Chapter 5

The Accounting Cycle: Adjustments

111

In most cases, expenses are entered from a purchase invoice or other source documents directly

into the accounting records, without looking back to see if there were any adjustments made in the

previous period. Thus, the transaction on October 7 could be recorded incorrectly if the adjusted

amount in salaries payable is forgotten and not applied to the transaction. If salaries payable is not applied,

$1,000 would be recorded as salaries expense for October instead of $500. To eliminate the possibility of

forgetting about the adjustment for accrued expenses and making an error, an optional step is to record a

reversing entry. This would be done on the first day of the new accounting period; in this example it would

be made on October 1, 2016 so it would not affect the reporting in September. The reversing entry would be

the opposite of the adjustment on September 30, 2016.

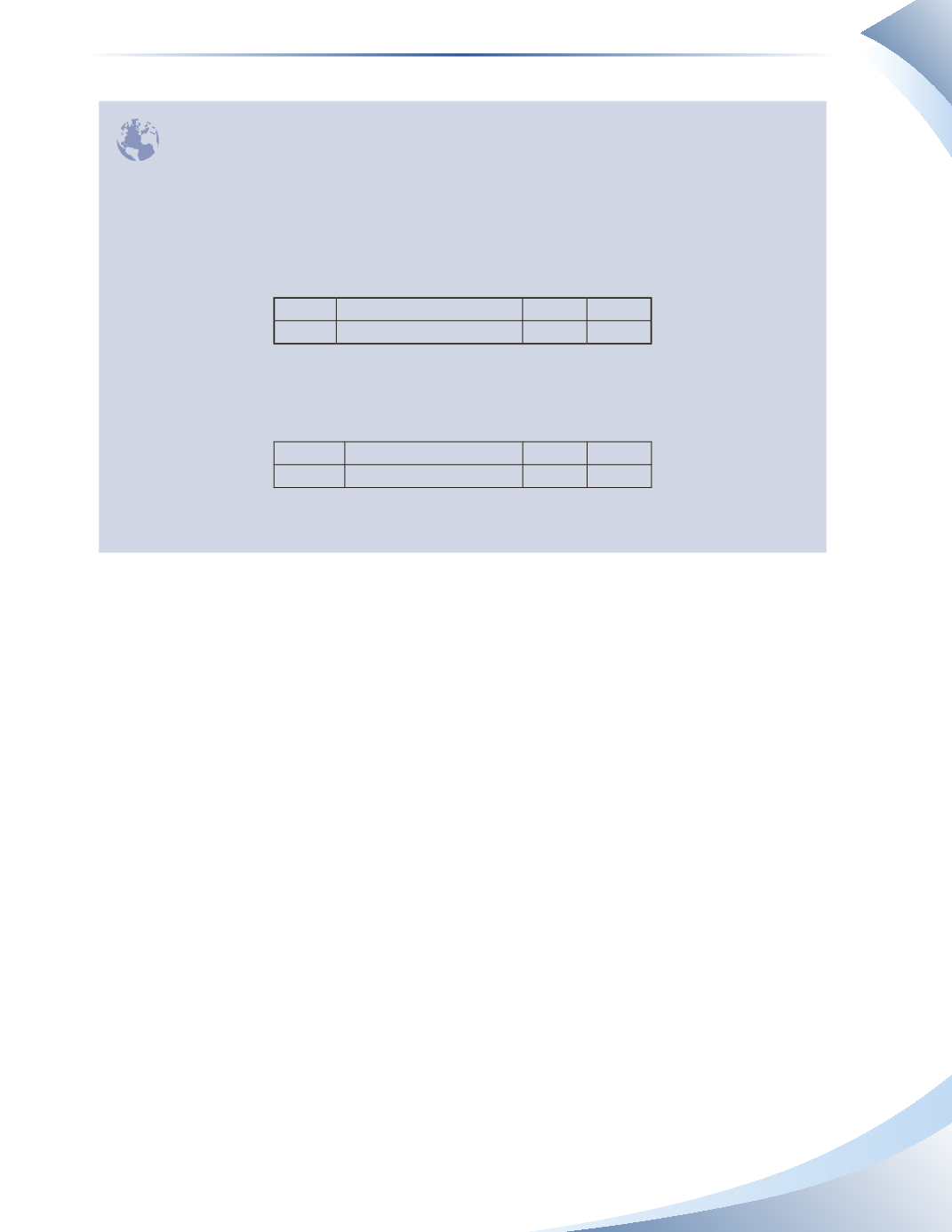

Oct 1 Salaries Payable

500

Salaries Expense

500

By creating this reversing entry, the effect of the adjustments of the previous month is undone for the current

month and leaves the expense account with a negative (credit) balance of $500. On October 7, the salary

payment would be made as usual for $1,000, but since salaries expense already has a negative balance of

$500, only $500 of salaries expense will be recognized in the month of October.

