Chapter 10

Cash Controls

301

Outstanding Cheques

The next reconciling item to consider is

outstanding cheques

. An outstanding cheque (issued by the

company) is one that has been recorded in the general ledger, but has not been recorded on the

bank statement.This can happen because after the company records the cheque, it is mailed to the

supplier. The supplier then records it in its books, prepares the deposit and takes it to the bank.

The process can take several days, so the cheque mailed on June 29 may not appear on the bank

statement until July 2 or 3.

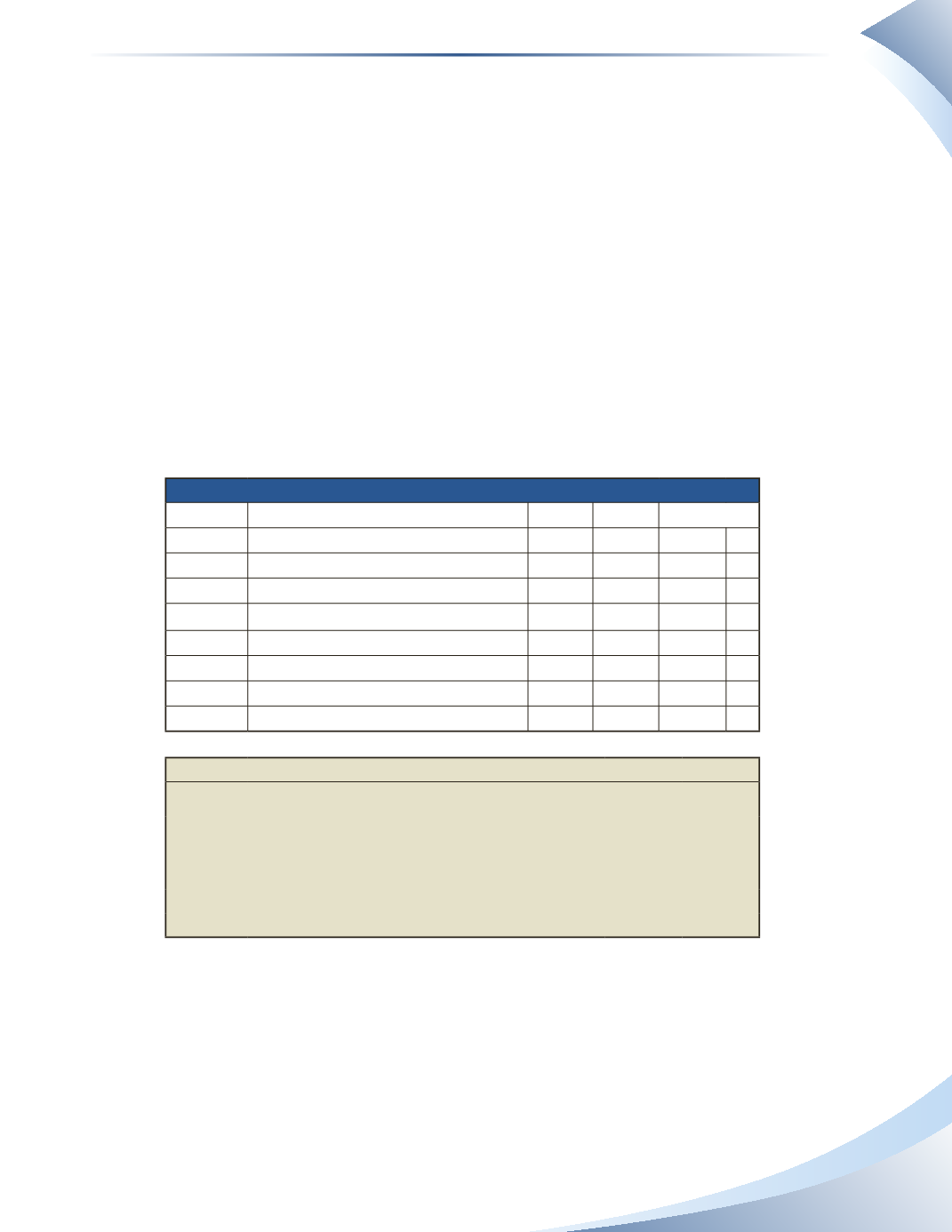

Consider an example: three cheques have been recorded in the ledger between June 28 and 30, as

reflected in Figure 10.16. None of these cheques have been processed by the bank by June 30.The

cheques are therefore outstanding.

To reconcile the ledger account with the bank statement, we must treat the cheques as if the

transaction had been completed by the bank (i.e. deduct the amounts from the bank record).

