Chapter 5

The Accounting Cycle: Adjustments

112

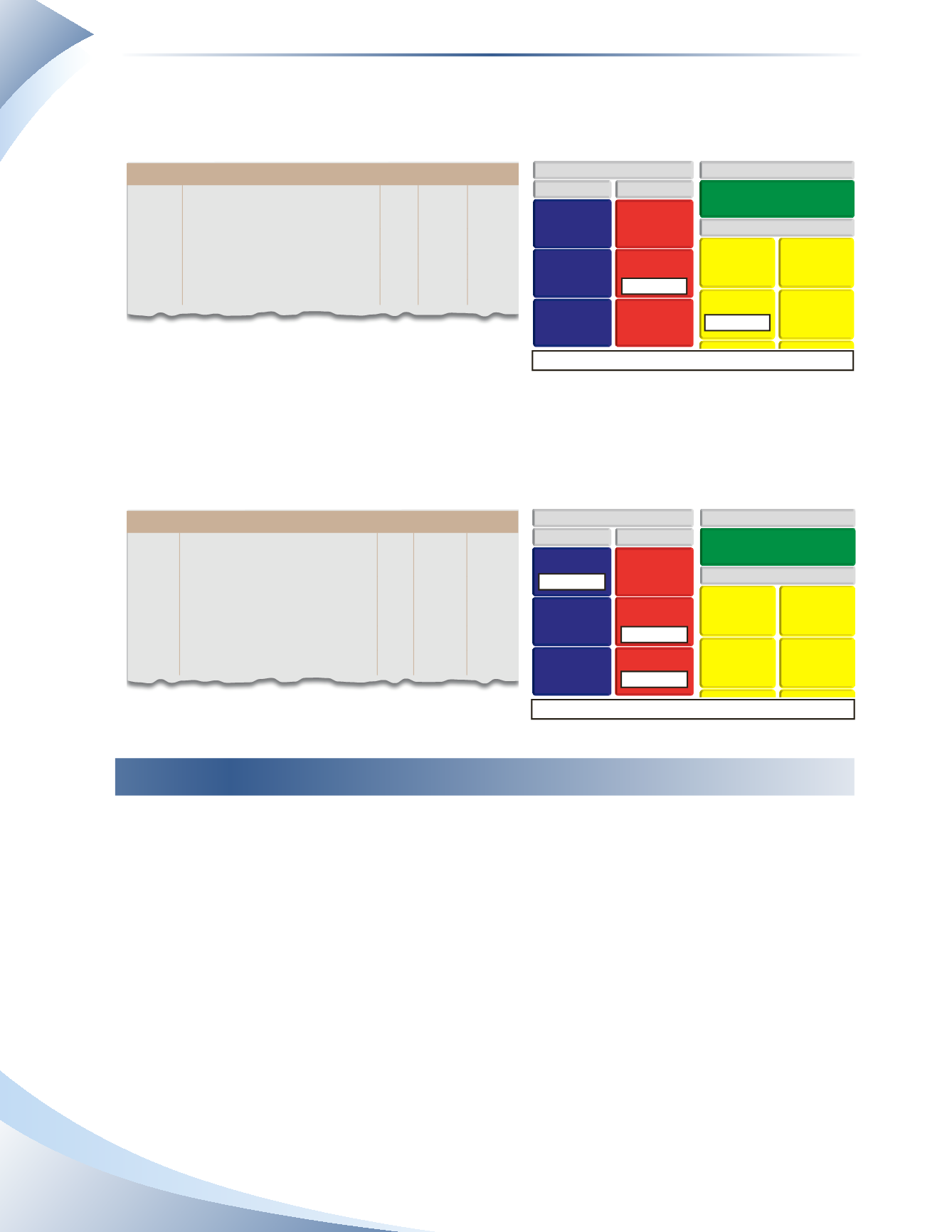

The $125 worth of interest will be recorded in interest expense and in a liability account called

interest payable.This account tracks all the interest owed.The adjusting entry is shown in Figure 5.7.

