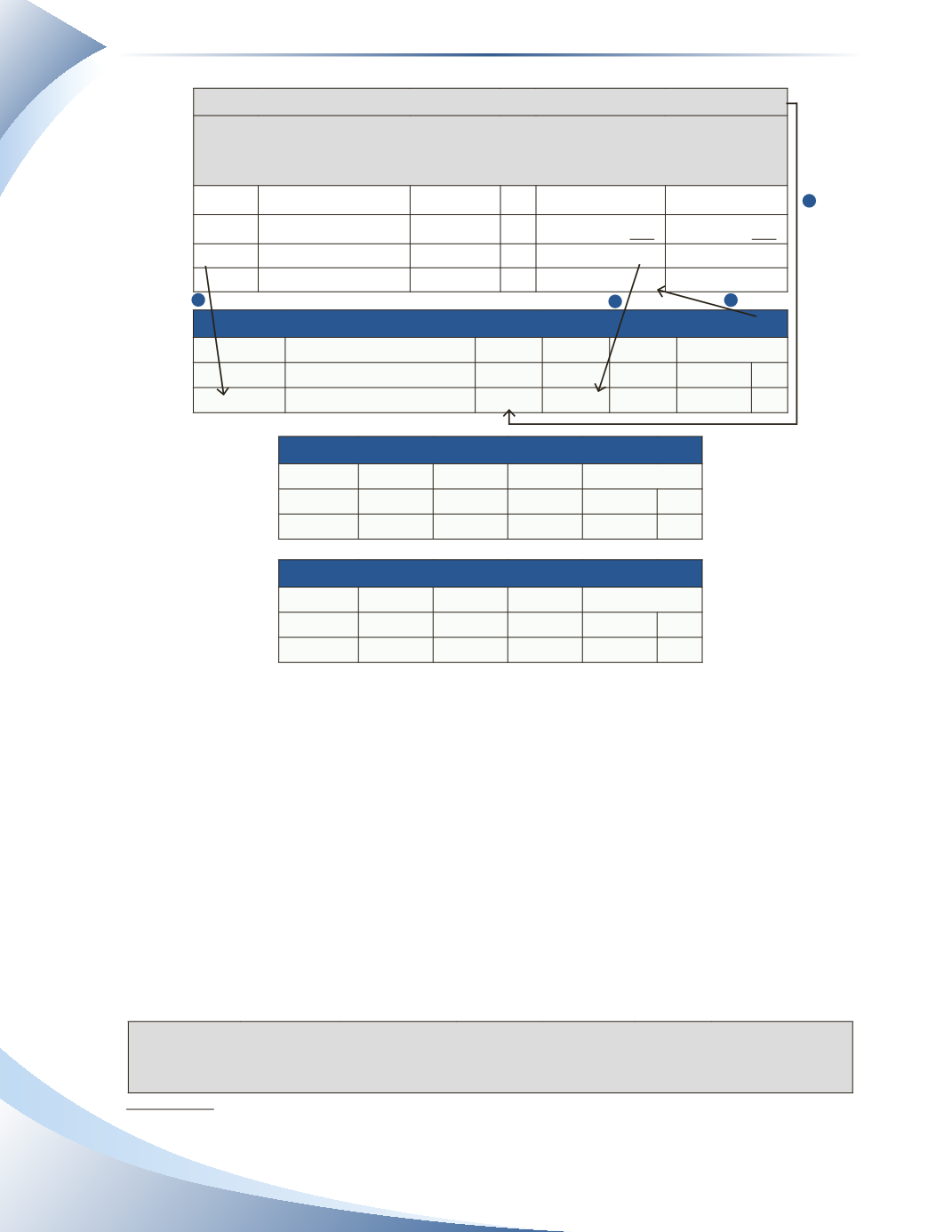

Sales Journal

Page 1

Date

Account

Invoice # PR

Accounts

Receivable/Sales

(DR/CR)

COGS/

Inventory

(DR/CR)

Jan 5 Joe Blog

5125

1,235

1,100

Jan 16 Furniture Retailers

5126

956

850

Jan 31 Total

$2,191

$1,950

(110/400)

(500/120)

Account:

Accounts Receivable

GL. No.

110

Date

Description

PR

DR

CR

Balance

2016

Jan 31

SJ1

2,191

2,191 DR

Account:

Joe Blog

Date

PR

DR

CR

Balance

2016

Jan 5

SJ1

1,235

1,235 DR

Account:

Furniture Retailers

Date

PR

DR

CR

Balance

2016

Jan 16

SJ1

956

956 DR

________________

figure 9.6

The total of $2,191 is posted to the accounts receivable control account and to sales revenue. The

total of $1,950 is posted to cost of goods sold and inventory.The total of the two customer accounts

($1,235 and $956) is equal to the balance of the accounts receivable control account.

