Chapter 6

The Accounting Cycle: Statements and Closing Entries

141

4,900

250

250

+

-

-

-

+

+

10,200

1,500

1,500

+

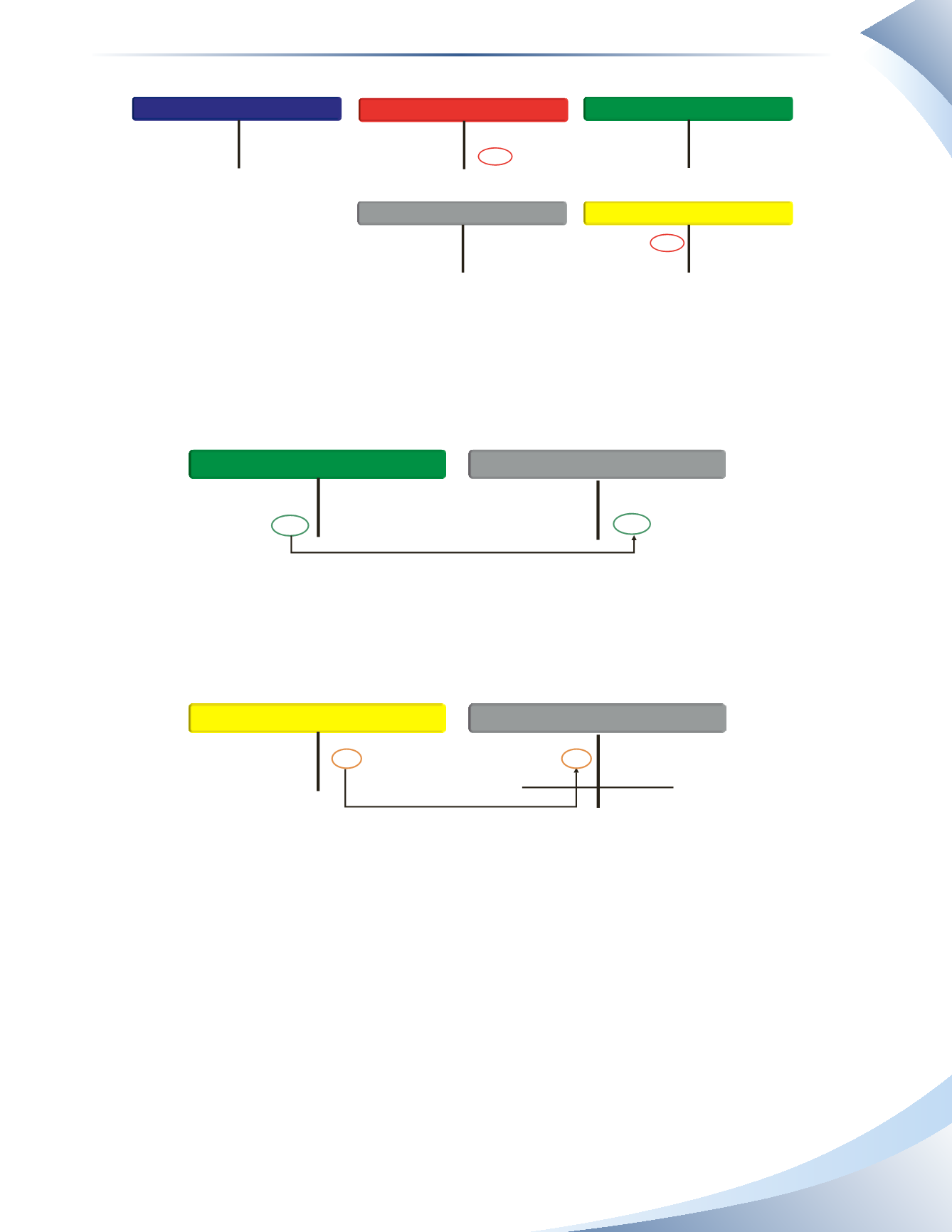

PARISH, CAPITAL

DECREASE (DR)

INCREASE (CR)

-

5,300

+

TELEPHONE EXPENSE

DECREASE (DR)

INCREASE (CR)

-

ASSETS

LIABILITIES

SERVICE REVENUE

INCREASE (DR)

DECREASE (DR)

DECREASE (DR)

DECREASE (CR)

INCREASE (CR)

INCREASE (CR)

________________

Figure 6.10

To get the balance sheet back into balance, owner’s capital must be updated with the revenue and

expense transactions. To do this, the revenue account must be closed by decreasing revenue and

increasing owner’s capital, as illustrated in Figure 6.11. The revenue account is now reduced to a

zero balance.

