Chapter 5

The Accounting Cycle: Adjustments

108

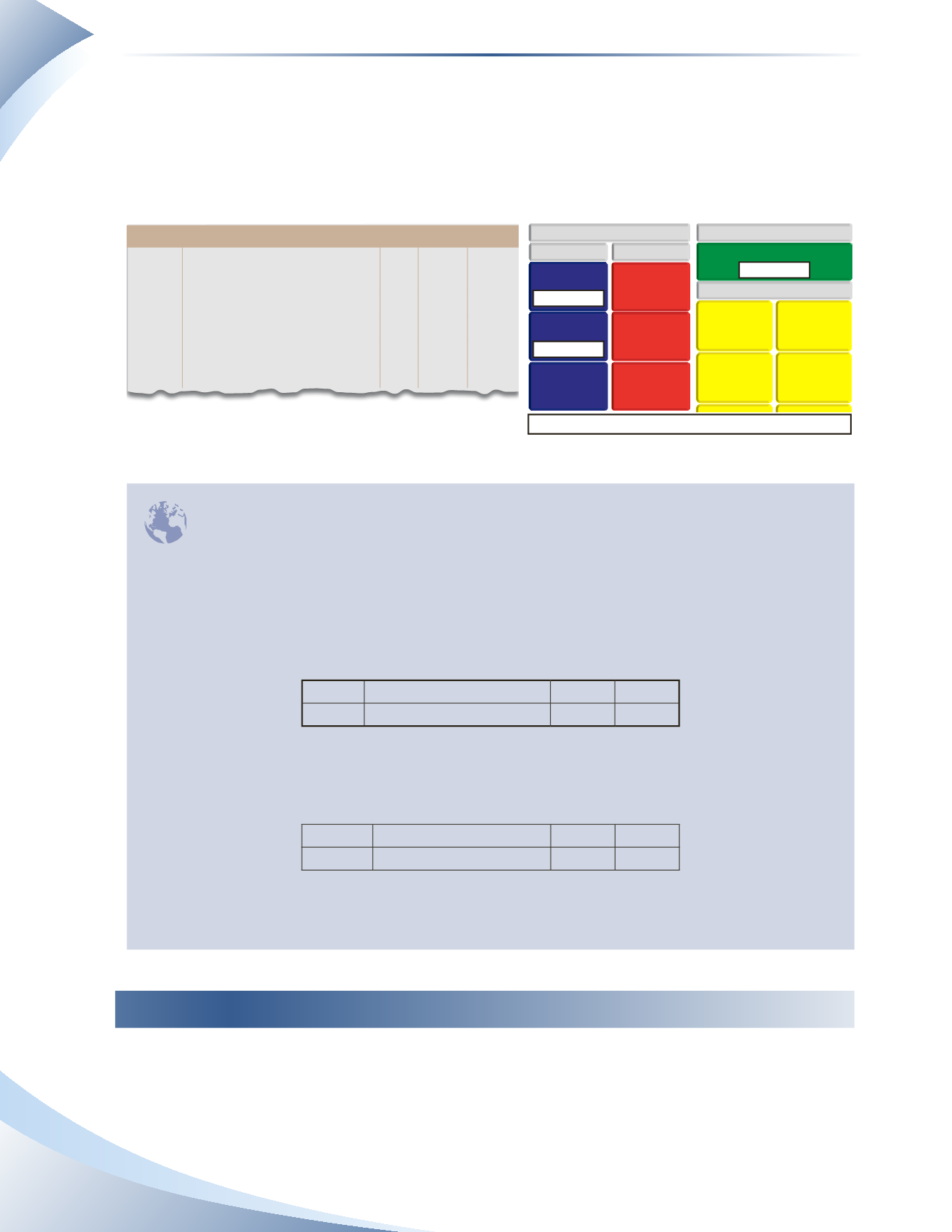

Once the contract is completed on October 20, you can bill the client. If they pay you immediately,

you will receive the full $6,000 cash. You will only record $4,000 worth of revenue earned for the

month of October since the other $2,000 worth of revenue was already recorded on September 30.

There will also be a $2,000 decrease to accounts receivable to indicate that the client has now paid

you the amount owed.This is illustrated in Figure 5.3.

In most cases, sales are entered from a sales invoice directly into the accounting records, without

looking back to see if there were any adjustments made in the previous period. Thus, the transaction

on October 20 could be recorded incorrectly if the adjusted amount in accounts receivable is

forgotten and not applied to the transaction. If accounts receivable is not applied, $6,000 would be recorded

as service revenue for October instead of $4,000. To eliminate the risk of forgetting about the adjustment

for accrued revenue and making an error, an optional step is to record a reversing entry. This would be done

on the first day of the new accounting period; in this example it would be made on October 1, 2016 so it

would not affect the reporting in September. The reversing entry would be the opposite of the adjustment

on September 30, 2016.

Oct 1 Service Revenue

2,000

Accounts Receivable

2,000

By creating this reversing entry, the effect of the adjustment of the previous month is undone for the current

month and leaves the revenue account with a negative (debit) balance of $2,000. On October 20, the full

amount of the contract of $6,000 can be recorded, but since service revenue already has a negative balance

of $2,000, only $4,000 of revenue will be recognized in the month of October.

