Chapter 5

The Accounting Cycle: Adjustments

115

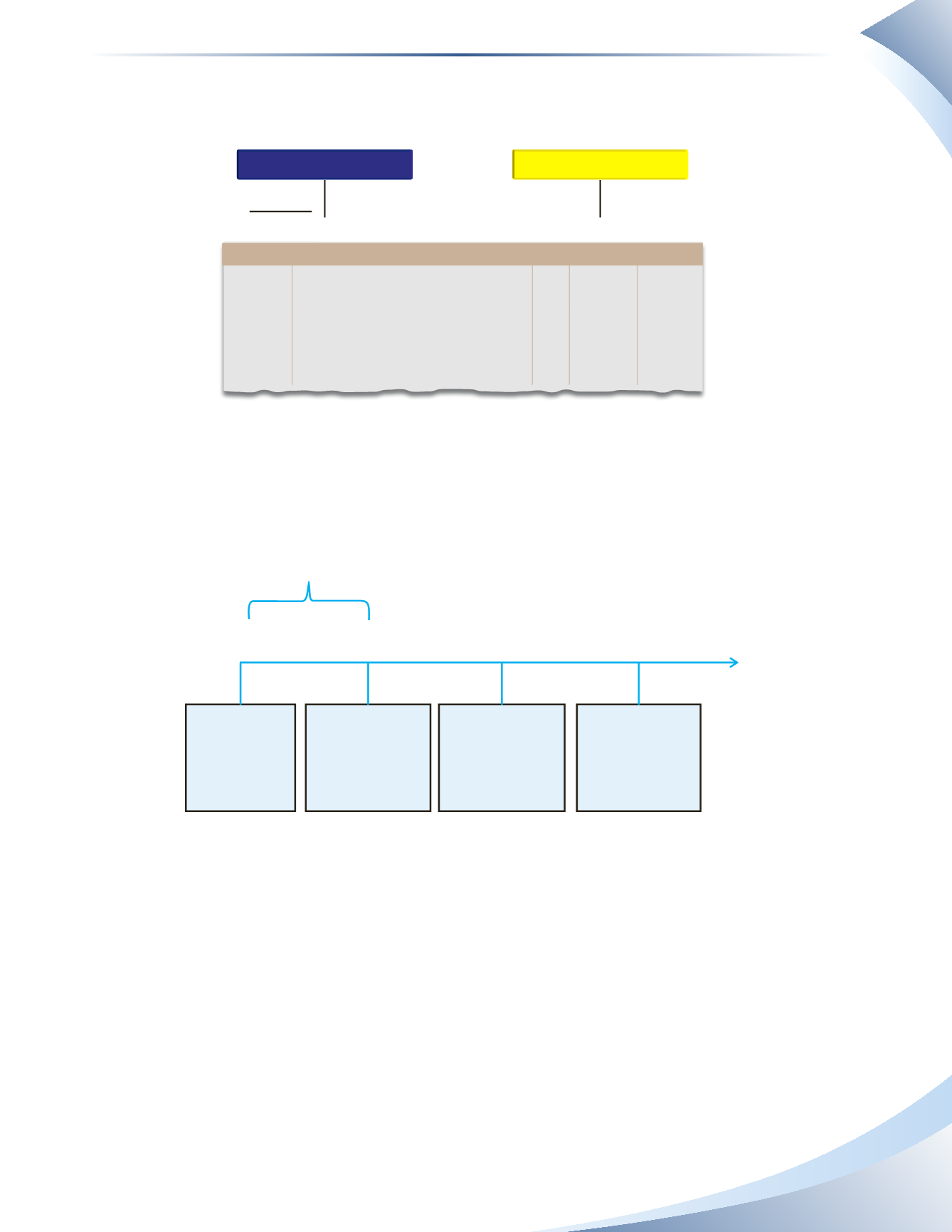

the income statement. As Figure 5.13 shows, after the adjustment on March 31, the prepaid rent

account will be left with a balance of $4,400 representing the two months that are still prepaid.

