Chapter 6

The Accounting Cycle: Statements and Closing Entries

140

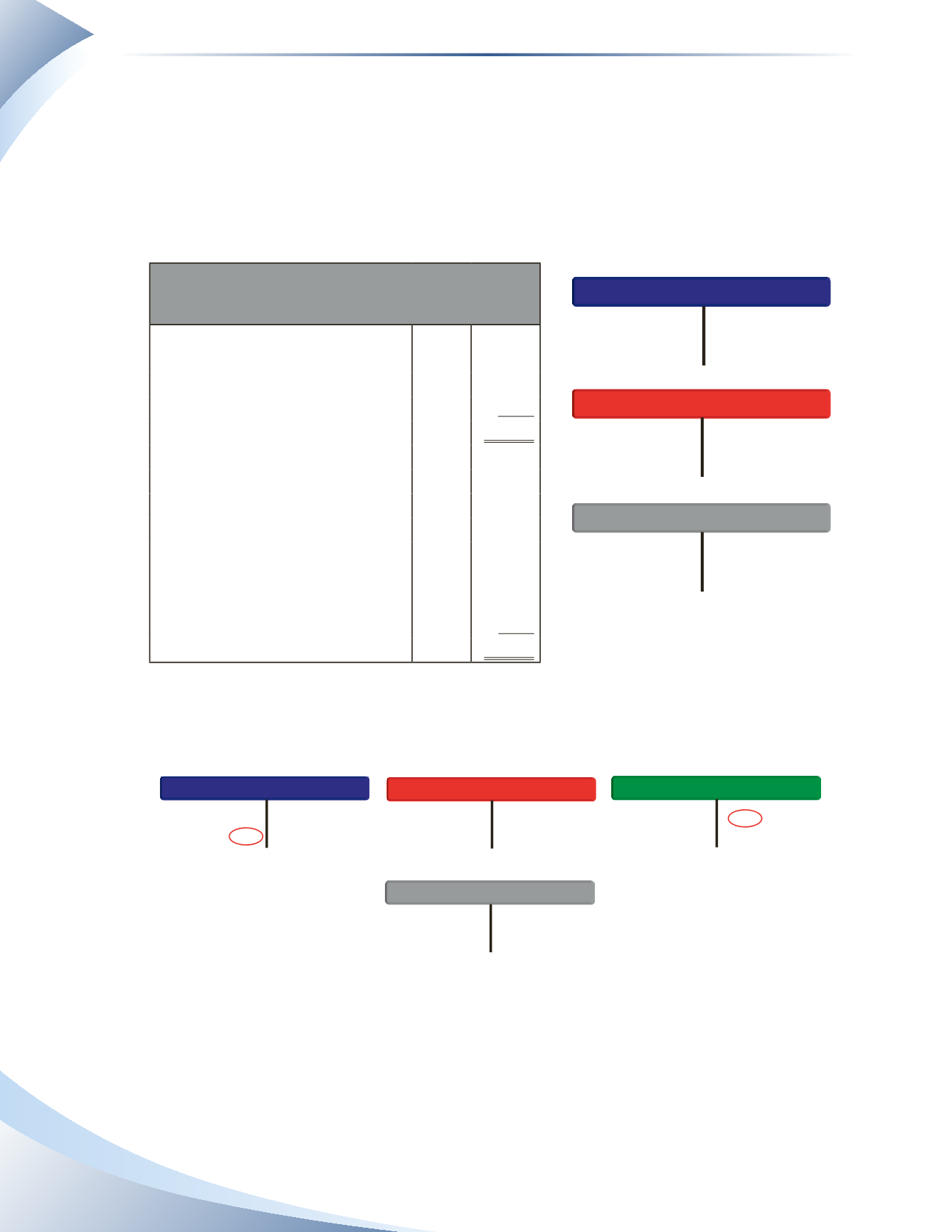

Direct Method: Close Directly to Owner’s Capital

Closing entries are those entries made to revenue and expenses at the end of an accounting period

to close out the accounts. To illustrate the concept of

closing entries,

examine MP Consulting’s

balance sheet at the beginning of January 2016 (i.e. the end of December 2015). At the beginning

of the period, MP Consulting’s balance sheet was in balance, as shown in Figure 6.8. T-accounts

are also used to illustrate the overall values of three categories: assets, liabilities and equity.

