Chapter 6

The Accounting Cycle: Statements and Closing Entries

138

The statement begins with the

opening balance of the owner’s

capital account. In our example,

the opening balance was $5,300

on January 1, 2016.

Owner’s equity will increase if

the owner invests more cash or

assets into the business, or if the

business earned a profit during the period. In our example, the owner invested $5,000 into the

business during the month. Notice the net income (marked 1) from the income statement in

Figure 6.4 is also added.

The equity will decrease if the owner withdraws any capital (cash or assets) from the business for

personal use, or if the business suffered a loss during the period.There was no loss in our example,

but there was a $2,000 withdrawal, as shown in the worksheet under Parish, Drawings.

The final closing balance of the capital account (marked 2) is transferred to the owner’s equity

section of the balance sheet in Figure 6.6.

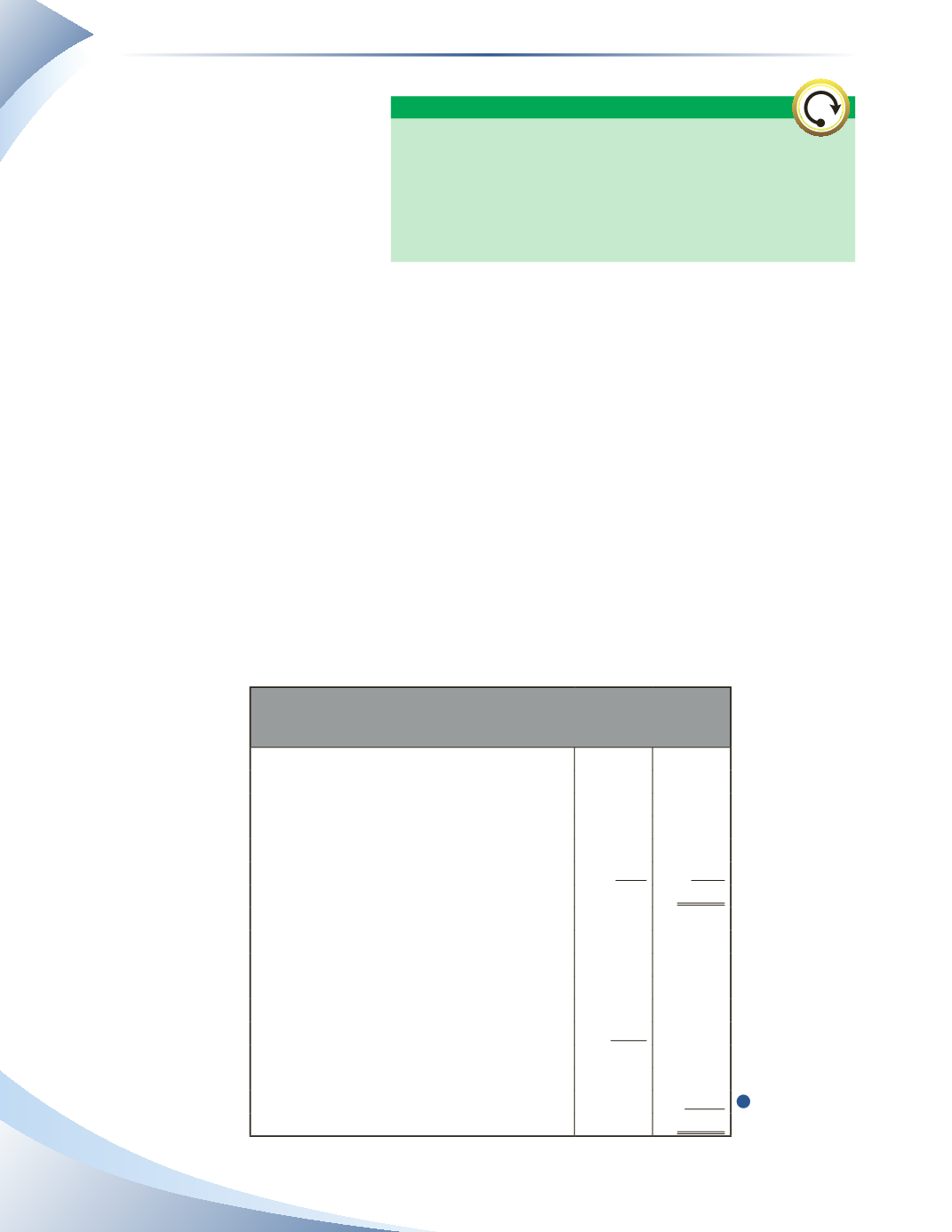

The Balance Sheet

The balance sheet is prepared using the values from the asset and liability accounts from the

adjusted trial balance. Previous chapters showed the balance sheet organized horizontally, with

assets beside liabilities and owner’s equity. An alternate organization, and the way balance sheets

are most commonly presented, is vertically. Assets are listed above liabilities and owner’s equity.

MP Consulting

Balance Sheet

As at January 31, 2016

Assets

Cash

$3,800

Accounts Receivable

4,000

Prepaid Insurance

1,100

Equipment

$8,300

Accumulated Depreciation

(150)

8,150

Total Assets

$17,050

Liabilities

Accounts Payable

$1,250

Interest Payable

25

Unearned Revenue

1,800

Bank Loan

2,500

Total Liabilities

$5,575

Owner’s Equity

Parish, Capital

11,475

Total Liabilities and Owner's Equity

$17,050

________________

Figure 6.6

The ending balance of owner’s equity for a given period

can be calculated as follows:

Ending Owner’s Equity = Beginning Owner’s Equity

+ Owner’s Contributions

+ Net Income (Loss)

− Owner’s Withdrawals

WORTH REPEATING

2