Chapter 10

Cash Controls

302

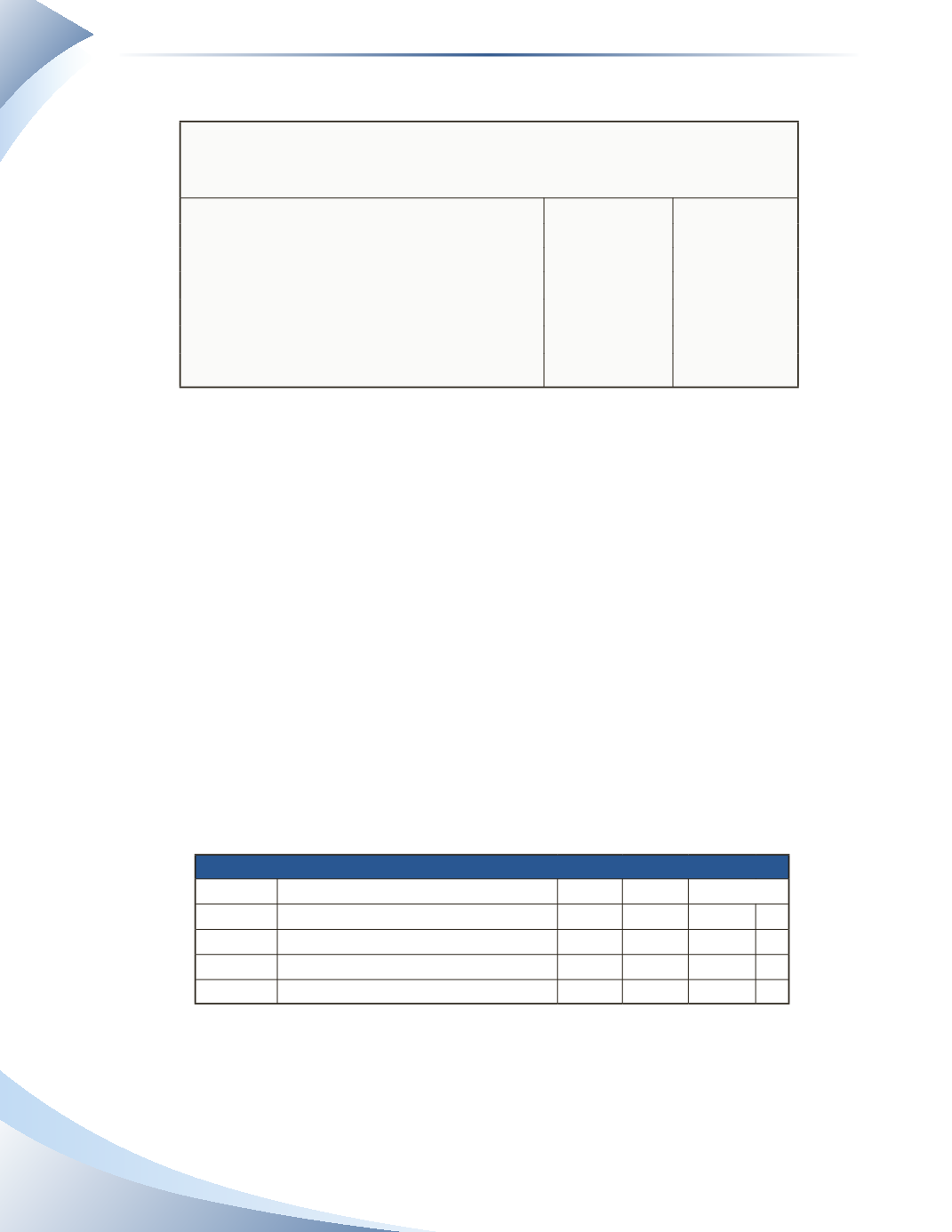

The bank reconciliation for outstanding cheques is shown in Figure 10.17.

HR Clothing

Bank Reconciliation

June 30, 2016

Ledger

Bank

Balance as per records

$2,600

$4,500

Less:

Outstanding cheques

Cheque #4 June 28

(400)

Cheque #5 June 29

(800)

Cheque #6 June 30

(700)

Reconciled balance

$2,600

$2,600

______________

Figure 10.17

No adjustment is required in the ledger account because the cheques are correctly recorded in the

general ledger but have not been cashed by the bank. The bank will eventually include them on

the bank statement.

