Chapter 5

The Accounting Cycle: Adjustments

114

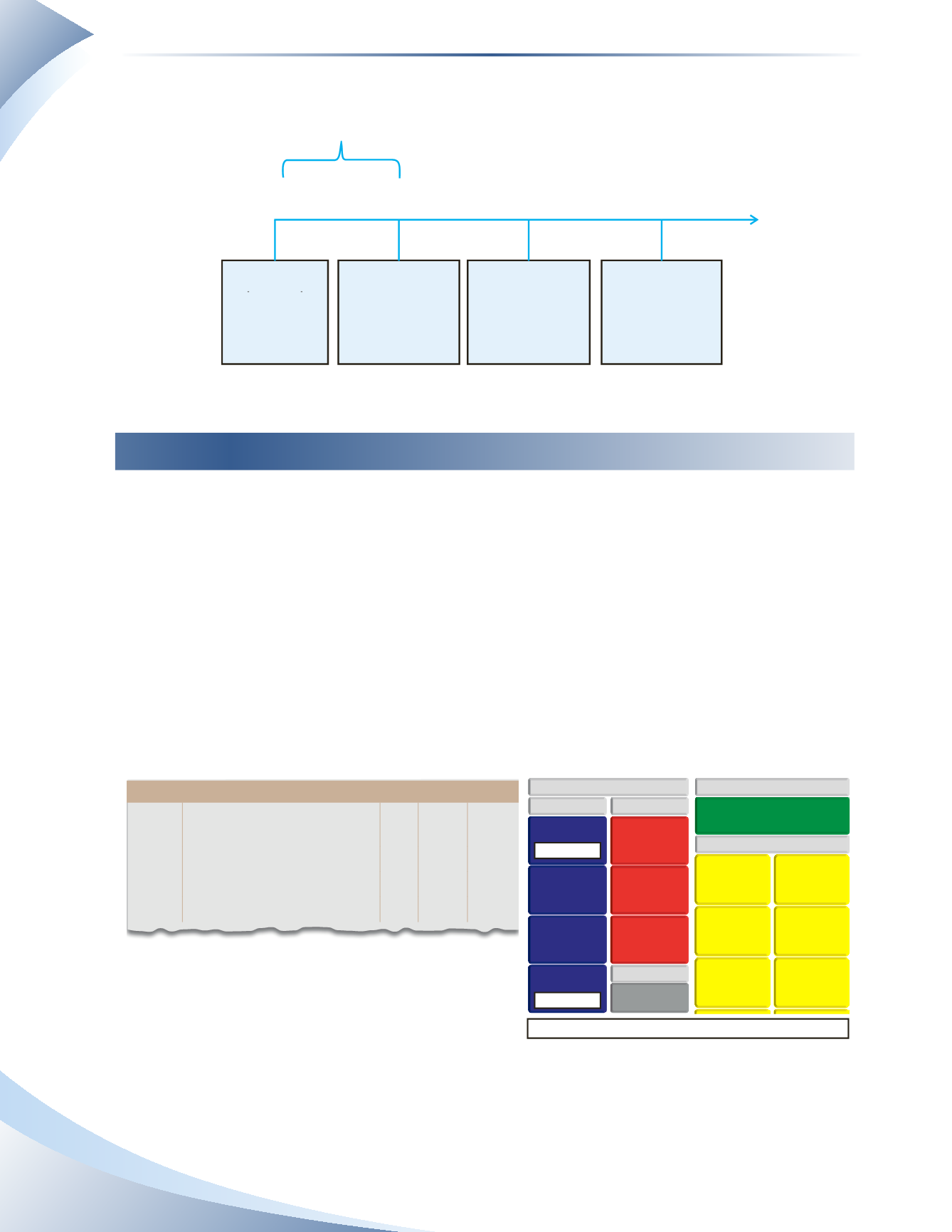

March 1

March 31

April 30

Adjustment Period

(One Month)

Transactions FromRaina's Perspective

Receive payment

from tenant

Date of Adjustment

Adjustment

Adjustment

Adjustment

Date of Adjustment

May 31

Date of Adjustment

DR $6,600 Cash (asset)

CR $6,600 Unearned

Revenue (liability)

DR $2,200 Unearned

Revenue (liability)

CR $2,200 Rent Revenue

(income statement)

DR $2,200 Unearned

Revenue (liability)

CR $2,200 Rent Revenue

(income statement)

DR $2,200 Unearned

Revenue (liability)

CR $2,200 Rent Revenue

(income statement)

Recognize earned rent

revenue for March

Recognize earned rent

revenue for April

Recognize earned rent

revenue for May

______________

FIGURE 5.11

Prepaid expenses

Similar to unearned revenue, accounting for prepaid expenses involves making adjustments for

amounts used. Recall that when a prepaid expense is recognized as an actual expense, prepaid

expenses (an asset) decreases and the expense (an income statement account) increases.This is the

adjusting entry for prepaid expenses.

