Chapter 1

Financial Statements: Personal Accounting

17

So, borrowing and repaying debt principal does not impact net worth, and neither does buying or

selling assets for the value stated in the balance sheet. The primary way you can change your net

worth is to have revenue exceed expenses (net worth increases) or have expenses exceed revenue

(net worth decreases).

Prepaid Expenses

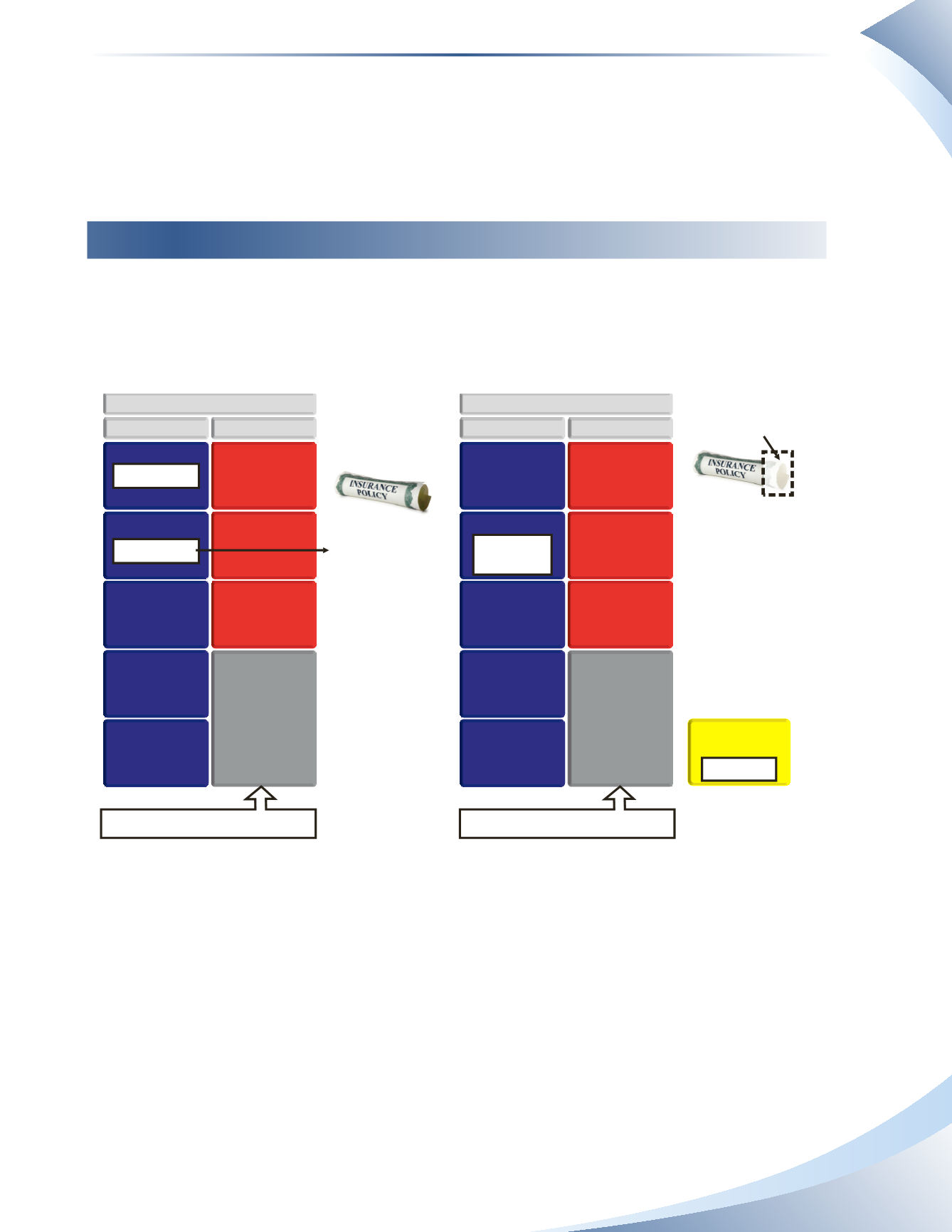

It is a common practice to pay for various expenses in advance, for example, insurance and rent.

These prepayments are not considered an expense at the time they are paid because the services

have not been provided.The example illustrated in Figure 1.31 explains the prepayment of $1,200

for insurance for one year.