GENERAL LEDGER

Account: Cash

GL. No. 101

Date

Description

DR CR

Balance

Jun 1 Opening Balance

5,000 DR

Jun 2 Cheque #1

300 4,700 DR

Jun 3 Cheque #2

500 4,200 DR

Jun 10 Cheque #3

700 3,500 DR

Jun 15 Deposit

1,000

4,500 DR

Jun 28 Cheque #4

400 4,100 DR

Jun 29 Cheque #5

800 3,300 DR

Jun 30 Cheque #6

700 2,600 DR

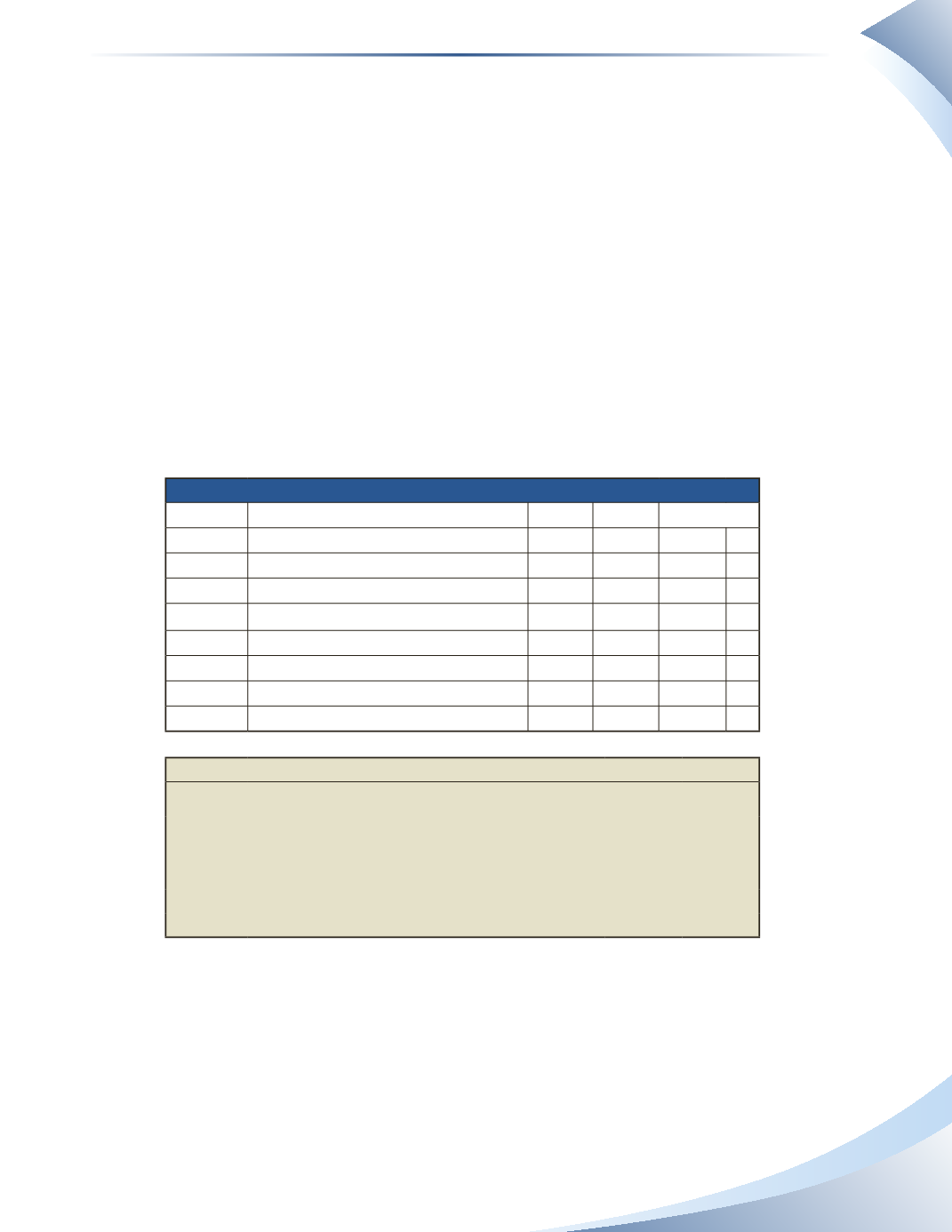

Bank Statement

June 1–June 30, 2016

Date

Description

Withdrawal Deposit Balance

Jun 1 Opening Balance

5,000

Jun 2 Cheque #1

300

4,700

Jun 3 Cheque #2

500

4,200

Jun 10 Cheque #3

700

3,500

Jun 15 Deposit

1,000

4,500

______________

Figure 10.16