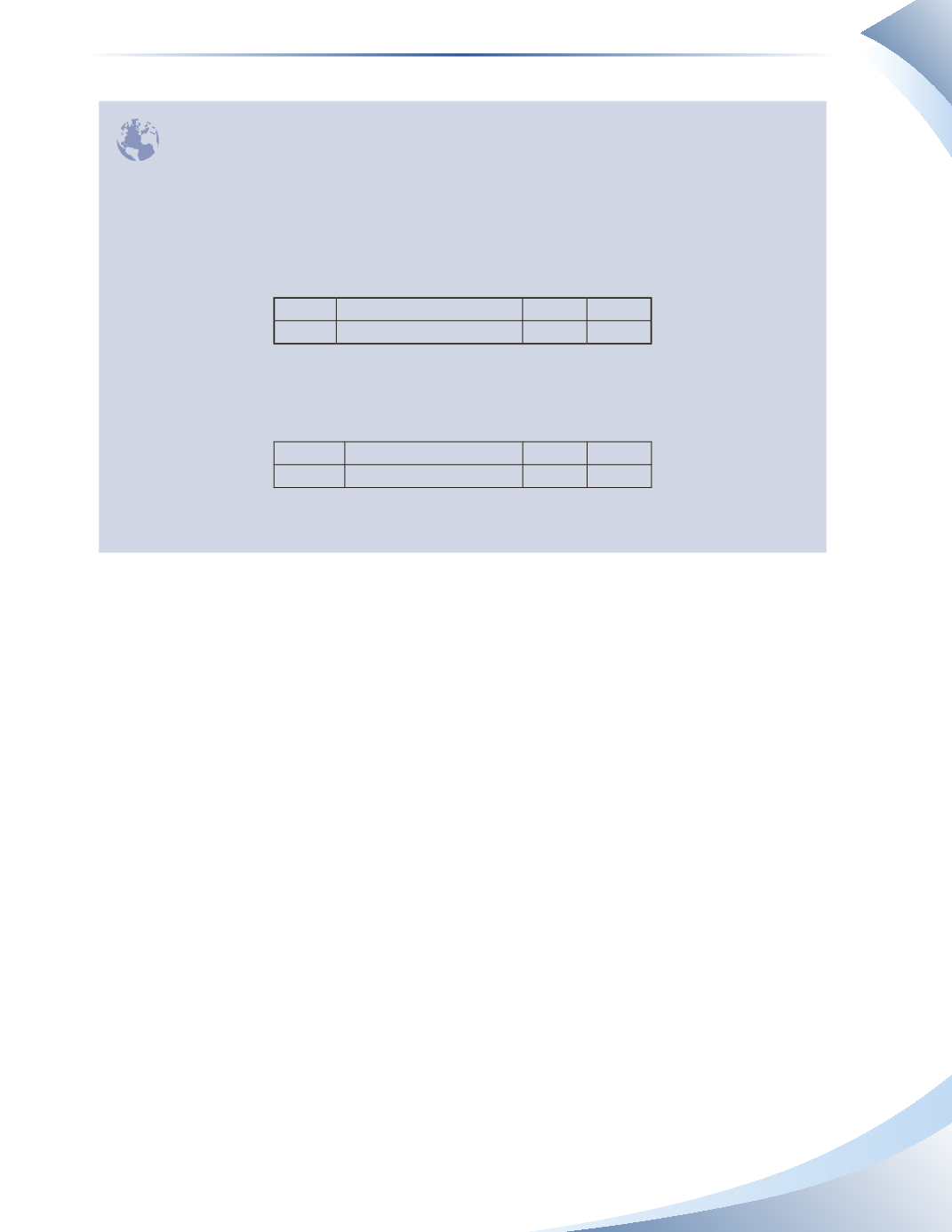

Oct 7 Salaries Expense

1,000

Cash

1,000

Some accounting software can create reversing entries for accrued revenue and accrued expenses, thus

removing the possibility of double counting revenue and expenses that have already been accrued.

INTHE REAL WORLD

Interest Expense

Borrowing cash is usually not free. The lender will charge interest on the amount borrowed and

expect payment at regular intervals. Interest accumulates, or accrues, during the interval before it

is paid. At the end of an accounting period, the borrower must calculate and record the amount of

interest that has accumulated to date as an accrued expense. Since it is owed to the lender, it will be

recorded in a liability account as well.

To calculate interest, three pieces of information must be known

1. The principal amount (the amount that was originally borrowed)

2. The interest rate (an annual percentage of interest charged on the principal)

3. The term of the loan (how long the debt will last)

For example, suppose a business borrowed $10,000 from the bank on July 1 and must repay the

loan in three months on October 1. The bank is charging 5% interest on the loan. Keep in mind

that interest rates are always expressed as an annual rate, so any duration that is less than one year

must be adjusted accordingly. If the business prepares its statements on September 30, and has not

prepared any statements since the loan was received, the entire amount of interest that has accrued

on the loan in the three months from July 1 to September 30 must be recorded.The calculation is

shown below.

Accrued Interest = Principal × Interest Rate × Time in Years

Accrued Interest = $10,000 × 5% ×

3

/

12

= $125