Chapter 5

The Accounting Cycle: Adjustments

110

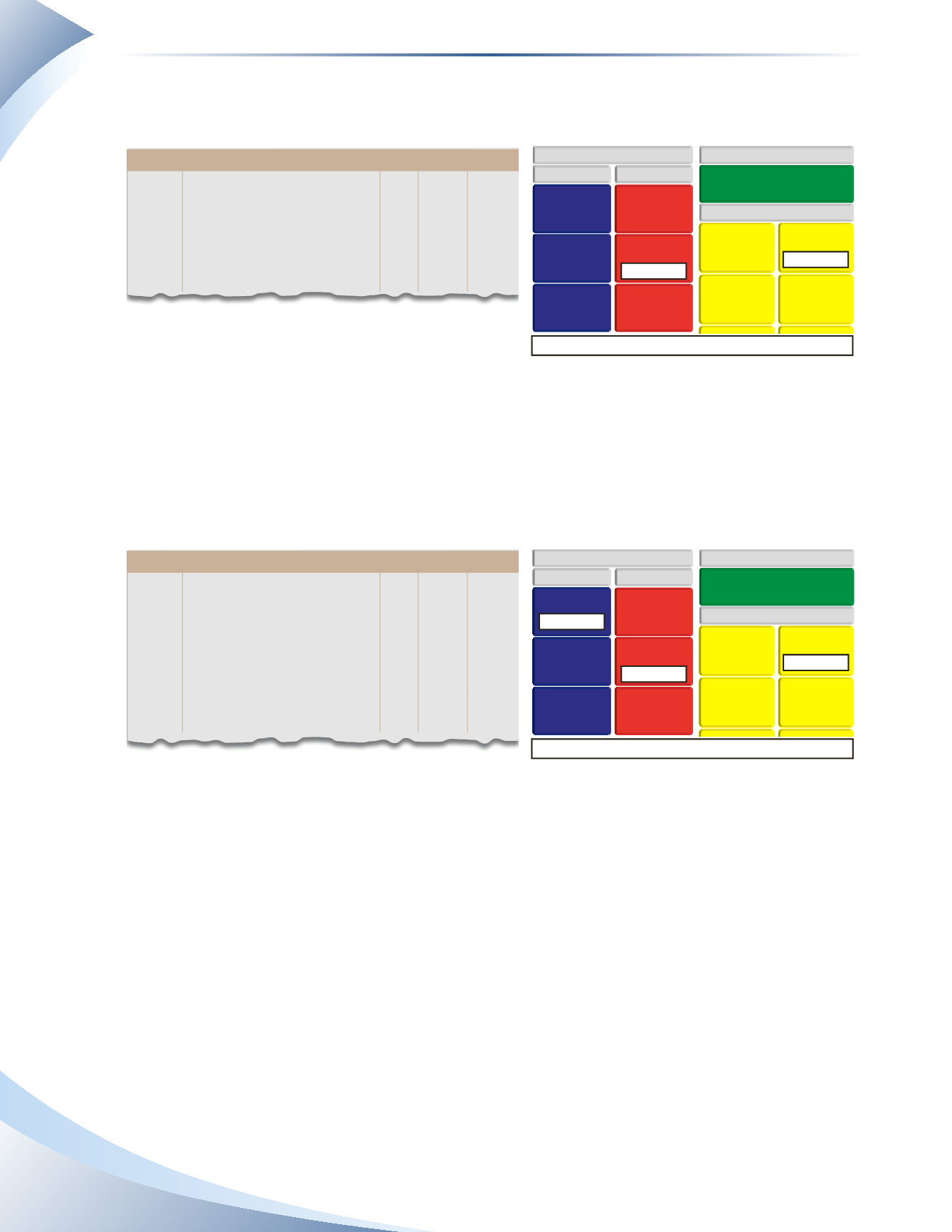

Since the salary payment is owed to the employee, we will use a liability account called salaries

payable to track the amount owing.

The $500 balance in the liability account will be paid at the next pay date. Thus, on October 7,

the business will pay the employee their salary of $1,000. The accrued amount in the liability

account will be cleared out since the business is paying the debt to the employee. Only $500 will

be recorded as an expense, since we only need to record the salary expense for the time worked in

October.The journal entry for this transaction is shown in Figure 5.6.

