Chapter 5

The Accounting Cycle: Adjustments

113

April and May. Raina makes adjustments to its accounting records at the end of each month

because it produces financial statements internally on a monthly basis.

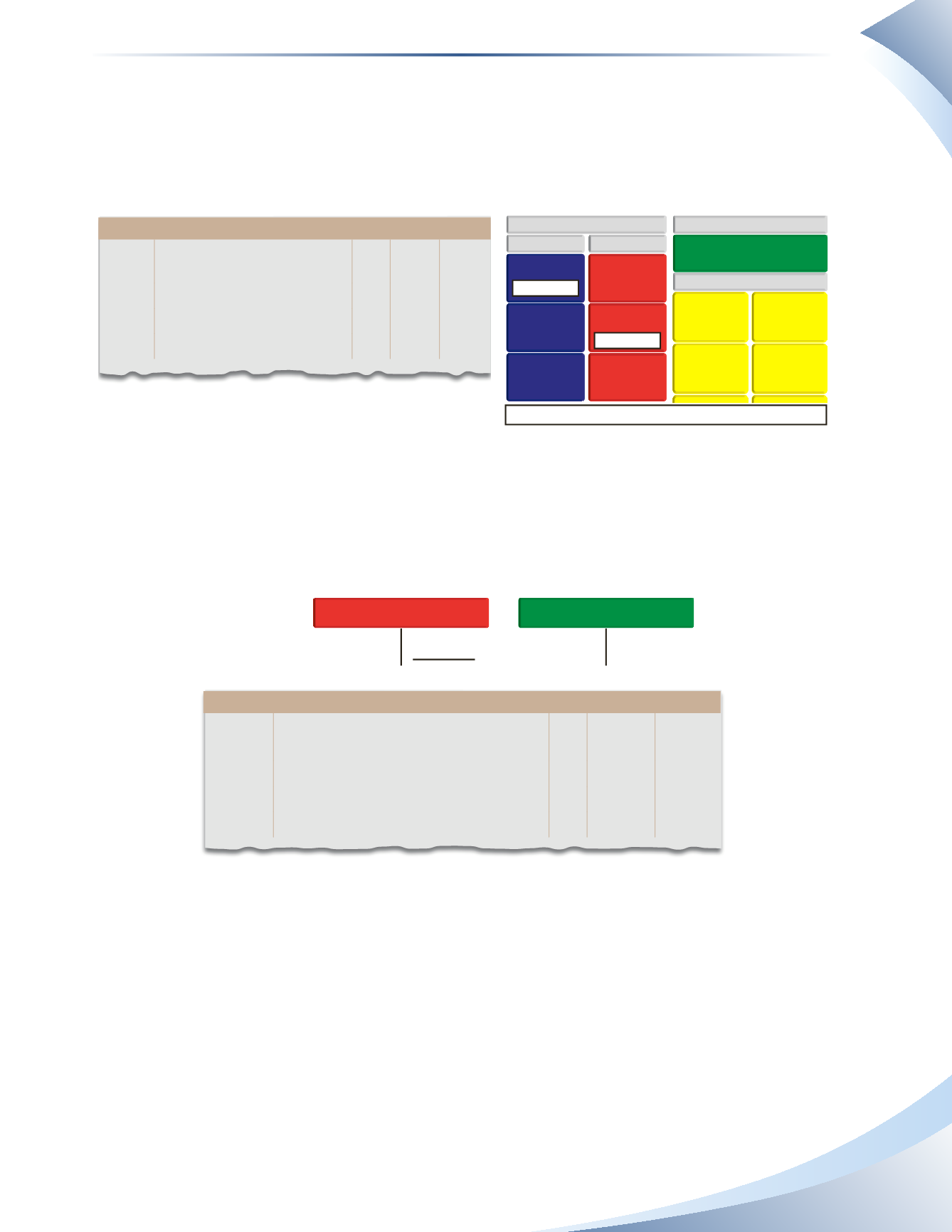

In Raina’s books, on March 1 when the payment is received, Raina will increase cash (an asset) by

$6,600 and increase unearned revenue (a liability) by $6,600.This is shown in Figure 5.9.