-

+

1,500 Current balance

1,500

+

PARISH, CAPITAL

DECREASE (DR)

INCREASE (CR)

-

5,300 Current balance

1,500

SERVICE REVENUE

DECREASE (DR)

INCREASE (CR)

________________

Figure 6.11

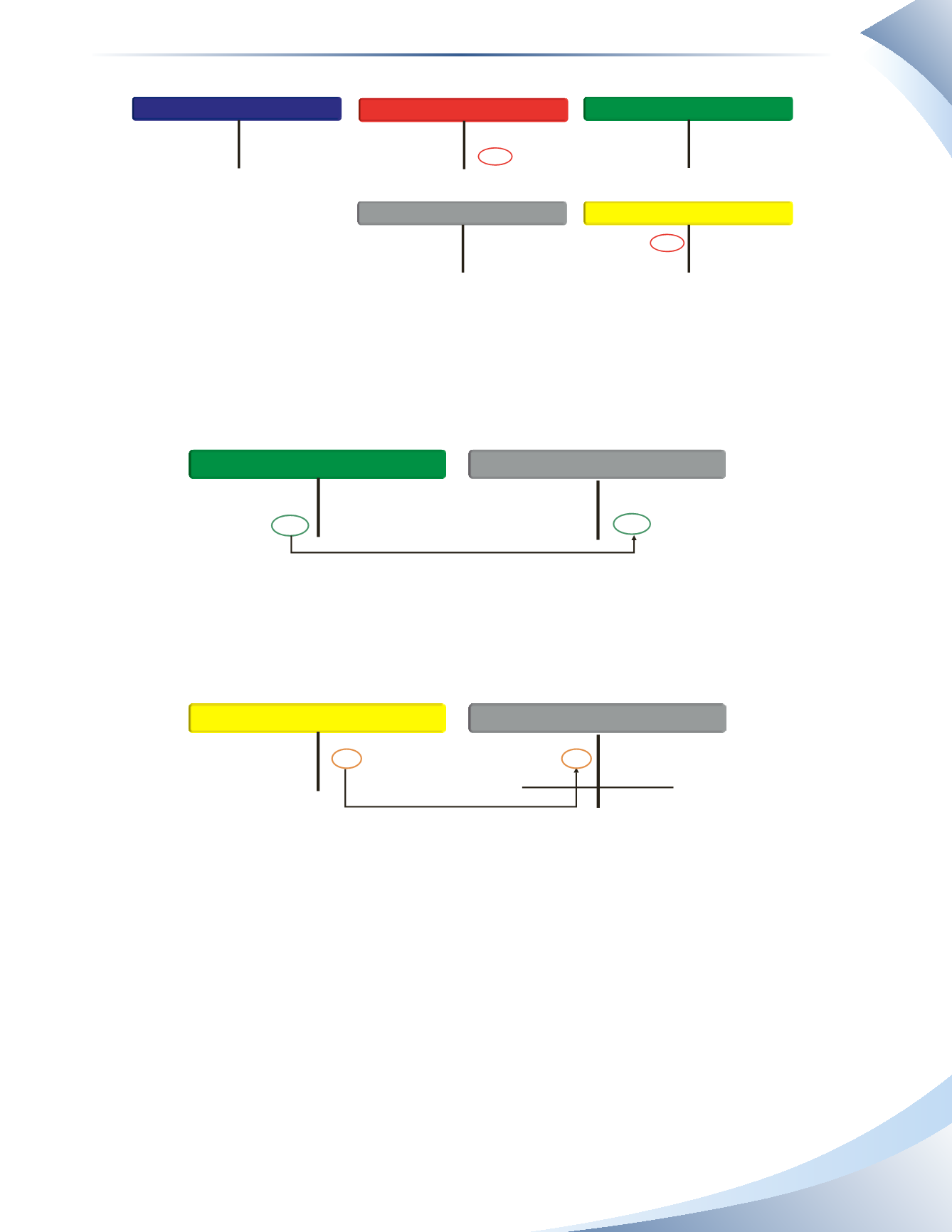

The expense account must also be closed by decreasing the expense and decreasing owner’s capital,

as illustrated in Figure 6.12.The expense account is now reduced to zero.

-

+

250

250

Current balance 250

+

PARISH, CAPITAL

DECREASE (DR)

INCREASE (CR)

-

5,300 Current balance

6,550 Ending balance

1,500

TELEPHONE EXPENSE

DECREASE (DR)

INCREASE (CR)

________________

Figure 6.12

The end result is that owner’s capital will have a new balance and assets will equal liabilities plus

equity.

To see how to close the books for MP Consulting, we will use the adjusted trial balance on the

worksheet, which shows all the balances we need. The adjusted trial balance is shown again in

Figure 6.13.