Chapter 10

Cash Controls

303

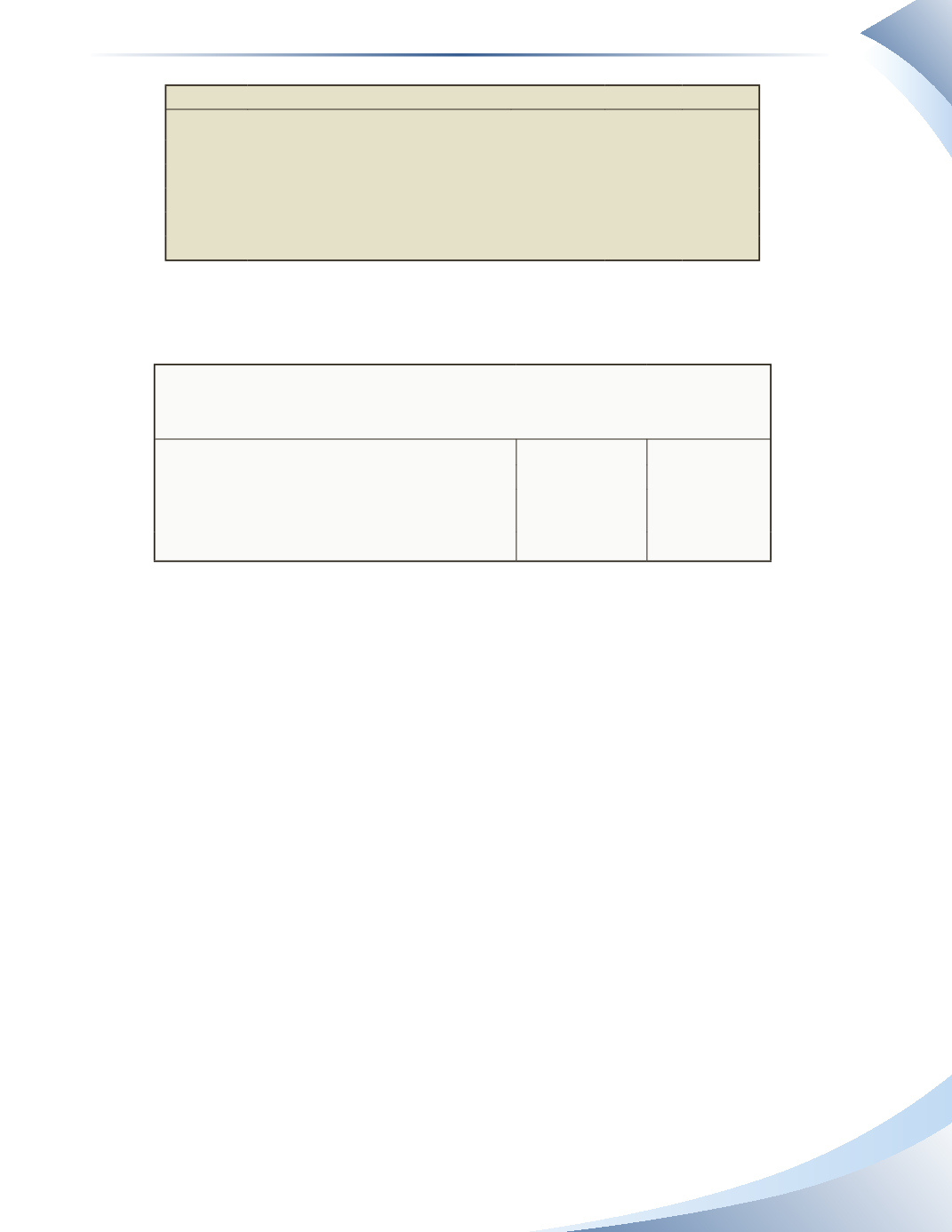

Bank Statement

June 1–June 30, 2016

Date

Description

Withdrawal Deposit Balance

Jun 1 Opening Balance

5,000

Jun 2 Cheque #1

300

4,700

Jun 3 Cheque #2

500

4,200

Jun 8 Cheque #108

800

3,400

Jun 10 Cheque #3

700

2,700

______________

Figure 10.18

The bank reconciliation for this item is shown in Figure 10.19.

