Chapter 12

Using Accounting Information

366

This cash can be invested in shares of other companies.The accounting for short-term investments

is beyond the scope of this course.

In essence, the quick ratio assesses the ability of the business to meet its most immediate debt

obligations without relying on the liquidation of inventory (which may take some time to sell).

A quick ratio of 1 indicates that the business has just enough liquid assets to pay for its current

liabilities. Anything below 1 might mean the business has too much of its money tied up in

inventory or other less liquid assets and may be unable to pay its short-term bills.

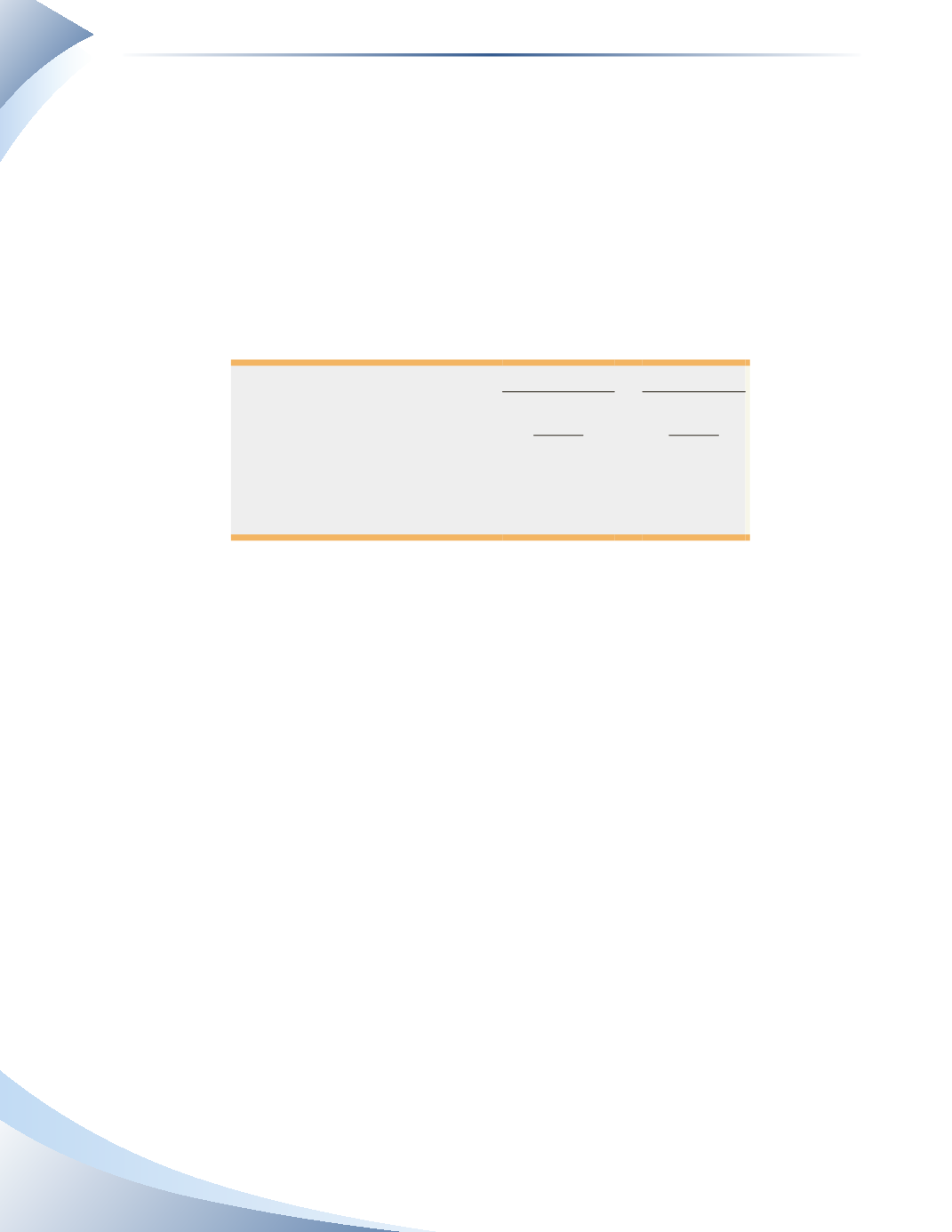

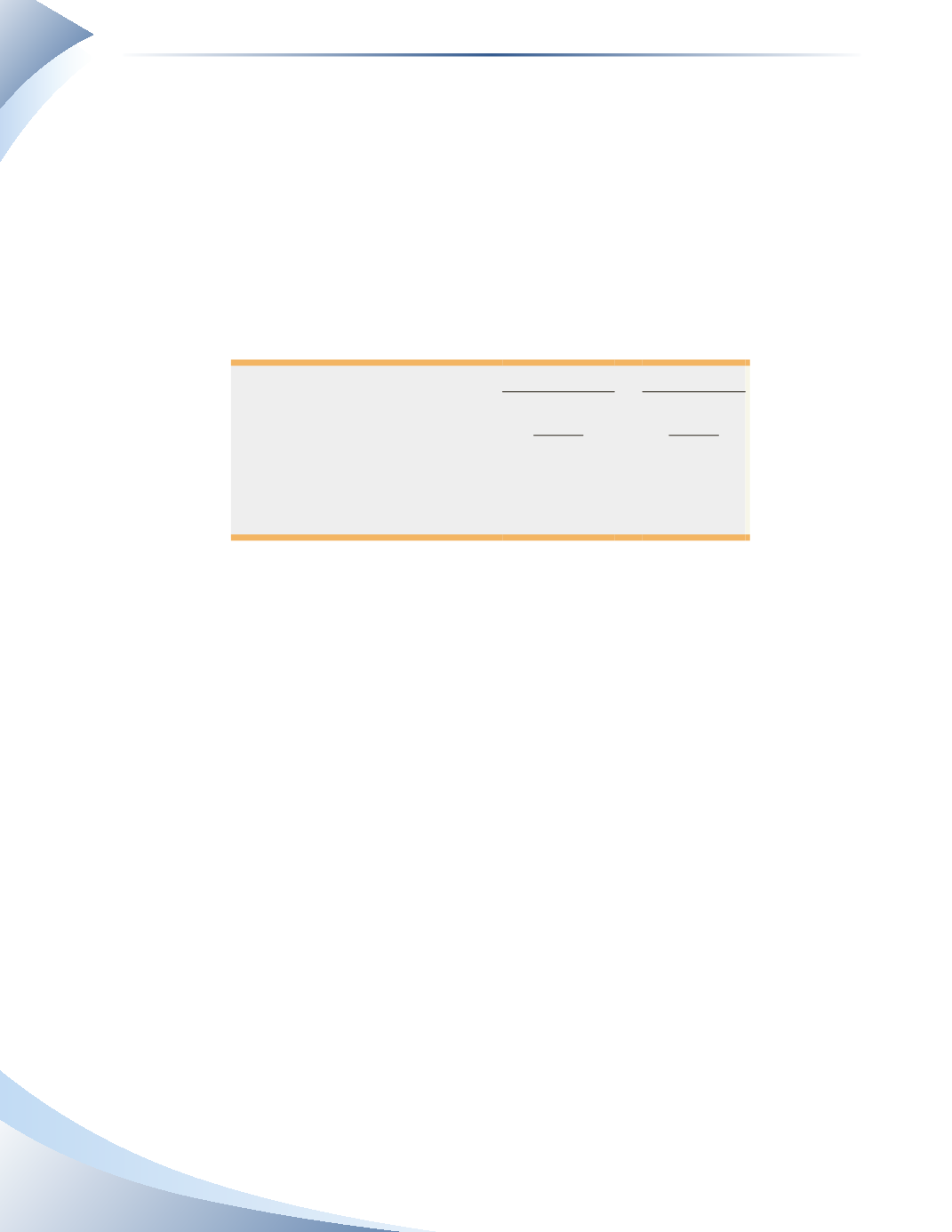

Quick ratios have been calculated using the numbers from Second Cup’s balance sheet in Figure

12.15. Note that Second Cup does not have any short-term investments.

2014

2013

Cash + Short-Term Investments +

Accounts Receivable

$14,944

$10,869

Current Liabilities

$23,684

$11,061

Quick Ratio

0.63

0.98

_______________

Figure 12.15

Notice that the quick ratio has decreased from 2013 (0.98) to 2014 (0.63). This means that the

company has gone from a nearly adequate short-term liquidity position to a dangerous one.

To address any potential problems here, and since the balance sheet provides only a snapshot of

business finances, further analyses should be performed over the course of the next few months

on the specific assets and liabilities of the business.This is to ensure that bills can be paid on time.

This situation could have worsened due to too much money being invested in inventory or fixed

assets. A review should be performed to address the situation and rectify any problems found.

Profitability Analysis

Profitability

refers to the ability of a company to generate profits.The greater the profitability, the

more valuable the company is to shareholders. A consistently unprofitable company is likely to go

bankrupt.There are several ratios available to help analyze the profitability of a company.They are

calculated using figures from the income statement as opposed to the balance sheet. The income

statement for Second Cup is shown in Figure 12.16.There are several revenues and expenses listed

which you may have never seen before, but we will focus on the analysis of the statement as a whole

rather than on individual accounts.