Bank Errors

Although rare, it is possible that banks will make errors, such as charging the company incorrectly

with a cheque belonging to another company. In that case, the company’s ledger balance is correct

and the bank must correct the error.

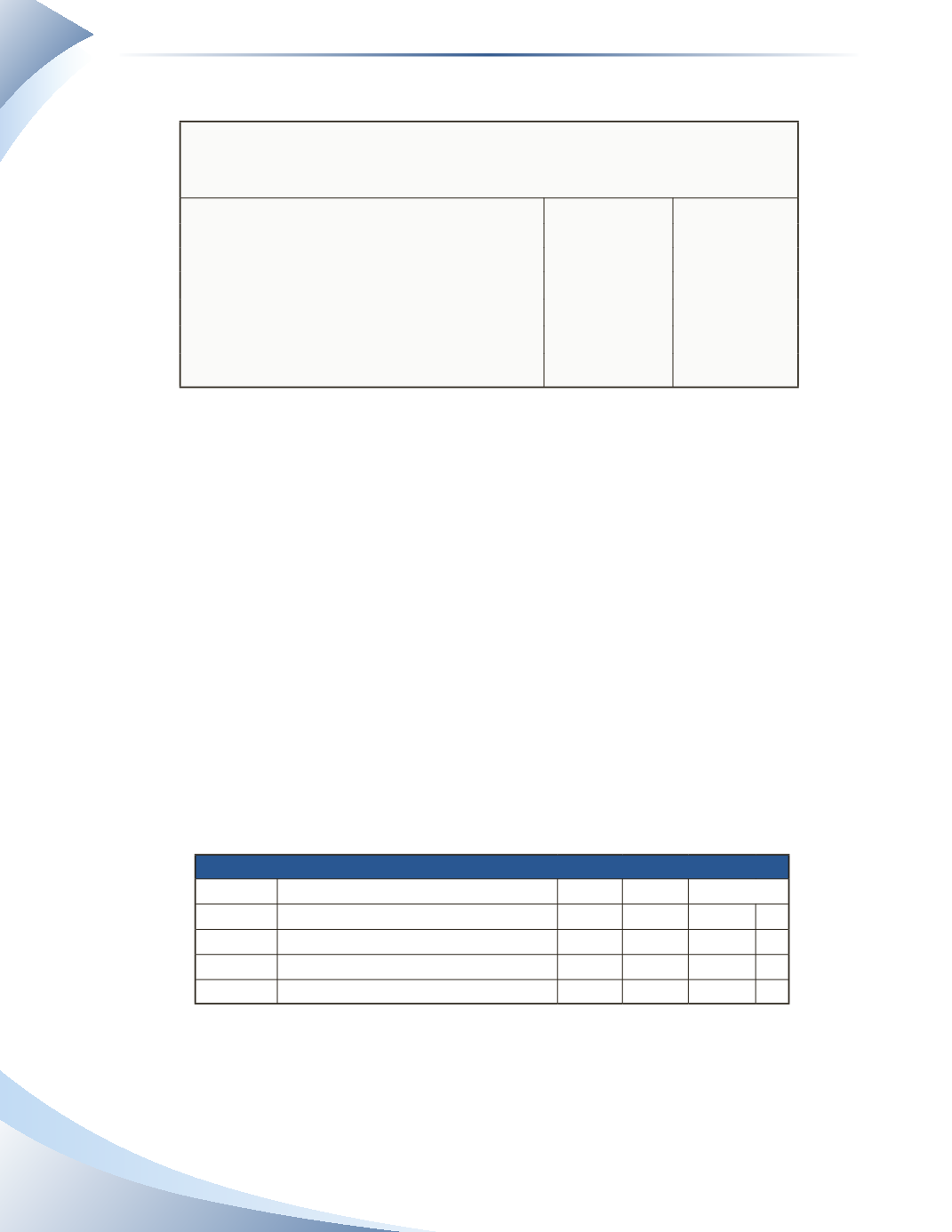

Consider an example: when the bookkeeper receives the bank statement and compares it with

the company records, she notices that the bank processed a cheque for $800 on June 8, but the

company has no knowledge of the cheque.This is shown in Figure 10.18.

At that point, the bookkeeper calls the bank and discovers that the cheque belongs to another

bank client.

GENERAL LEDGER

Account: Cash

GL. No. 101

Date

Description

DR CR

Balance

Jun 1 Opening Balance

5,000 DR

Jun 2 Cheque #1

300 4,700 DR

Jun 3 Cheque #2

500 4,200 DR

Jun 10 Cheque #3

700 3,500 DR