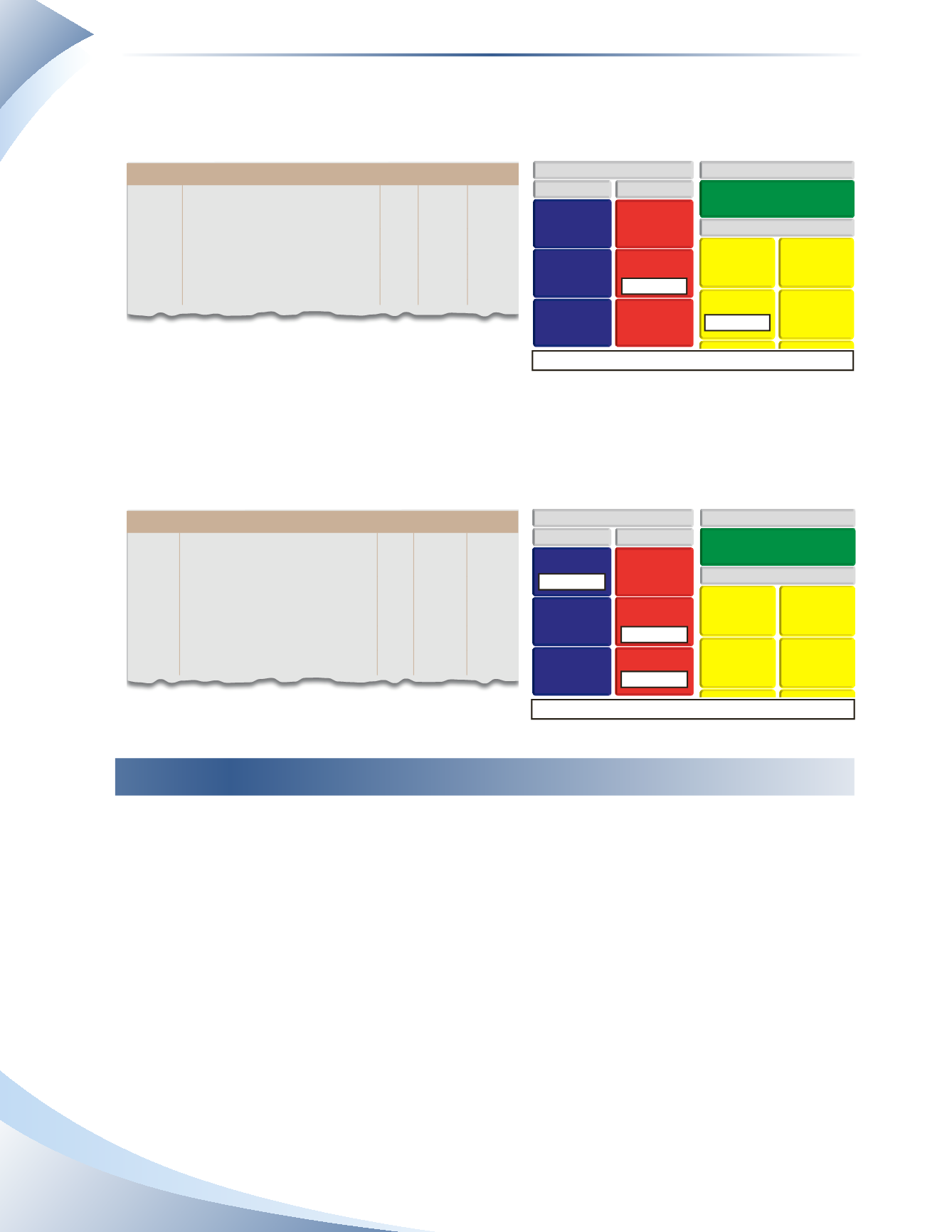

After the accrued interest for the loan has been recorded, the statements will be up-to-date and

accurate.When it comes time to pay back the loan and interest on October 1, there will not be any

interest expense to record.The payment will simply be a reduction of the bank loan and the interest

payable, as shown in Figure 5.8.

____________

FIGURE 5.8

unearned revenue

You will recall from earlier discussions that unearned revenue is a liability that arises when a

customer pays for services or products in advance. When a customer pays in advance for a service

or product, cash increases. Since the business now has an obligation to provide services or products

to the customer, this amount is recorded in unearned revenue, a liability account, until the product

or service is provided to the customer. The adjustment to unearned revenue is to account for the

earning of revenue for the services which were paid for in advance. An adjustment to recognize

unearned revenue as earned will always decrease unearned revenue and increase revenue.

To illustrate the concept of adjustments related to unearned revenue, consider Raina Property

Management (Raina). Raina recently bought a large office building which it rents out as separate

offices to tenants. The company has a policy of collecting the first three months’ rent in advance

when a new tenant moves in. For each office, Raina charges $2,200 per month for rent. On March

1, 2016, a new tenant moved in and paid $6,600 immediately to Raina to cover rent for March,

BALANCE SHEET

LIABILITIES

ACCOUNTS

PAYABLE

INTEREST

PAYABLE

BANK LOAN

INCOME STATEMENT

EXPENSES

SERVICE REVENUE

DEPRECIATION

INTEREST

SALARIES

RENT

Owner’s equity decreases by $125

ASSETS

CASH

OFFICE

SUPPLIES

ACCOUNTS

RECEIVABLE

+ $125 CR

+ $125 DR

journal

Page 1

date

2016

account title and explanation Pr debit credit

Sep 30 Interest Expense

125

Interest Payable

125

To accrue interest owing

____________

FIGURE 5.7

journal

Page 1

date

2016

account title and explanation Pr debit credit

Oct 1 Bank Loan

10,000

Interest Payable

125

Cash

10,125

To pay loan and interest

BALANCE SHEET

LIABILITIES

ACCOUNTS

PAYABLE

INTEREST

PAYABLE

BANK LOAN

INCOME STATEMENT

EXPENSES

SERVICE REVENUE

DEPRECIATION

INTEREST

SALARIES

RENT

No change in owner’s equity

ASSETS

CASH

OFFICE

SUPPLIES

ACCOUNTS

RECEIVABLE

- $125 DR

- $10,000 DR

- $10,125 CR