PREPAID RENT

RENT EXPENSE

+

+

-

-

6,600

4,400

2,200

Adjustment

2,200

journal Page 1

date

2016

account title and explanation Pr debit credit

Mar 31 Rent Expense

2,200

Prepaid Rent

2,200

To adjust for 1 month rent used

______________

FIGURE 5.13

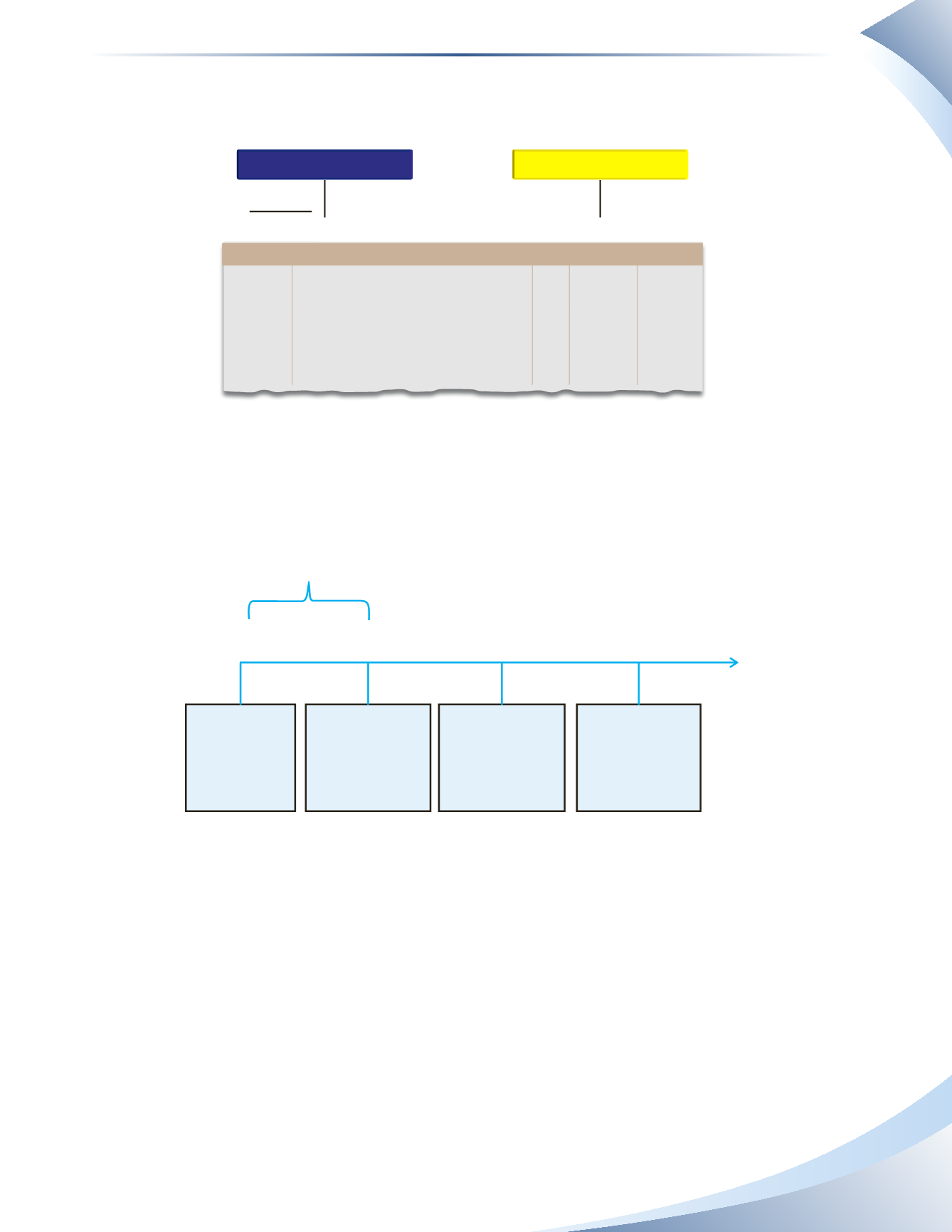

The same adjustment will be made on April 30 (to recognize April’s rent expense) and May 31

(to recognize May’s rent expense). Figure 5.14 shows the timing of the transactions related to the

prepaid rent.

March 1

March 31

April 30

Adjustment Period

(One Month)

Transactions FromTenant's Perspective

Make prepayment to

Raina for March, April

and May Rent

Date of Adjustment

Adjustment

Adjustment

Adjustment

Date of Adjustment

May 31

Date of Adjustment

CR $6,600 Cash (asset)

CR $2,200 Prepaid

Expenses (asset)

CR $2,200 Prepaid

Expenses (asset)

CR $2,200 Prepaid

Expenses (asset)

DR $6,600 Prepaid

Expenses (asset)

DR $2,200 Rent Expense

(income statement)

DR $2,200 Rent Expense

(income statement)

DR $2,200 Rent Expense

(income statement)

Recognize earned rent

expense for May

Recognize earned rent

expense for April

Recognize earned rent

expense for March

______________

FIGURE 5.14

Prepaid expenses and unearned revenue are opposites. Usually, as in this example, the prepaid

expense of one company (the tenant) is the unearned revenue of another company (Raina). The

above example illustrated prepaid rent, however the same idea and transactions would apply for an

item such as prepaid insurance or prepaid property taxes.

office supplies

Another type of prepaid expense is office supplies. Office supplies are the physical items used to run

the office of a business and include paper, photocopy toner, printer toner, pens, etc. When they are

initially purchased, these items are recorded as assets on the balance sheet. Instead of recording each

item as an expense when it is used, a single adjusting entry is made for the total office supplies used.