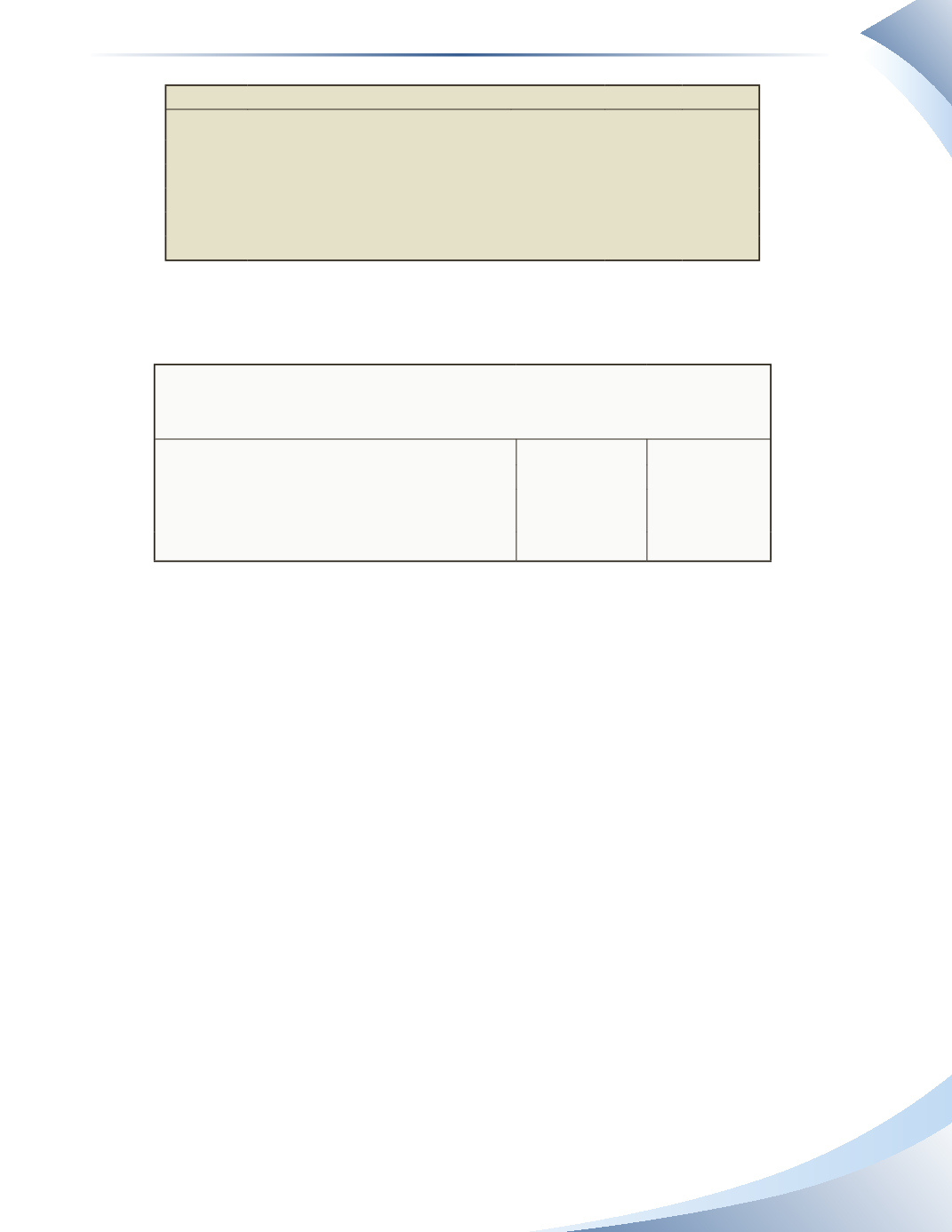

HR Clothing

Bank Reconciliation

June 30, 2016

Ledger

Bank

Balance as per records

$3,500

$2,700

Add:

Bank Error

, cheque incorrectly charged to

account June 8

800

Reconciled balance

$3,500

$3,500

______________

Figure 10.19

Since the adjustment is in the bank column, it does not need to be adjusted in the company’s books.

The amount is an error, not a timing difference, and the bank must correct the error by depositing

funds back into the company’s account. The company needs to follow up to ensure that the bank

corrects the error.

An incorrect deposit may also appear on the bank statement. In that case, the bank reconciliation

would reflect a deduction from the bank balance because it is overstated as a result of the deposit.

The company would follow up to ensure that the amount was deducted from its bank account.

Ledger Errors

It is possible for bookkeepers to make errors.These errors would appear in the company’s records.

Consider an example: upon investigating the difference between the bank statement and the ledger,

the bookkeeper discovers that a cheque recorded as $950 in the ledger should have been recorded

as $590.

The bank cashed the correct amount of the cheque ($590).The bank reconciliation for this item is

shown in Figure 10.20.