Chapter 12

Using Accounting Information

365

The current ratio assesses business liquidity by determining the extent to which current assets can

cover current debts. This means the business’ ability to pay off its debt due within one year. No

business wants to find itself in a position of having to sell long-term assets to pay current bills. A

current ratio of 1.0 indicates that the business has just enough current assets to pay for its current

liabilities.

Depending on the industry, the higher the current ratio, the more assurance that the business has

enough of a cushion that it can afford to have some cash tied up in current assets, such as inventory

and accounts receivable. However, a very high current ratio could indicate poor management of

current assets. For example, if the current ratio of a business is 5.0, it has $5.00 in current assets for

every dollar that it owes in the next 12 months.This indicates that the business may have too much

cash. Money in a bank account earning 0.1% interest is not an efficient use of assets, especially if

the business can earn a better rate of return elsewhere. Cash should either be invested in new long-

term assets or perhaps invested in the short term until a better use for the cash can be established.

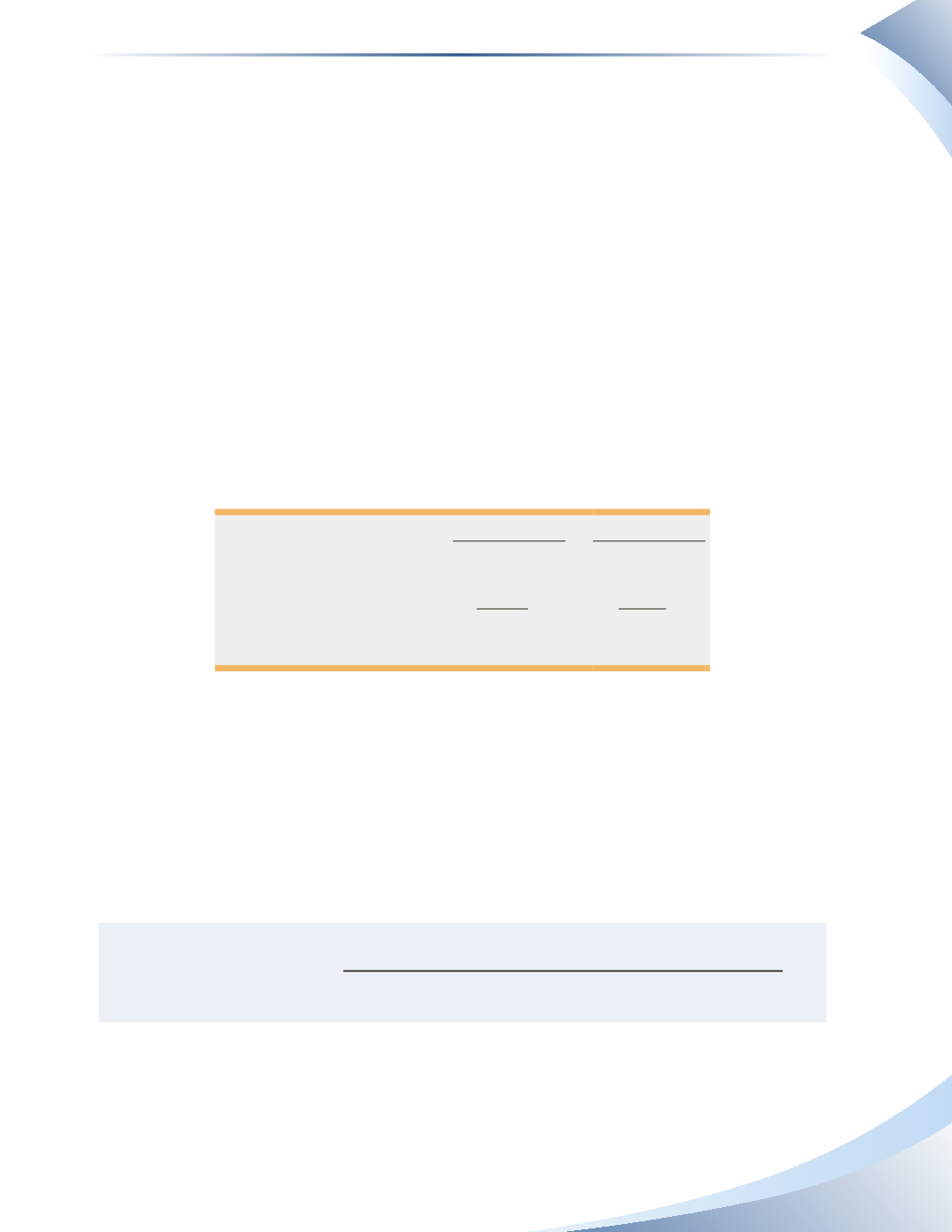

The chart in Figure 12.14 calculates the current ratio using the numbers provided in Second Cup’s

financial statements.

2014

2013

Current Assets

$16,430

$11,402

Current Liabilities

$23,684

$11,061

Current Ratio

0.69

1.03

_______________

Figure 12.14

In this case, the ratio indicates an unhealthy situation. Not only is the ratio well below 1 in the

most recent year, but it has decreased from one year to the next. Second Cup may run into cash flow

problems within the next year.

Quick Ratio

The other liquidity ratio that is relevant to the analysis of a business is the quick ratio

(also known

as the acid test).The ratio is calculated as shown below.

=

Cash + Short-Term Investments + Accounts Receivable

Quick Ratio

Current Liabilities

The quick ratio is much like the current ratio; the only difference is that the quick ratio excludes

some current assets which cannot be quickly converted to cash (such as inventory and prepaid

expenses). Short-term investments occur when a company has excess cash and wishes to invest it.