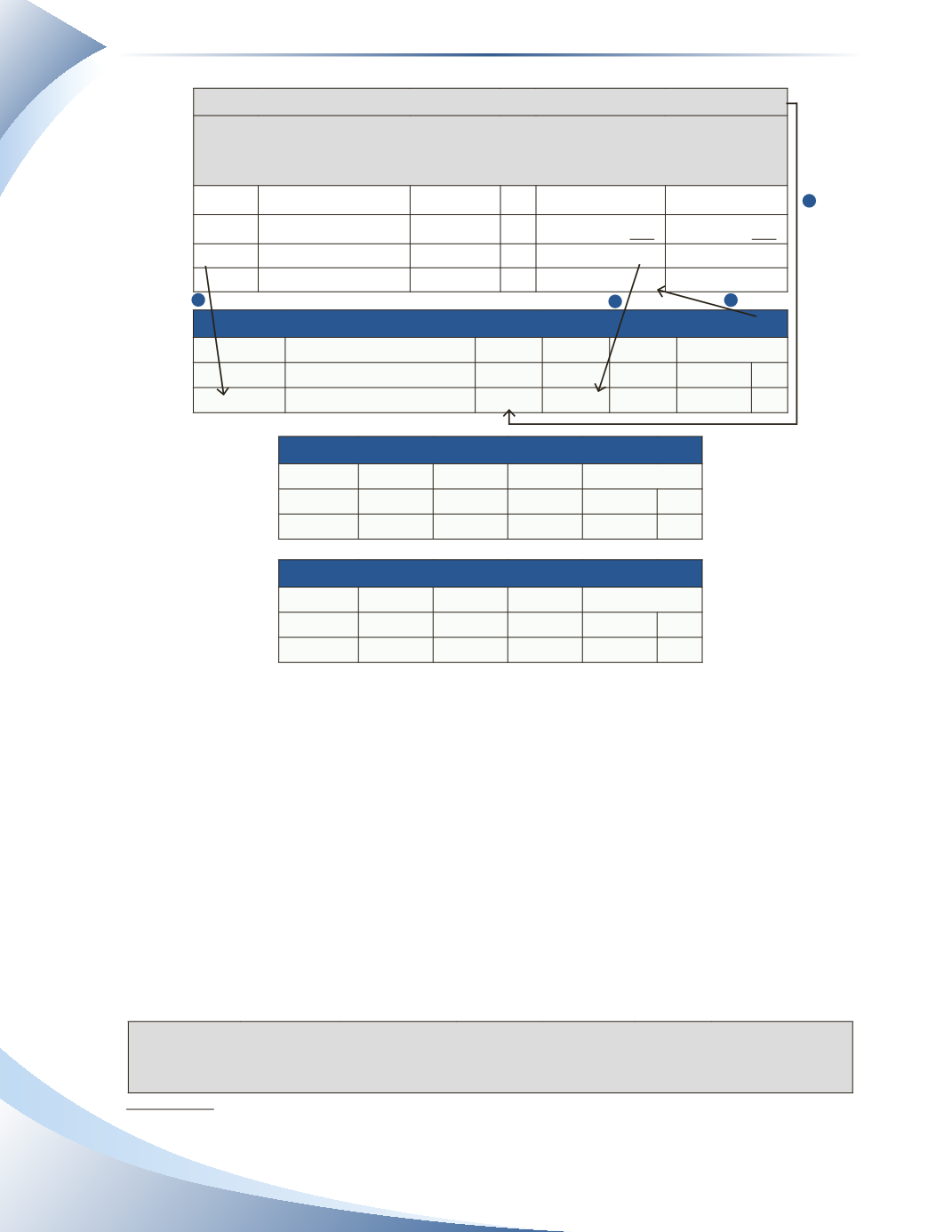

The Cash Receipts Journal

The cash receipts journal records all receipts of cash. Typical reasons for the receipt of cash are

listed in the column headings (Accounts Receivable, Sales and Bank Loan) which vary depending

on the company. A column titled Other is used to record cash receipts that do not fall under one of

the frequently used categories. Any amount recorded in the Other column is immediately posted

to the appropriate general ledger account.The Sales Discount column is used if customers make a

payment within the discount period specified by the company.

Cash

(DR)

Sales

Discount

(DR)

Accounts

Receivable

(CR)

Sales

(CR)

Bank Loan

(CR)

Other

(CR)

COGS/

Inventory

(DR/CR)

figure 9.7

2

1

3

4