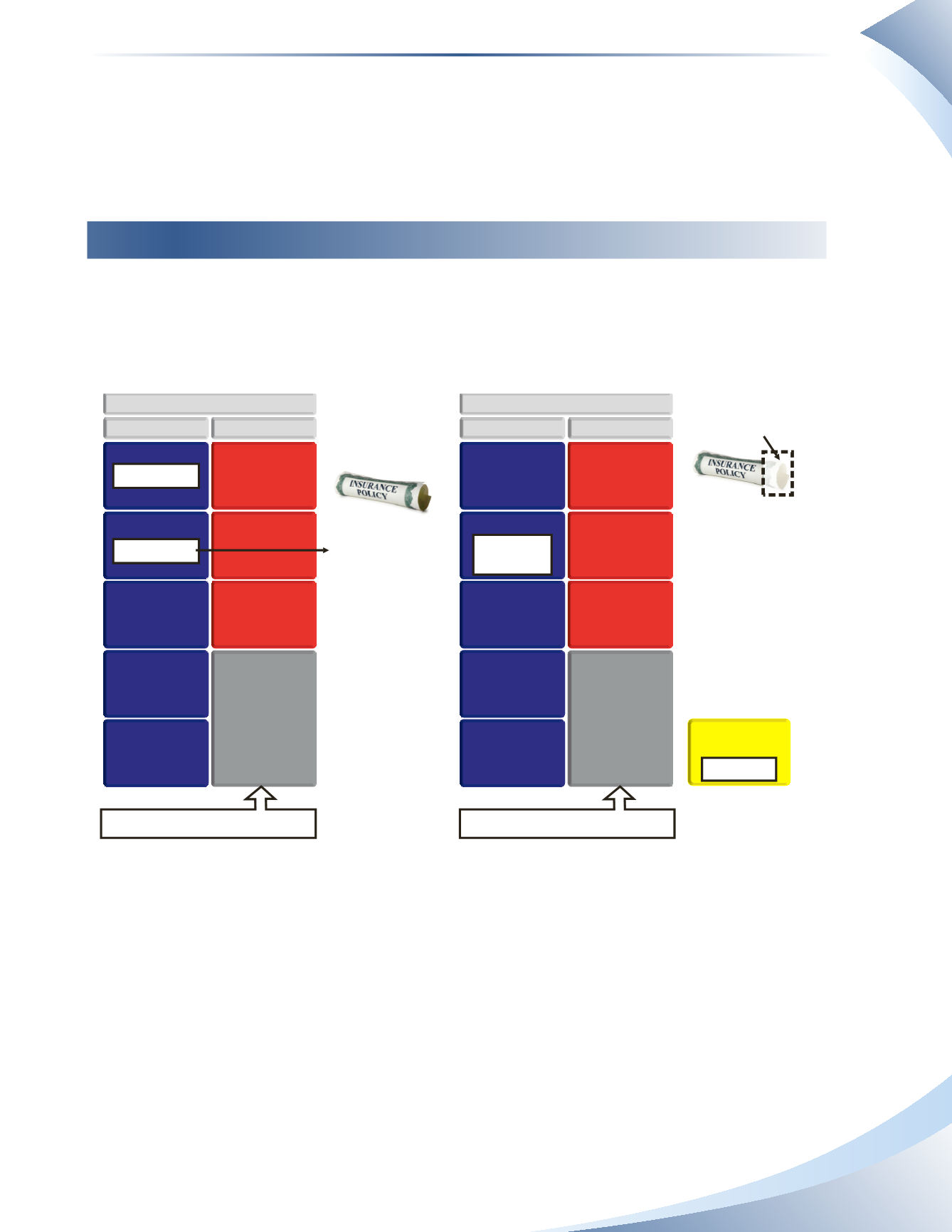

2. After one month of

coverage, if the

insurance policy were

cancelled you would

not get your money

back for the month you

have used. This

reduces the value of

the asset.

You will also recognize

the expense for the

one month of services

provided, which

reduces net worth.

Insurance used

2

2

ASSETS

ASSETS

PERSONAL BALANCE SHEET

PERSONAL BALANCE SHEET

LIABILITIES

LIABILITIES

CASH

CASH

PREPAID EXPENSES

PREPAID EXPENSES

HOUSE

HOUSE

AUTOMOBILE

AUTOMOBILE

CONTENTS OF HOME

CONTENTS OF HOME

UNPAID

ACOUNT S

UNPAID ACCOUNTS

MORTGAGE

MORTGAGE

LOANS

LOANS

NET WORTH

NET WORTH

1. - $1,200

1. + $1,200

1. You pay $1,200 to

the insurance company,

which provides you

with coverage for one

year. They will refund a

por on of you money

if you cancel the policy

before the full year is

over.

$1,200

2. - $100

INSURANCE

EXPENSE

2. + $100

No change in net worth

Net worth decreased by $100

______________

FIGURE 1.31

When you prepay your insurance, you might think intuitively that your net worth decreased because

the cash is no longer in your bank account. However, what you have really done is purchase a one

year insurance policy, which you now own. Anything you own and will benefit you in the future

is considered an asset and recorded on the balance sheet. In this case the amount paid for the

insurance policy is considered a prepaid expense. A

prepaid expense

occurs when you pay cash for

an expense (like insurance) before you use it. You own the policy for one year and the insurance

company must provide you with coverage for that period of time. If you cancel the insurance policy

before the year is up, the company will have to refund your money for the amount of the policy

that you did not use.