Chapter 1

Financial Statements: Personal Accounting

19

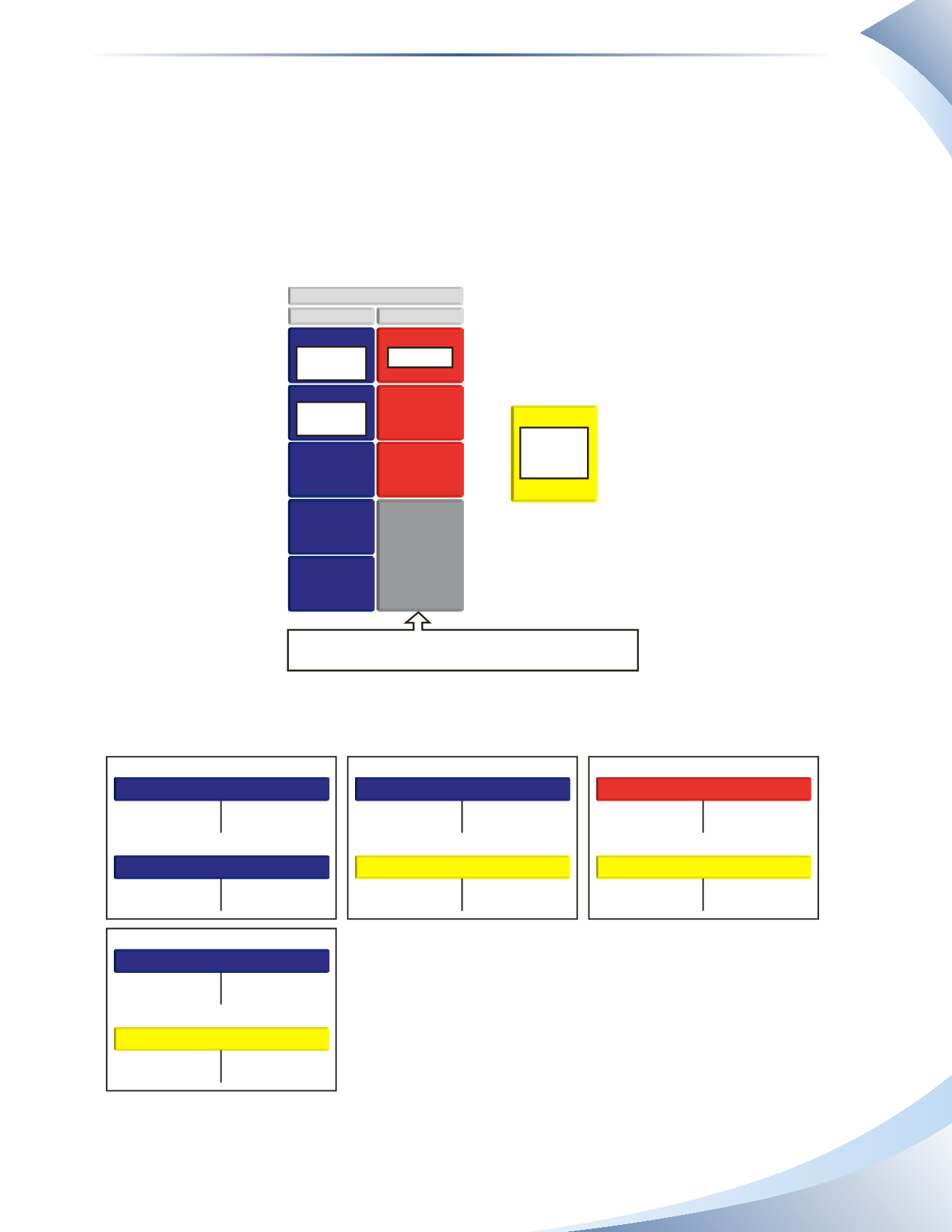

According to accrual-based accounting, expenses are always recorded when they are incurred.This

has nothing to do with when the cash payment is made. If we assume an expense is $100, there are

three possible timings the payment can be made in relation to the expense being incurred.

1. Pay before and recognize the expense when it is incurred (prepaid expense).

2. Pay as the expense is incurred (cash).

3. Pay after the expense is incurred (unpaid account).

2

ASSETS

PERSONAL BALANCE SHEET

LIABILITIES

CASH

PREPAID EXPENSES

HOUSE

AUTOMOBILE

CONTENTS

OF HOME

UNPAID ACCOUNTS

MORTGAGE

LOANS

NETWORTH

3. +$100

1a. -$100

2. -$100

1a. +$100

1b. -$100

1b. + $100

2. + $100

3. + $100

EXPENSE

In all three cases, net worth decreases by $100 which is

recognized as an expense and recorded on the income statement

In all three cases, the expense is

recorded when it is incurred, regardless

of when the cash is actually paid.