Prepaid rent

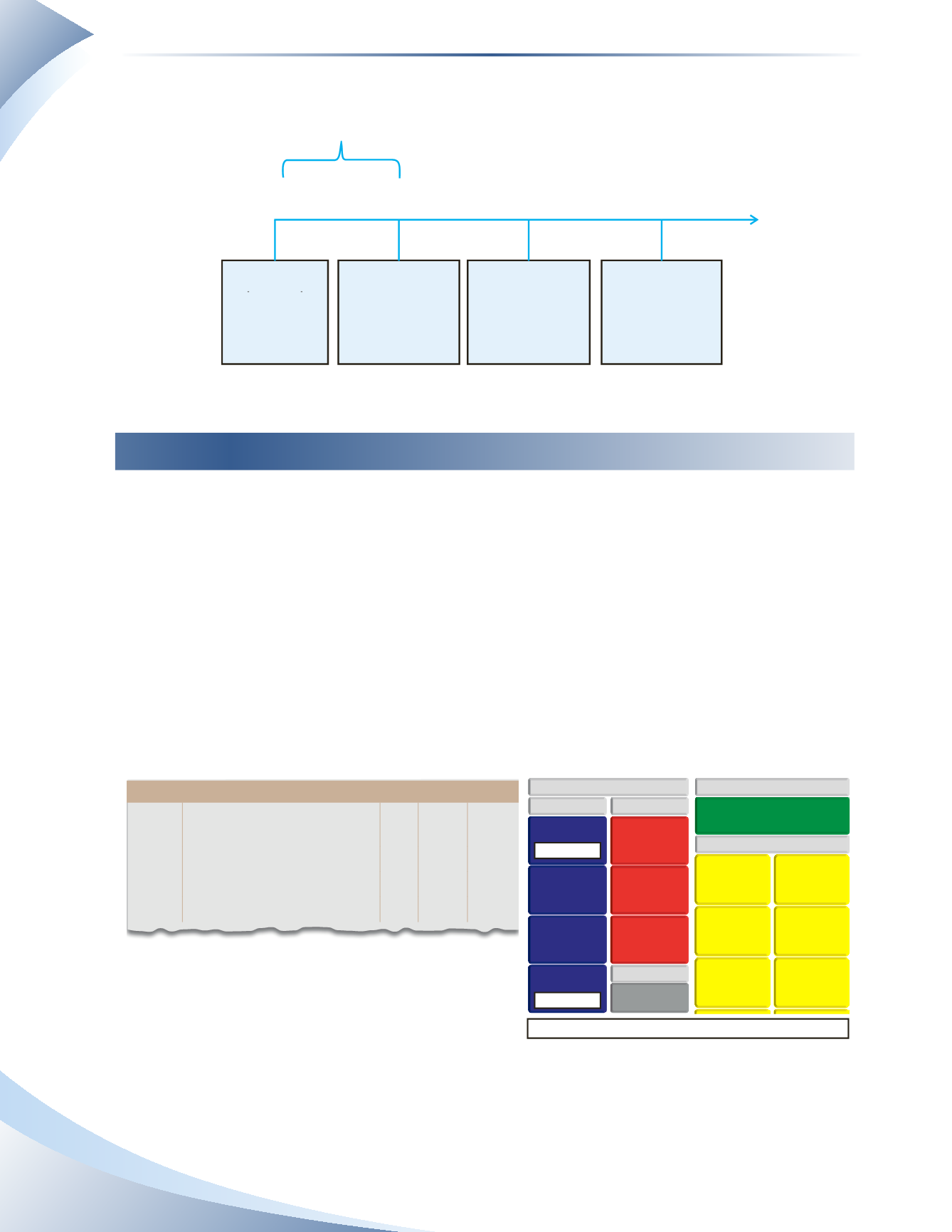

We can apply this to the example of Raina Property Management which was illustrated in the

unearned revenue section.Now examine the financial impact of the transactions from the perspective

of the tenant who paid Raina three months of rent at $2,200 per month in advance. On March 1,

the tenant would have recorded a cash payment to Raina for $6,600 as a prepayment for rent, as

shown in Figure 5.12.

If the tenant also uses a monthly accounting period, then it will adjust the prepaid rent at the end

of each month. In this case, the tenant is adjusting based on what has been used (one month) on

March 31. The adjustment will decrease the prepaid rent account and increase rent expense on

OWNER’S CAPITAL

BALANCE SHEET

LIABILITIES

OWNER’S EQUITY

ACCOUNTS

PAYABLE

UNEARNED

REVENUE

BANK LOAN

INCOME STATEMENT

EXPENSES

SERVICE REVENUE

DEPRECIATION

INSURANCE

INTEREST

SALARIES

RENT

TELEPHONE

No change in owner’s equity

ASSETS

CASH

OFFICE

SUPPLIES

PREPAID

EXPENSES

ACCOUNTS

RECEIVABLE

-$6,600 CR

+$6,600 DR

journal

Page 1

date

2016

account title and explanation Pr debit credit

Mar 1 Prepaid Rent

6,600

Cash

6,600

Pay cash for 3 months rent

____________

FIGURE 5.12