Chapter 5

The Accounting Cycle: Adjustments

109

expense because the bill may not be received until later in the following month. Two examples of

this are electricity or water bills. An accrued expense will always increase a liability and increase an

expense account.

For accrued expenses, the end of the period will not report the correct amount of expenses on the

income statement without an adjustment. Also, since this expense represents an amount owed,

liabilities on the balance sheet will also be incorrectly stated. The adjusting entry for an accrued

expense will correct this. We will examine two examples of accrued expenses: salaries and interest.

Salaries Expense

Salaries to employees are paid after the work has been completed. If the work and the payment for

the work occur within the same period, no adjustment will have to be made. However, if the work

done by the employee occurs in a different period than the payment, an adjustment must be made

at the end of the period.

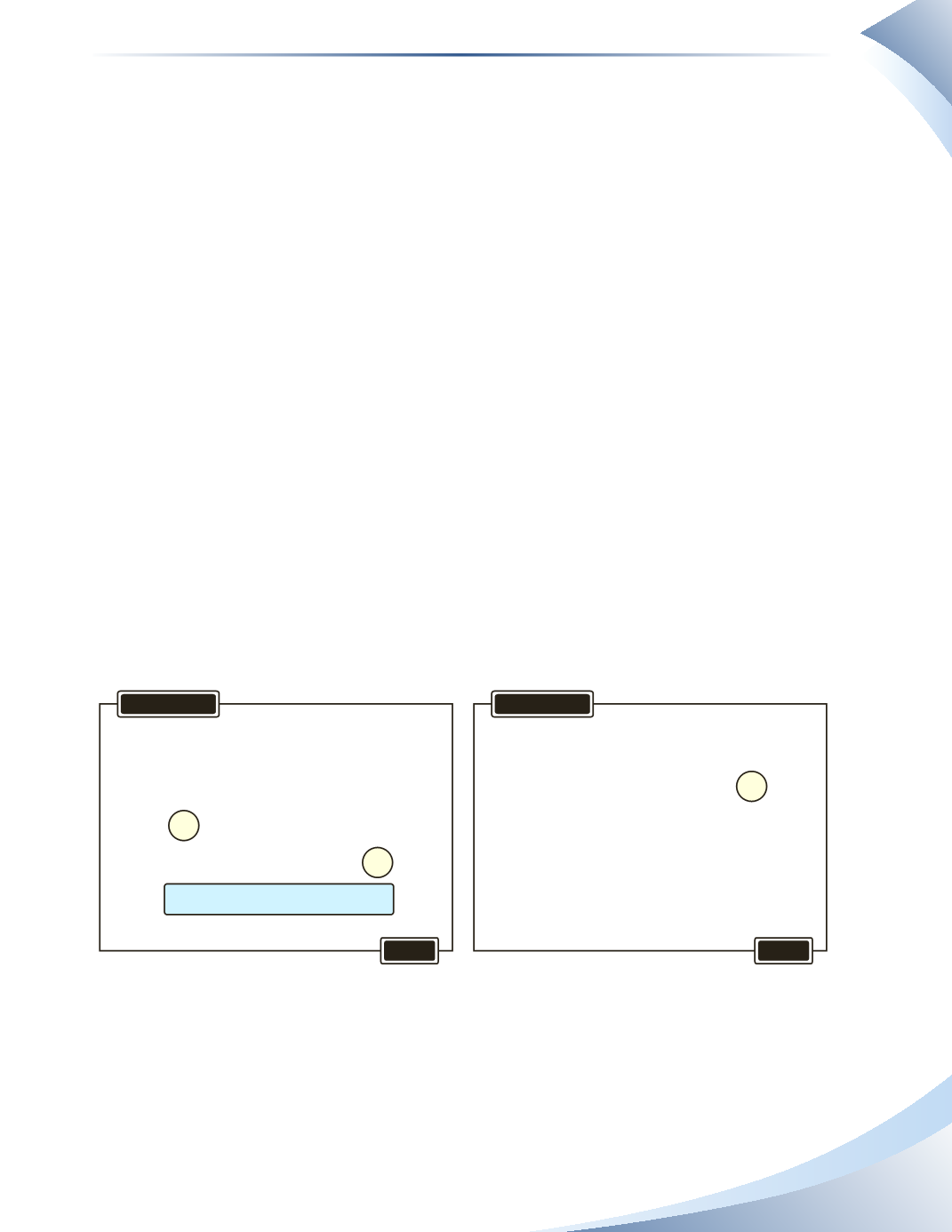

For example, suppose an employee is paid every two weeks. From the calendar in Figure 5.4, we

see the first pay period starts on September 12 and ends on September 23 when the employee

gets paid. Since the payment on September 23 is for work done in the same month, this will be a

transaction similar to what you have learned to pay salaries expense with cash.

The employee will then work the last week of September and the business will not pay until

October 7, which is the next pay date. The business accrues a salary expense for the employee for

the week worked in September. This expense must be recorded in September, even though the

employee will not be paid until October.

Sun

Mon Tue

Wed Thu Fri

Sat

1 2 3

4 5 6 7 8 9 10

11 12 13 14 15 16 17

18 19 20 21 22 23 24

25 26 27 28 29 30

Sun

Mon Tue

Wed Thu Fri

Sat

1

2 3 4 5 6 7 8

9 10 11 12 13 14 15

16 17 18 19 20 21 22

23 24 25 26 27 28 29

30 31

September

October

2016

2016

Days worked but not paid

Start of pay period

Pay Date

Pay Date

____________

Figure 5.4

If the employee earns $1,000 every two weeks, they earn $100 per day ($1,000 ÷ 10 working days).

Thus, the business must create an adjusting entry for salaries expense for $500 ($100 per day × 5

days). Figure 5.5 illustrates the adjusting entry. Equity decreases, which is recorded as an expense.