______________

FIGURE 1.34

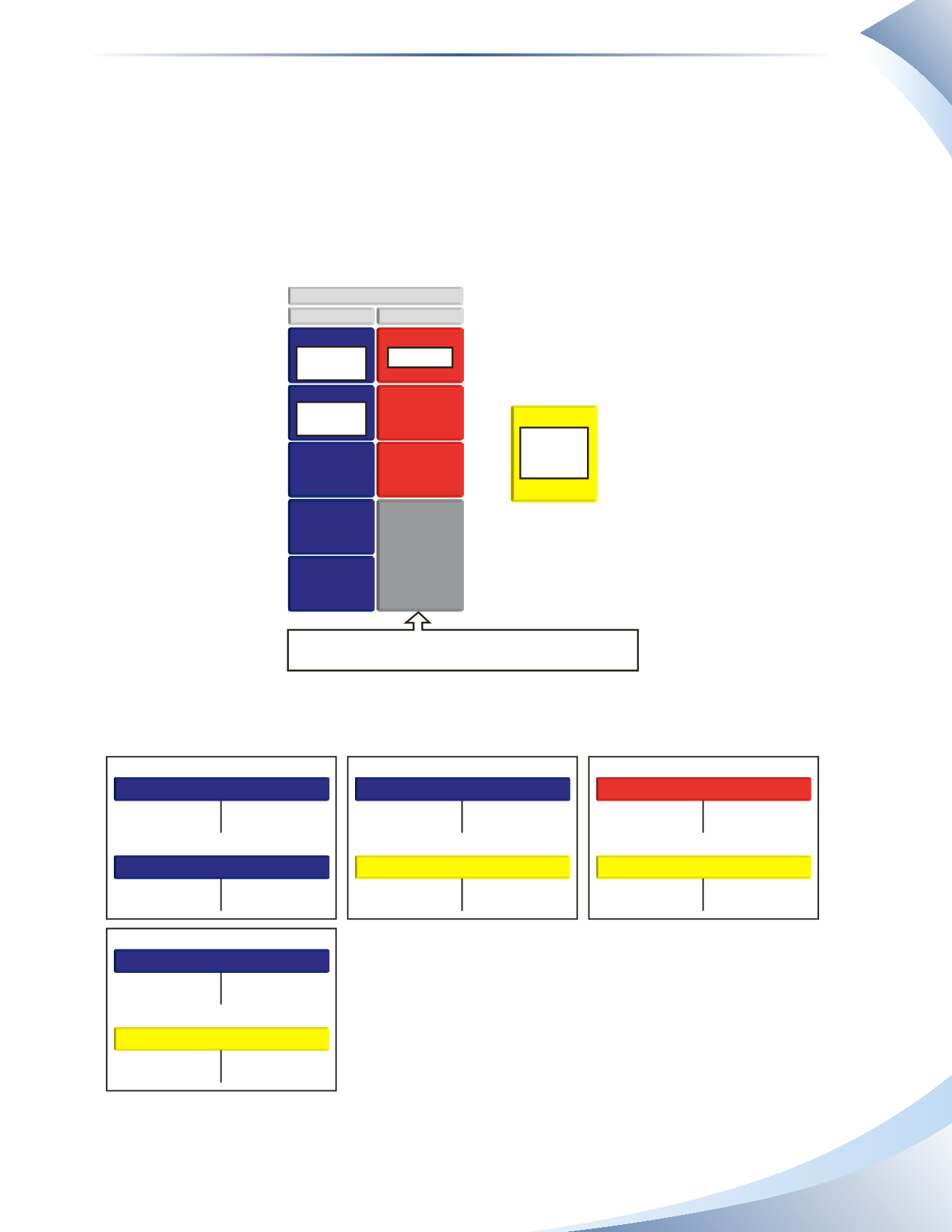

(1) Pay as the expense is incurred

(3) Pay after the expense is incurred

+

+

UNPAID ACCOUNTS

EXPENSE

-

-

INCREASE

INCREASE

DECREASE

DECREASE

3. 100

3. 100

+

+

CASH

EXPENSE

-

-

INCREASE

INCREASE

DECREASE

DECREASE

2. 100

2. 100

+

+

PREPAID EXPENSES

EXPENSE

-

-

INCREASE

INCREASE

DECREASE

DECREASE

1b. 100

1b. 100

+

+

CASH

PREPAID EXPENSES

-

-

INCREASE

INCREASE

DECREASE

DECREASE

1a. 100

1a. 100

(1) Pay before and recognize the expense

when it is incurred

______________

FIGURE 1.35