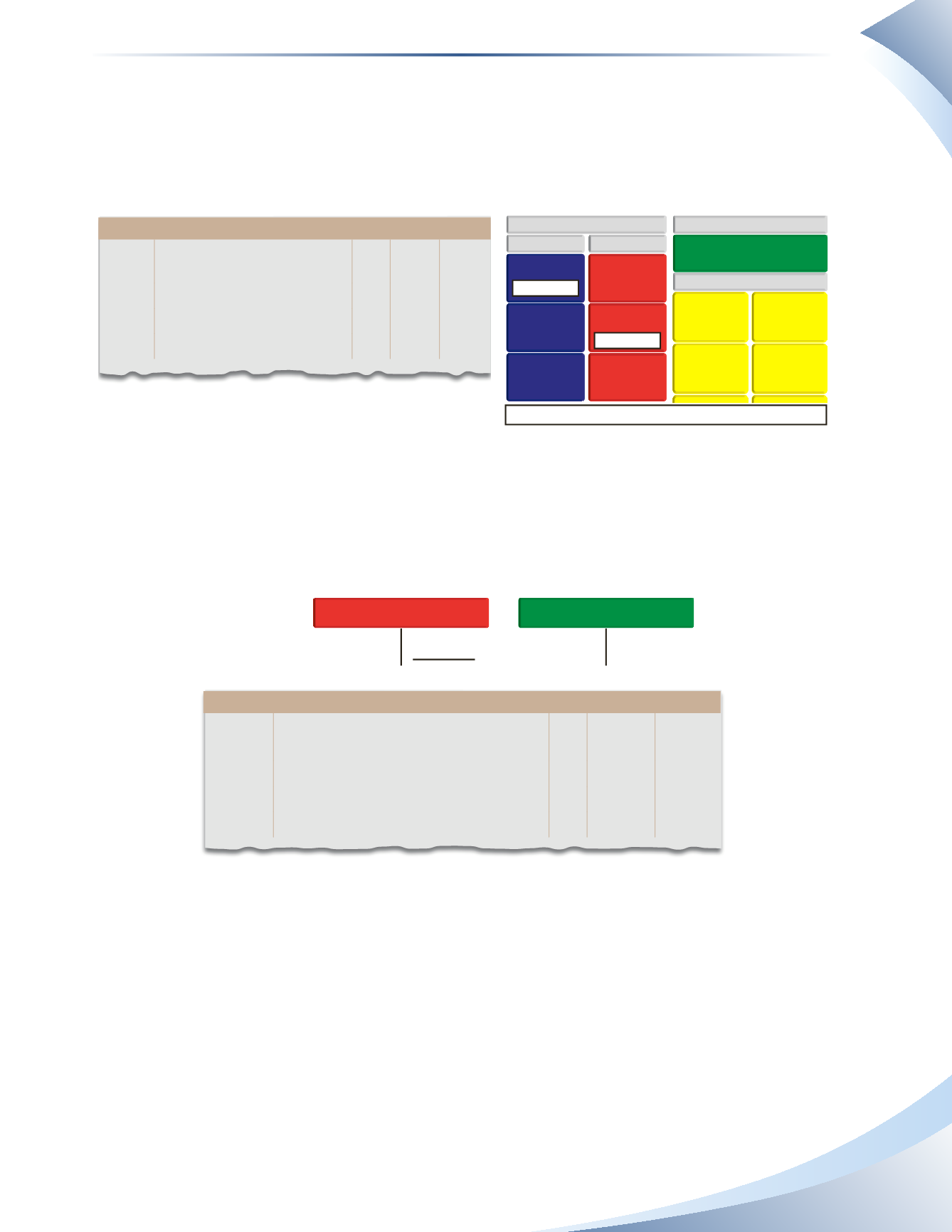

As of March 31, Raina has earned one month of revenue. On this date, the company will decrease

unearned revenue (a liability) by $2,200 and increase owner’s equity by $2,200 with an increase to

rent revenue (an income statement account). After this adjustment is made on March 31, Figure

5.10 shows that Raina still owes $4,400 worth of rent to the tenant.

UNEARNED REVENUE

RENT REVENUE

-

-

+

+

2,200 6,600

4,400

Adjustment

2,200

journal

Page 1

date

2016

account title and explanation Pr debit credit

Mar 31 Unearned Revenue

2,200

Rent Revenue

2,200

To adjust for 1 month rent earned

______________

FIGURE 5.10

The same adjustment will be made on April 30 (to recognize April’s rent revenue) and May 31

(to recognize May’s rent revenue). Figure 5.11 shows the timing of the transactions related to

unearned revenue.

BALANCE SHEET

LIABILITIES

ACCOUNTS

PAYABLE

UNEARNED

REVENUE

BANK LOAN

INCOME STATEMENT

EXPENSES

SERVICE REVENUE

DEPRECIATION

INTEREST

SALARIES

RENT

No change in owner’s equity

ASSETS

CASH

OFFICE

SUPPLIES

ACCOUNTS

RECEIVABLE

+$6,600 CR

+$6,600 DR

journal

Page 1

date

2016

account title and explanation Pr debit credit

Mar 1 Cash

6,600

Unearned Revenue

6,600

Receive cash for 3 months rent

____________

FIGURE 5.9