Chapter 1

Financial Statements: Personal Accounting

18

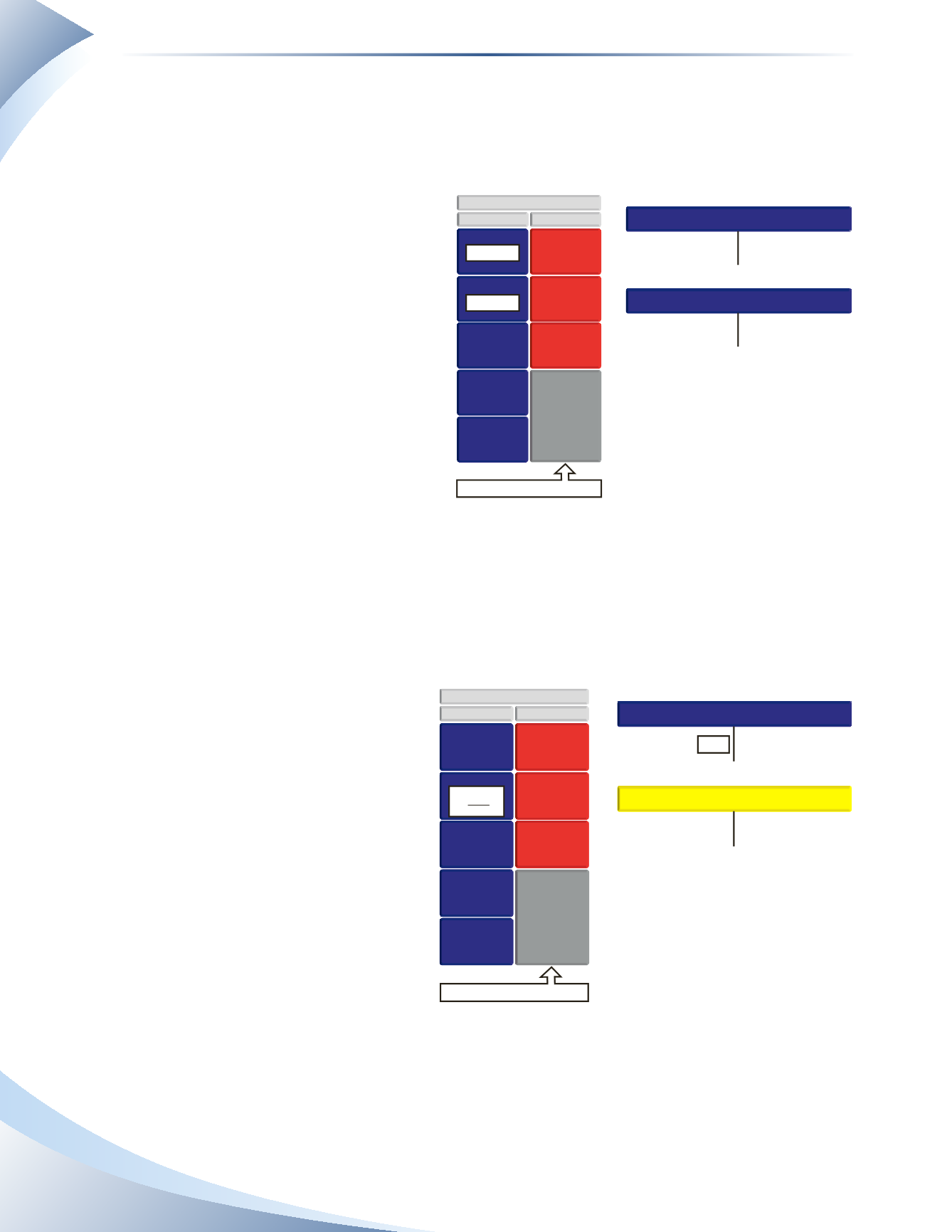

Figure 1.32 illustrates another example of a prepaid expense. Assume that you hire a gardening

service that costs $600 per year ($50 per month).The service provider requests that you prepay the

full $600 in January. In a perfect world, if you were to cancel the contract with the company the

next morning, you would receive all the money back because the company has not yet provided the

service. In effect, you have simply given

the company an interest-free loan.

Therefore, if you were to cancel the

contract in three months, you would get

back $450 [$600 − ($50 per month × 3

months)]; if it were cancelled in six

months, you would get back $300: and

so on.

You have paid the $600 in advance but

the service provider owes you the service

which you will receive in the future.

As a result, this payment is considered

an asset (which is a prepaid expense).

There is no expense (i.e. a decrease in net

worth) until the service is provided.

As each month goes by, the value of the prepaid expense will decrease together with your net worth.

In other words, you are recognizing

the expense in the month in which it is used—not when it is

paid.