____________

FIGURE 5.6

BALANCE SHEET

LIABILITIES

ACCOUNTS

PAYABLE

SALARIES

PAYABLE

BANK LOAN

INCOME STATEMENT

EXPENSES

SERVICE REVENUE

DEPRECIATION

INSURANCE

SALARIES

RENT

Owner’s equity decreases by $500

ASSETS

CASH

OFFICE

SUPPLIES

ACCOUNTS

RECEIVABLE

+ $500 CR

+ $500 DR

journal

Page 1

date

2016

account title and explanation Pr debit credit

Sep 30 Salaries Expense

500

Salaries Payable

500

To accrue salaries owing

____________

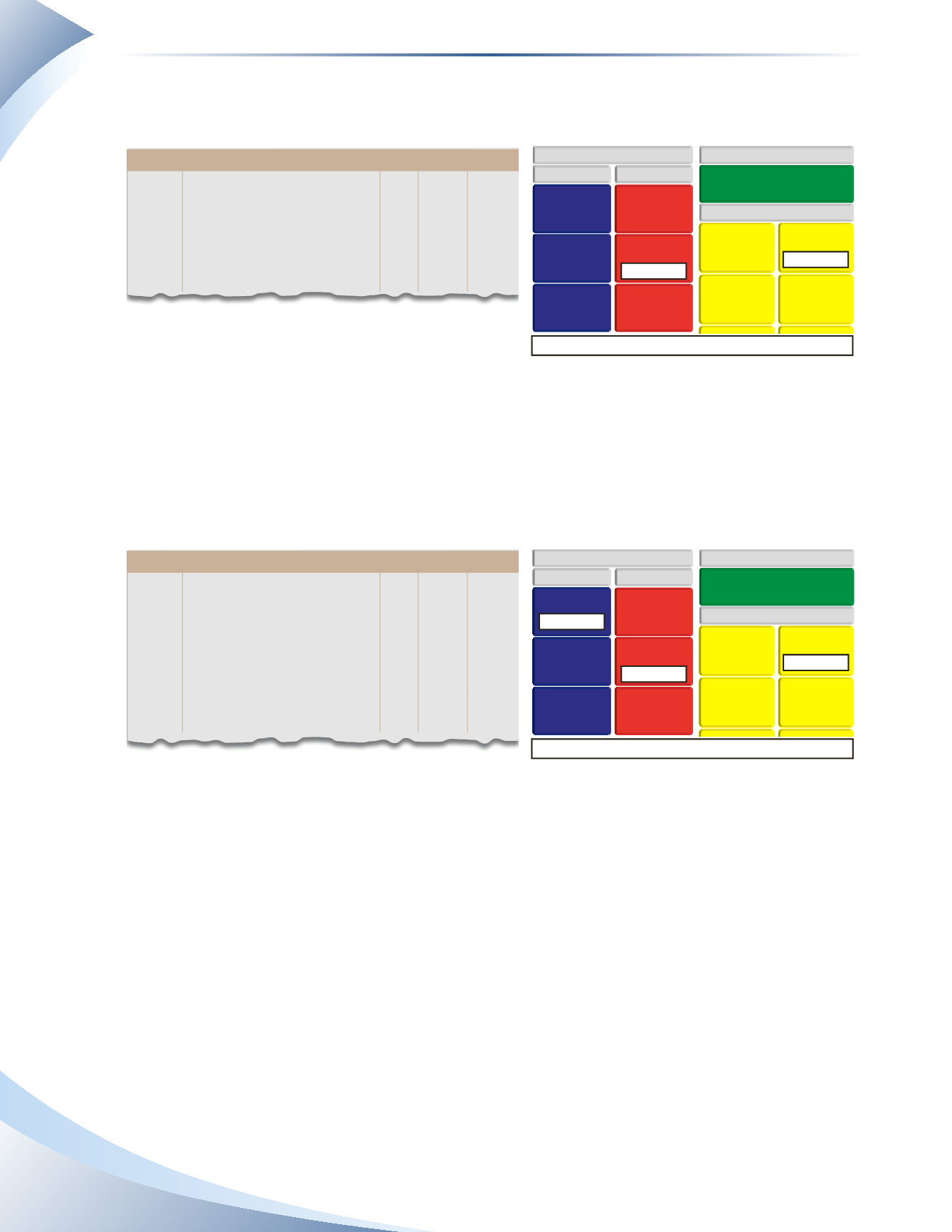

FIGURE 5.5

journal

Page 1

date

2016

account title and explanation Pr debit credit

Oct 7 Salaries Expense

500

Salaries Payable

500

Cash

1,000

To record payment of salaries

owing

BALANCE SHEET

LIABILITIES

ACCOUNTS

PAYABLE

SALARIES

PAYABLE

BANK LOAN

INCOME STATEMENT

EXPENSES

SERVICE REVENUE

DEPRECIATION

INSURANCE

SALARIES

RENT

Owner’s equity decreases by $500

ASSETS

CASH

OFFICE

SUPPLIES

ACCOUNTS

RECEIVABLE

- $500 DR

- $1,000 CR

+ $500 DR