MP Consulting

Balance Sheet

As at December 31, 2015

Assets

Cash

$3,000

Accounts Receivable

1,200

Equipment

6,000

Total Assets

$10,200

Liabilities

Accounts Payable

$1,000

Unearned Revenue

900

Bank Loan

3,000

Total Liabilities

$4,900

Owner's Equity

Parish, Capital

5,300

Total Liabilities and Owner's Equity

$10,200

________________

figure 6.8

+

PARISH, CAPITAL

DECREASE (DR)

INCREASE (CR)

+

-

-

-

+

10,200

4,900

5,300

ASSETS

LIABILITIES

INCREASE (DR)

DECREASE (DR)

DECREASE (CR)

INCREASE (CR)

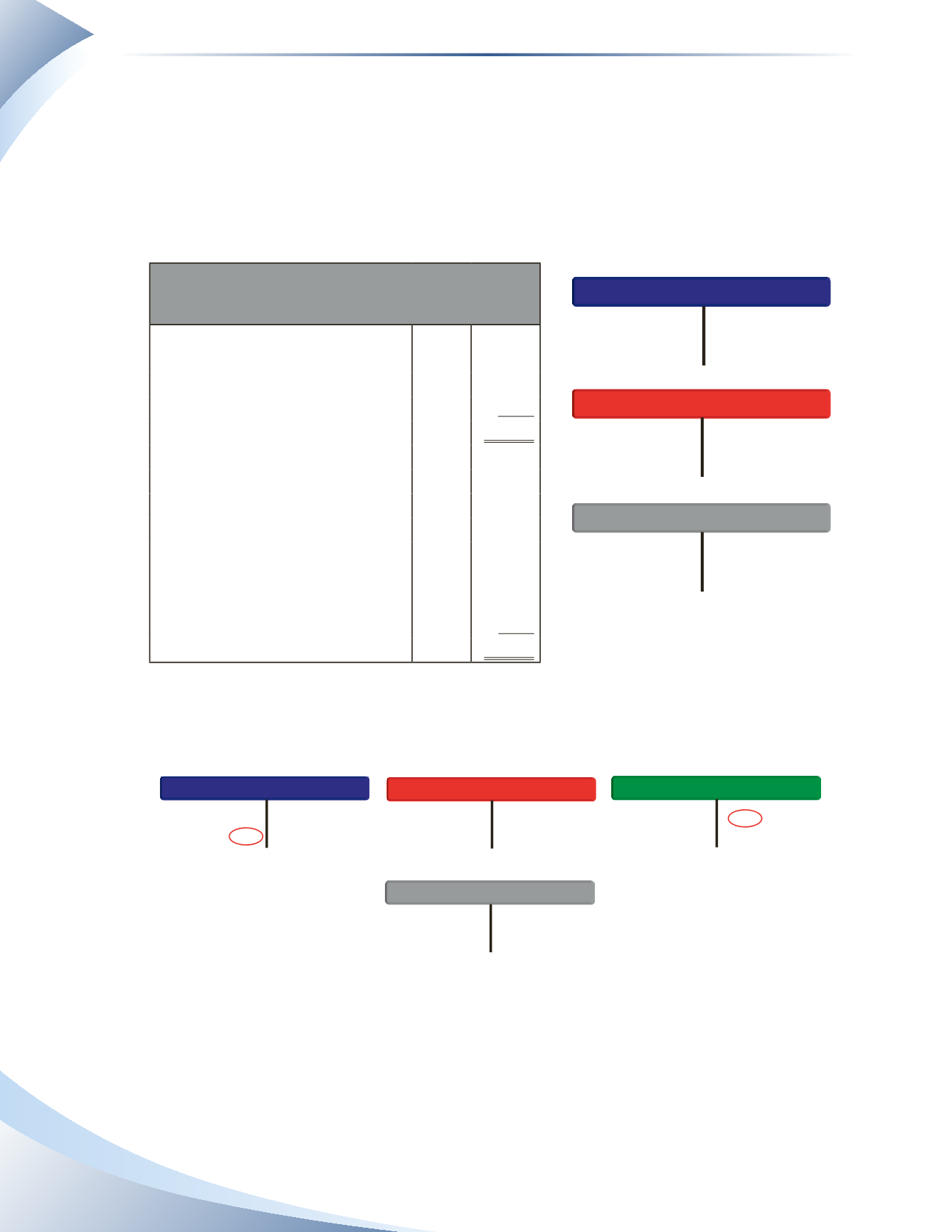

Notice what happens in Figure 6.9 when we provide services to a customer who pays cash.

4,900

+

PARISH, CAPITAL

DECREASE (DR)

INCREASE (CR)

+

-

-

-

-

+

+

10,200

1,500

1,500

5,300

ASSETS

LIABILITIES

SERVICE REVENUE

INCREASE (DR)

DECREASE (DR)

DECREASE (DR)

DECREASE (CR)

INCREASE (CR)

INCREASE (CR)

________________

Figure 6.9

The balance sheet is now out of balance because assets have increased, but owner’s capital has not

been updated. A similar discrepancy occurs if a telephone bill is received and will be paid later, as

shown in Figure 6.10.