Chapter 6

The Accounting Cycle: Statements and Closing Entries

142

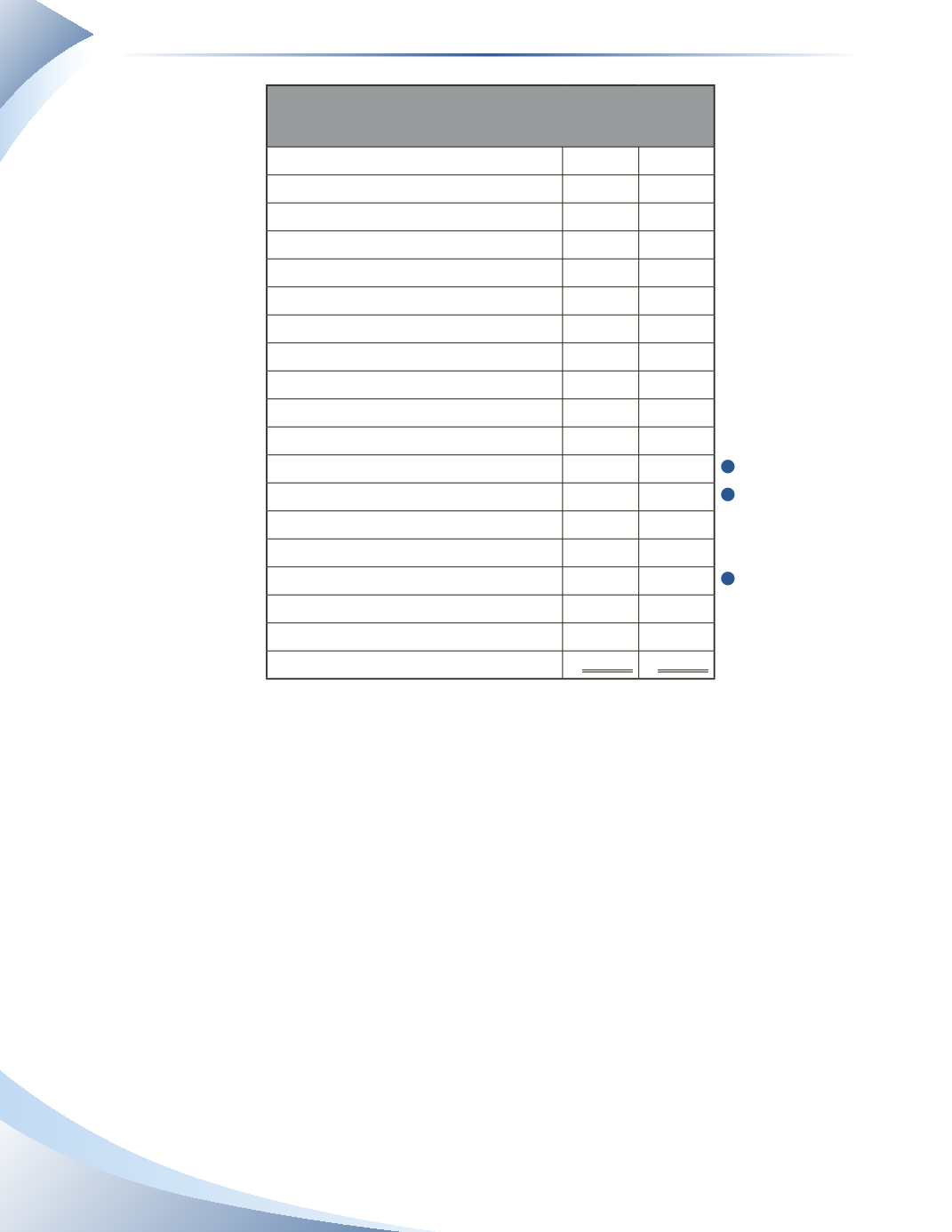

MP Consulting

Adjusted Trial Balance

January 31, 2016

Account Titles

DR

CR

Cash

$3,800

Accounts Receivable

4,000

Prepaid Insurance

1,100

Equipment

8,300

Accumulated Depreciation

$150

Accounts Payable

1,250

Interest Payable

25

Unearned Revenue

1,800

Bank Loan

2,500

Parish, Capital

10,300

Parish, Drawings

2,000

Service Revenue

4,500

Depreciation Expense

150

Insurance Expense

100

Interest Expense

25

Rent Expense

800

Telephone Expense

250

Total

$20,525 $20,525

________________

Figure 6.13

Notice that the revenue balance is a credit, the expense balances are debits and the owner’s draw-

ings balance is also a debit. To reset (close) the balances back to zero to prepare for the next

accounting period, we must decrease the value of each of these accounts. Thus, revenue will be

debited, expenses will be credited and owner’s drawings will be credited. In the context of closing

entries, the terms “close,” “reset” and “zero out” can be used interchangeably.

Figure 6.14 illustrates the journal entries to close the accounts directly to the capital account.The

steps involved are explained.

3

1

2