266

Chapter 9

Accounting Information Systems

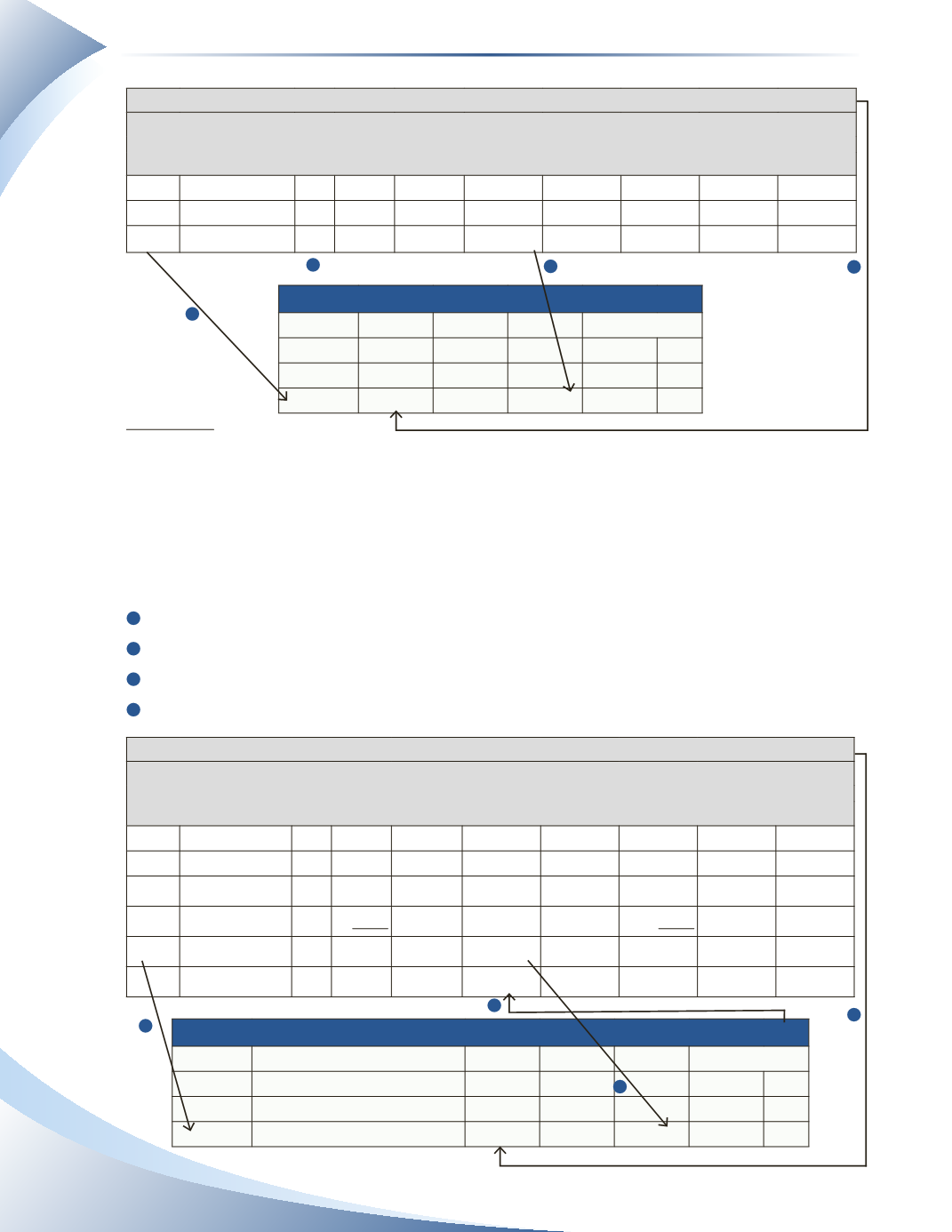

Cash Receipts Journal

Page 3

Sales Accounts

Bank

COGS/

Cash Discount Receivable Sales

Loan Other Inventory

Date Account

PR (DR)

(DR)

(CR)

(CR)

(CR)

(CR)

(DR/CR)

Jan 2 Cash Sale

350

350

280

Jan 4 Hanlon, Capital

300 4,000

4,000

Jan 10 Joe Blog

588

12

600

Account:

Joe Blog

Date

PR

DR

CR

Balance

2016

Jan 5

SJ1

1,235

1,235 DR

Jan 10

CR3

600

635 DR

figure 9.10

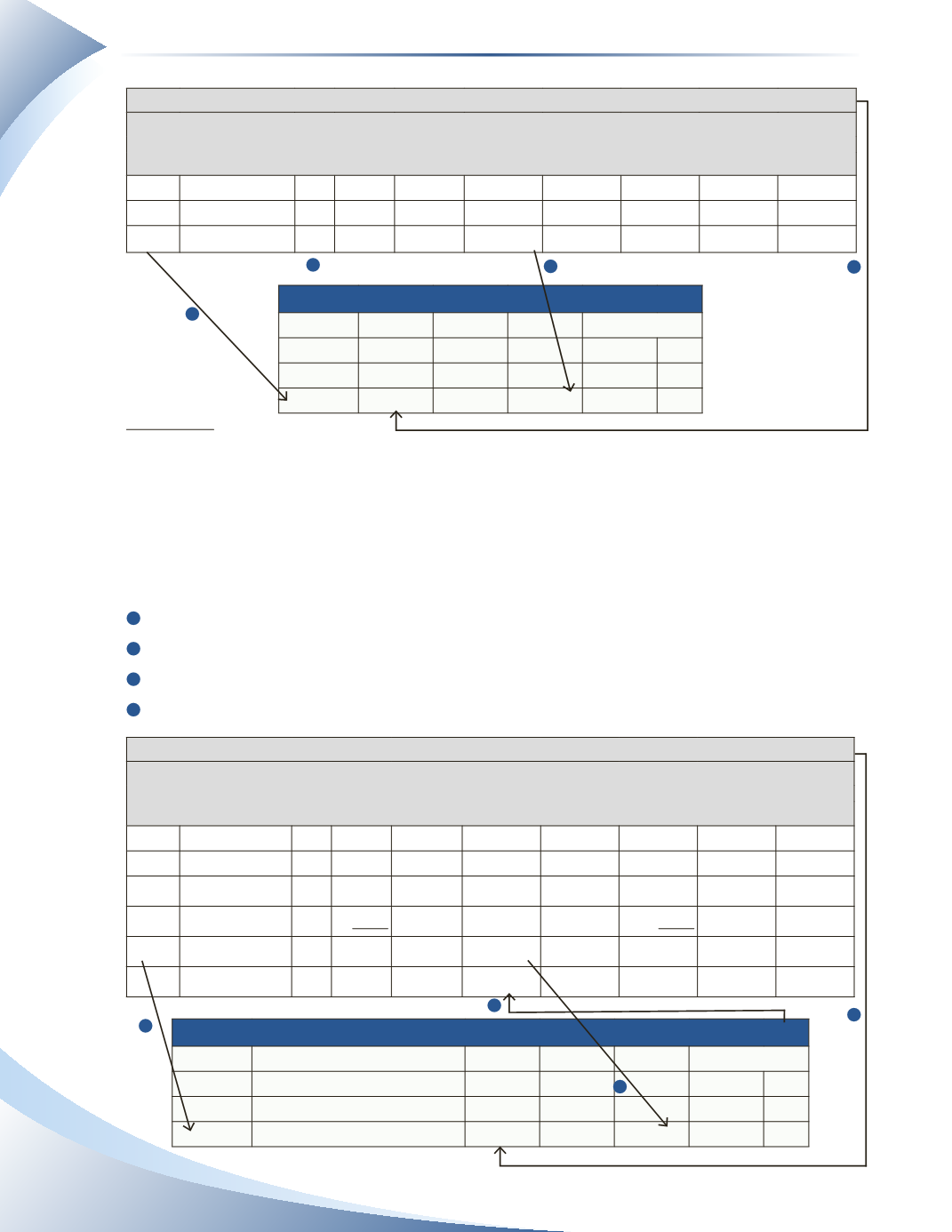

At the end of the month, all columns are totalled and the totals are posted to the appropriate general

ledger accounts. In Figure 9.11, this means that $6,938 is posted as a debit to cash, $12 is posted as a

debit to sales discounts, $600 is posted as a credit accounts receivable, and so on.The Other column

total is not posted, thus an X is used to indicate that no posting is required.

The posting to the accounts receivable control account follows these steps.

1

Transfer the date from the cash receipts journal to the date column in the ledger account.

2

Make a note of the journal and page number in the PR column of the ledger.

3

Transfer the total of the accounts receivable column to the credit column in the ledger account.

4

Indicate the posting is complete by writing the general ledger number under the total.

Cash Receipts Journal

Page 3

Sales Accounts

Bank

COGS/

Cash Discount Receivable Sales

Loan Other Inventory

Date Account

PR (DR)

(DR)

(CR)

(CR)

(CR)

(CR)

(DR/CR)

Jan 2 Cash Sale

350

350

280

Jan 4 Hanlon, Capital 300 4,000

4,000

Jan 10 Joe Blog

588

12

600

Jan 22 TD Bank

2,000

2,000

Jan 31 Total

$6,938

$12

$600

$350 $2,000 $4,000

$280

(101)

(405)

(110)

(400)

(220)

(X)

(500/120)

Account:

Accounts Receivable

GL. No.

110

Date

Description

PR

DR

CR

Balance

2016

Jan 31

SJ1

2,191

2,191 DR

Jan 31

CR3

600 1,591 DR

1

2

3

4

3

1

2

4