Chapter 1

Financial Statements: Personal Accounting

22

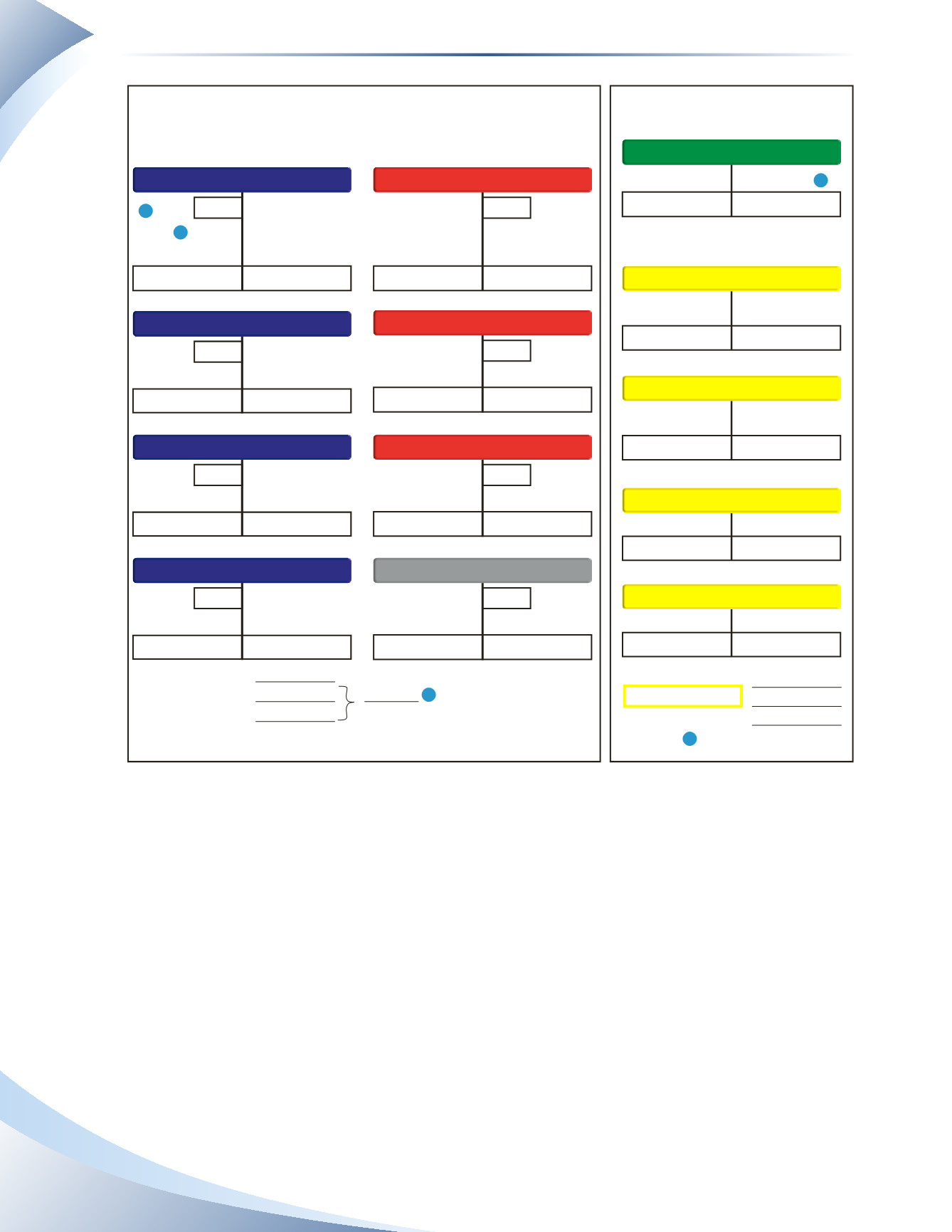

Personal Balance Sheet

As at April 30, 2016

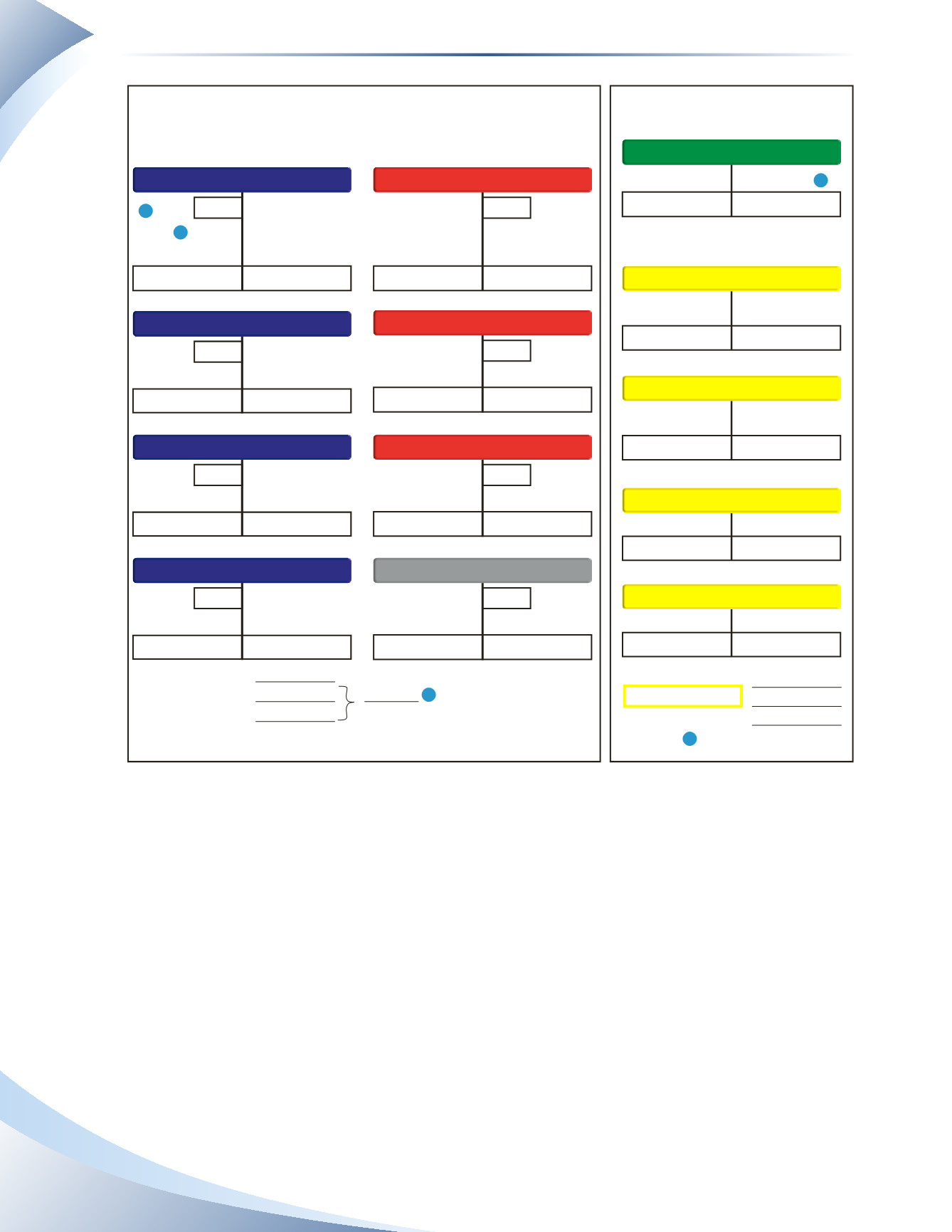

Personal Income Statement

For the Month Ended April 30, 2016

ASSETS (what we own)

LIABILITIES (what we owe)

CASH

PREPAID INSURANCE

CONTENTS OF HOME

HOUSE

+

+

+

+

–

–

–

–

INCREASE

DECREASE

INCREASE

DECREASE

INCREASE

DECREASE

INCREASE

DECREASE

Opening

Balance

Opening

Balance

Opening

Balance

Opening

Balance

$1,000

$1,500

$90,000

$0

$65,500

$0

$6,000

$150,000

$5,700

$3,050

$89,100

$4,000

$66,300

$1,200

$7,400

$150,000

2,500

4,000

800

1,200

1,400

1,200

1,000

400

150

1,400

6. 900

4. 4,000

5. 800

1.

4.

5.

2.

7.

2.

6.

8.

3.

7.

UNPAID ACCOUNTS

MORTGAGE

BANK LOAN

NETWORTH

+

+

+

+

–

–

–

–

DECREASE

INCREASE

DECREASE

INCREASE

DECREASE

INCREASE

DECREASE

INCREASE

Opening

Balance

Opening

Balance

Opening

Balance

Opening

Balance

$2,500

1. 2,500

REVENUE

+

–

DECREASE

INCREASE

ENTERTAINMENT EXPENSE

FOOD EXPENSE

INSURANCE EXPENSE

INTEREST EXPENSE

+

+

+

+

–

–

–

–

INCREASE

DECREASE

INCREASE

DECREASE

INCREASE

DECREASE

INCREASE

DECREASE

LESS EXPENSES

3. 150

8. 400

6. 100

$2,500

650

$1,850

$150

$400

$100

Total Revenue

Less: Total Expenses

Equals Surplus (Deficit)

Total Assets

Net Worth*

* Ending NetWorth = Beginning NetWorth + Capital + Surplus (Deficit)

$68,150 = $65,500 + $800 + $1,850

Total Liabilities

$164,300

96,150

68,150

$164,300

1

2

4

3

2

______________

FIGURE 1.37

For the net worth calculation at the bottom of the balance sheet, we start with the the opening net

worth of $65,500 and add the lottery winnings of $800. Since we show a surplus of $1,850 from

the income statement, we will add this to net worth. This gives us a closing net worth balance of

$68,150. Note that if we had a deficit on the income statement, this would be subtracted from net

worth.