Chapter 6

The Accounting Cycle: Statements and Closing entries

143

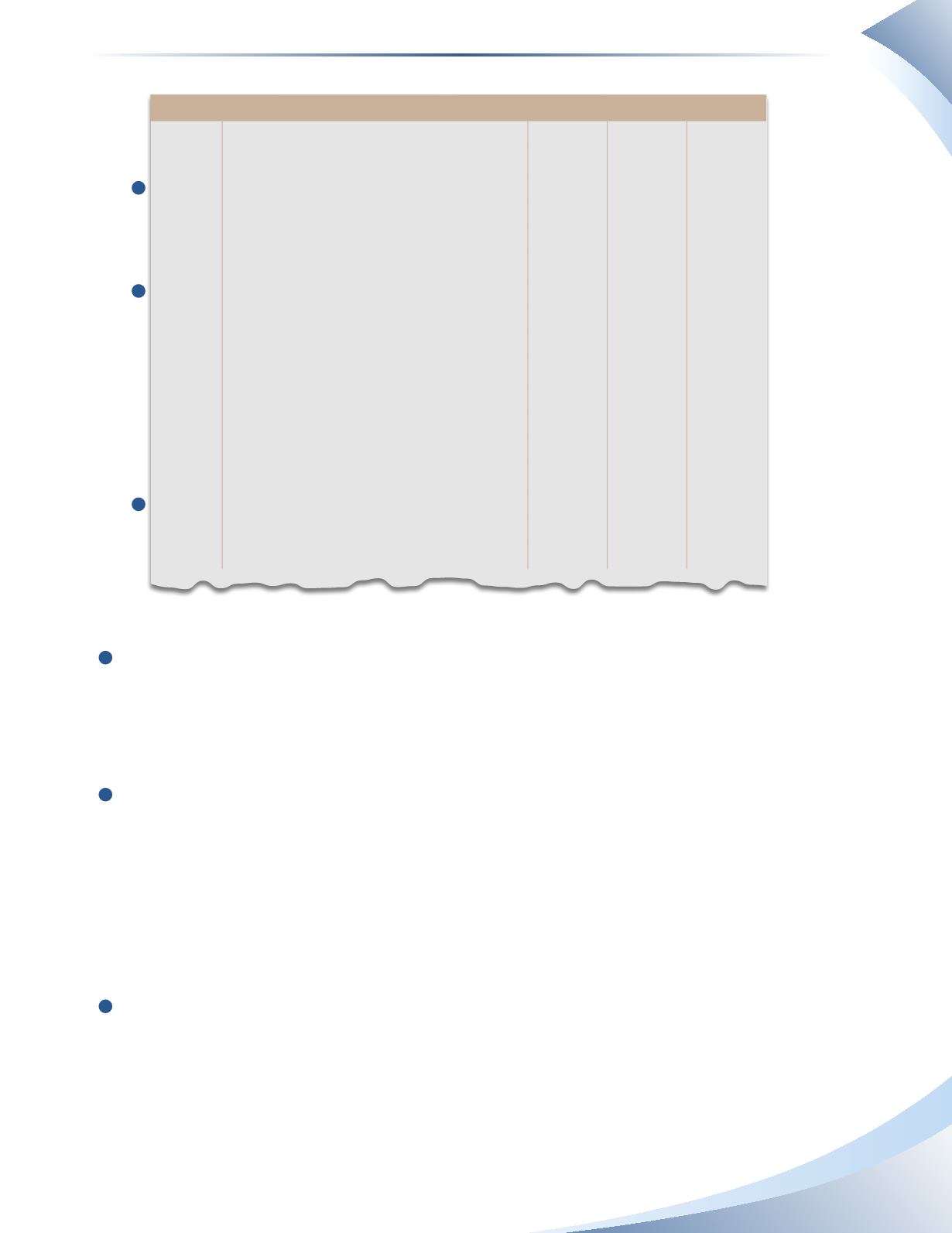

JournAl

Page 3

date

Account Title and explanation

Pr

debit

Credit

2016

Jan 31 Service revenue

400

4,500

Parish, Capital

300

4,500

To close revenue

Jan 31 Parish, Capital

300

1,325

Depreciation expense

510

150

insurance expense

515

100

interest expense

520

25

rent expense

540

800

Telephone expense

550

250

To close expenses

Jan 31 Parish, Capital

300

2,000

Parish, Drawings

310

2,000

To close owner's drawings

________________

Figure 6.14

1

Zero out the revenue account

The transaction is recorded by debiting (decreasing) the current revenue balance with $4,500 and

crediting (increasing) owner’s capital with the same amount.The revenue account is now reduced

to zero.

2

Zero out the expense accounts

The transaction is recorded by crediting (decreasing) the current expense balances and debiting

(decreasing) owner’s capital with the total of all expense amounts. The expense accounts are now

reduced to zero. Notice in Figure 6.14 that instead of closing each expense account individually to

owner’s capital, all expenses were listed in one transaction. This saves time and effort (imagine if

the company had 50 or more expense accounts).The debit to owner’s capital is the total of all the

expenses.

3

Zero out the owner’s drawings account

The transaction is recorded by crediting (decreasing) the current owner’s drawings balance with

$2,000 and debiting (decreasing) owner’s capital with the same amount. The owner’s drawings

account is now reduced to zero.

1

2

3