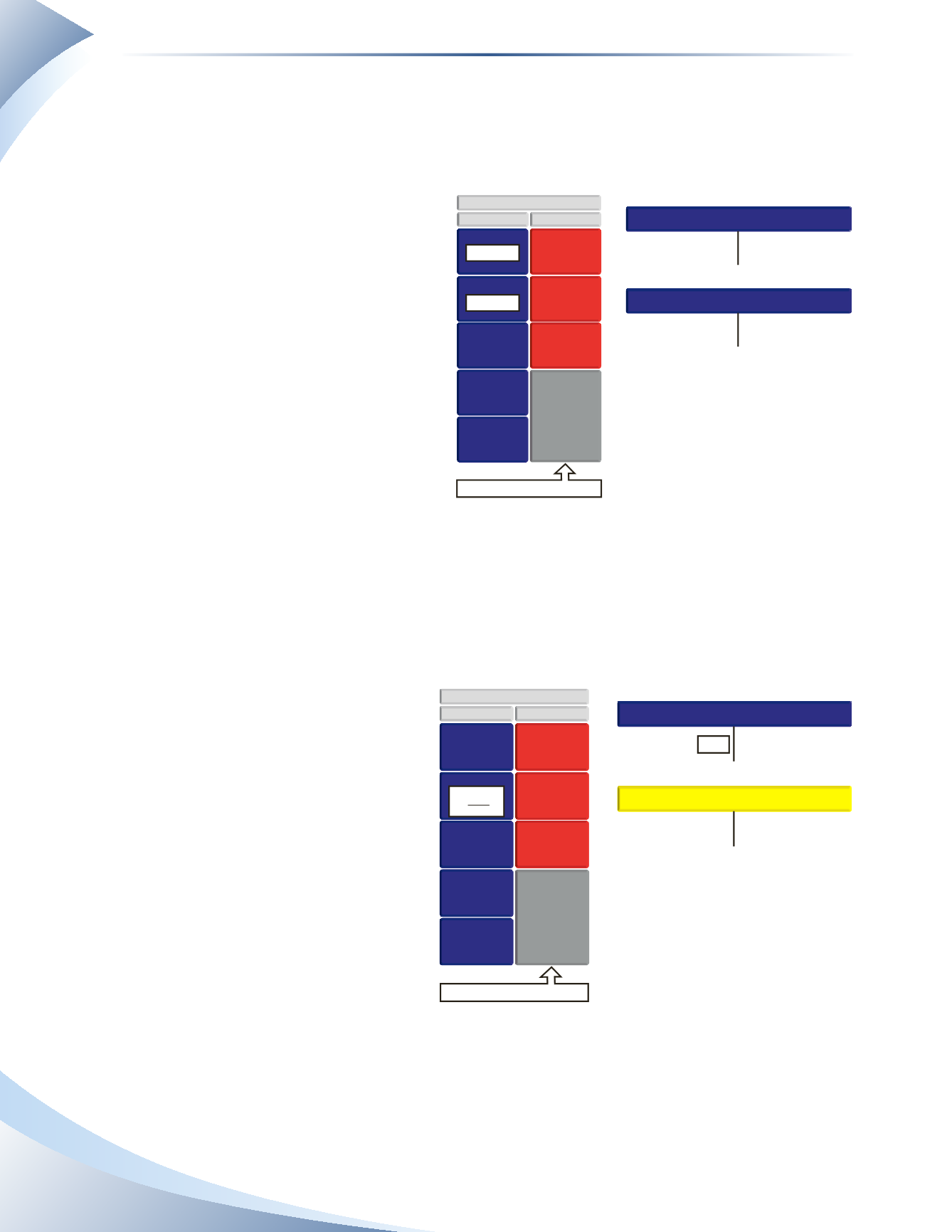

If you prepare your financial statement

each month, after the first month’s

service is provided, you will recog-

nize $50 as an expense for that month

(which decreases net worth) and the

remaining prepaid portion will be

$550 as shown in Figure 1.33.

An increase in expenses relates to a

decrease in net worth. Cash does not

have to be involved to increase an

expense and decrease net worth. You

will recognize $50 as an expense for

each of the next 11 months as the

supplier provides the service.

2

ASSETS

PERSONAL BALANCE SHEET

LIABILITIES

CASH

PREPAID EXPENSES

HOUSE

AUTOMOBILE

CONTENTS

OF HOME

UNPAID

ACCOUNTS

MORTGAGE

LOANS

NETWORTH

- $600

+ $600

+

+

CASH

PREPAID EXPENSES

-

-

INCREASE

INCREASE

DECREASE

DECREASE

600

600

No change in net worth

______________

FIGURE 1.32

2

ASSETS

PERSONAL BALANCE SHEET

LIABILITIES

CASH

PREPAID EXPENSES

HOUSE

AUTOMOBILE

CONTENTS

OFHOME

UNPAID

ACCOUNTS

MORTGAGE

LOANS

NETWORTH

$600

- 50

= $550

+

+

PREPAID EXPENSES

MAINTENANCE EXPENSE

-

-

INCREASE

INCREASE

DECREASE

DECREASE

50

$600

50

Opening

Balance

Net worth decreased by $50

______________

FIGURE 1.33