Oct 20 Cash

6,000

Service Revenue

6,000

It is important to note that a reversing entry is just an option businesses can use to make their bookkeeping

easier. It does not change anything about the accrual-based accounting and it typically occurs only at the

beginning of an accounting period.

INTHE REAL WORLD

accrued expenses

Similar to accrued revenue,

accrued expenses

are expenses that have been incurred but have not

yet been recorded. Examples of expenses that may accrue at month end include property taxes,

salaries, interest on a loan and rent. In some cases, a business may have to estimate the accrued

journal

Page 1

date

2016

account title and explanation Pr debit credit

Oct 20 Cash

6,000

Accounts Receivable

2,000

Service Revenue

4,000

To record collection from client

____________

FIGURE 5.3

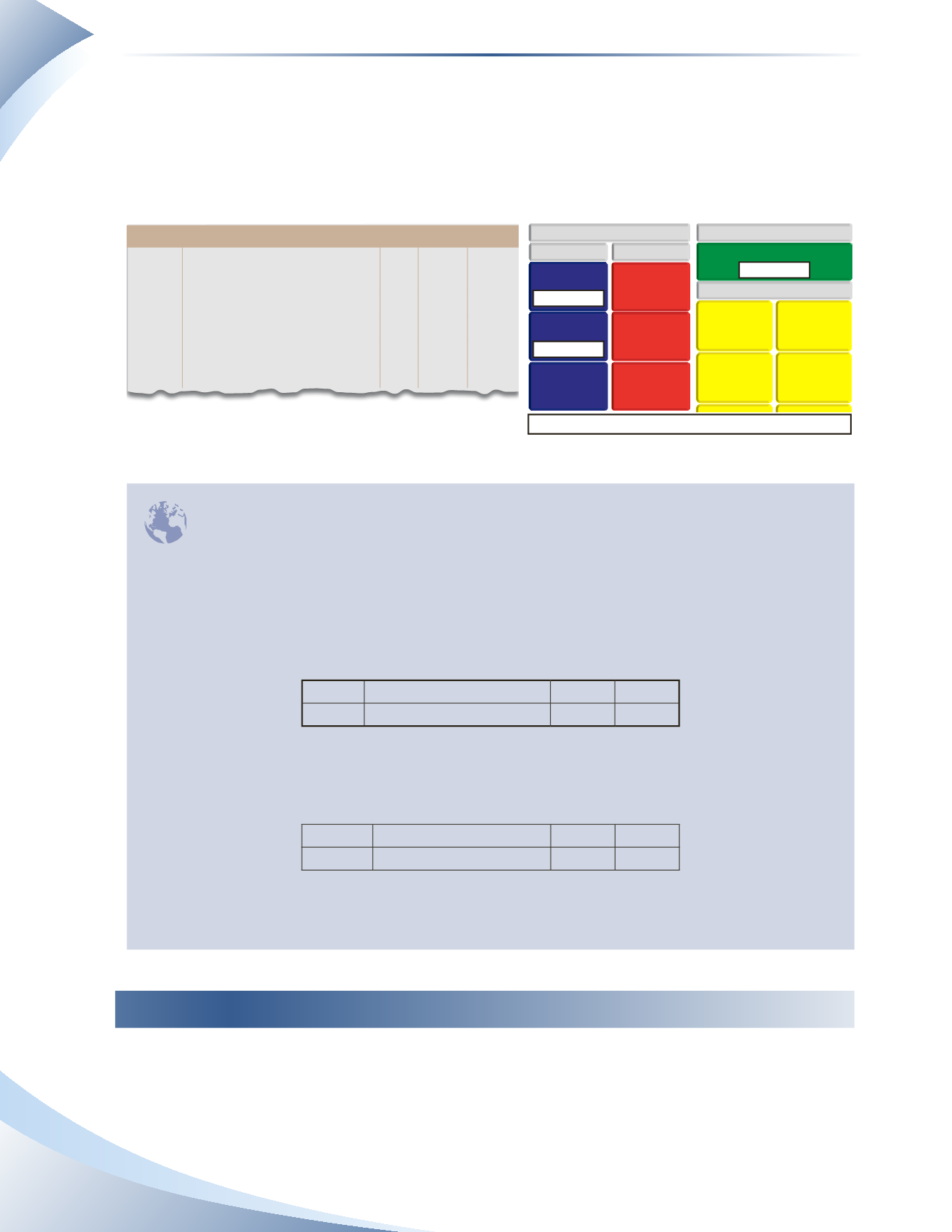

BALANCE SHEET

LIABILITIES

ACCOUNTS

PAYABLE

UNEARNED

REVENUE

LOAN PAYABLE

INCOME STATEMENT

EXPENSES

SERVICE REVENUE

DEPRECIATION

INSURANCE

SALARIES

RENT

Owner’s equity increases by $4,000

ASSETS

CASH

OFFICE

SUPPLIES

ACCOUNTS

RECEIVABLE

- $2,000 CR

+ $6,000 DR

+ $4,000 CR