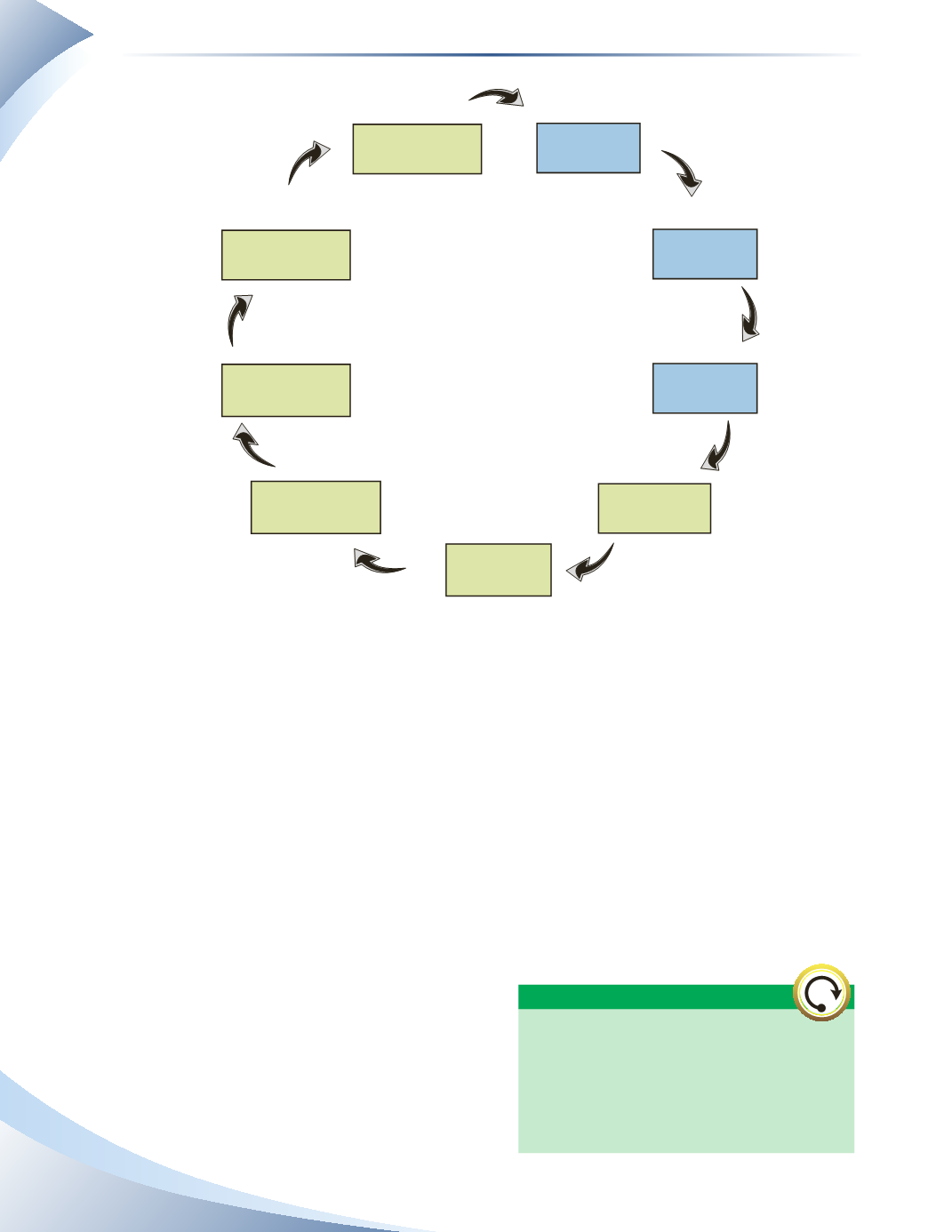

Chapter 5

The Accounting Cycle: Adjustments

106

Step 1

Step 2

Step 3

Step 4

Step 5

Step 6

Step 7

Step 8

Step 9

ACCOUNTING

CYCLE

Analyze

transactions

Journalize the

transactions

Post to ledger

accounts

Prepare the trial

balance

Journalize and

post adjusting

entries

Prepare the

adjusted trial

balance

Prepare the

financial

statements

Journalize and post

closing entries

Prepare the post-

closing trial balance

______________

FIGURE 5.1

An accounting period is the period of time covered by the financial statements. A company will

have a

fiscal year

, which is usually a one-year time frame. A company’s fiscal year may cover the

same time as the calendar year from January 1 to December 31; however some companies have a

fiscal year that ends during a slow time of the year. For example, a retail store may have its fiscal

year end at the end of January, after the Christmas rush is finished. In this case, the fiscal year is

from February 1 to January 31.

A company will usually prepare a set of financial statements at the end of each fiscal year, although

some prepare the statements more frequently to better manage the business. Whenever these

statements are prepared, remember that accrual-based accounting states that revenue and expenses

should be recognized in the accounting period when they occur, regardless of when the cash

payment is received or made.

Adjusting entries

are made at the end of the

accounting period to record assets, liabilities,

equity, revenue and expenses according to revenue

and expense recognition. Every adjustment will

affect both a balance sheet account and an income

statement account. Adjusting entries typically fall

under five broad categories

Revenue recognition states that

revenue must be recorded when services are

performed, regardless of when cash is received.

Expense recognition requires that expenses

must be recorded in the same period in which

they were used to generate revenue.

WORTH REPEATING