Chapter 2

Linking Personal Accounting to Business Accounting

28

7.

Unearned revenue

is an obligation the business has to provide products or service to a

customer. It is used when a customer prepays the business for services or products.

8. Just as a person may have loans or mortgages, a business may also have long-term debt such

as loans.

9. The category of net worth is referred to as

equity

. The equity may belong to the business

owner, the partners or shareholders, depending on the organization of the business. Business

organization will be discussed later.

10. Revenue will be called either service revenue or sales revenue. If a business provides services to

its customers, it will use

service revenue

. If it sells products to its customers, it will use

sales

revenue

. Some businesses will provide both and use both accounts on the income statement.

11. Although there are some similarities in the expense items on the income statement, a business

will usually have more types of expenses.We will discuss these new expenses as they appear in

the textbook.A business will typically list its expenses on the income statement in alphabetical

order.

12. Surplus (deficit) on the personal income statement is now called net income (loss).

Net

income

occurs when revenue exceeds expenses for the period and will increase equity. A

net

loss

occurs when expenses exceed revenue for the period and will decrease equity.

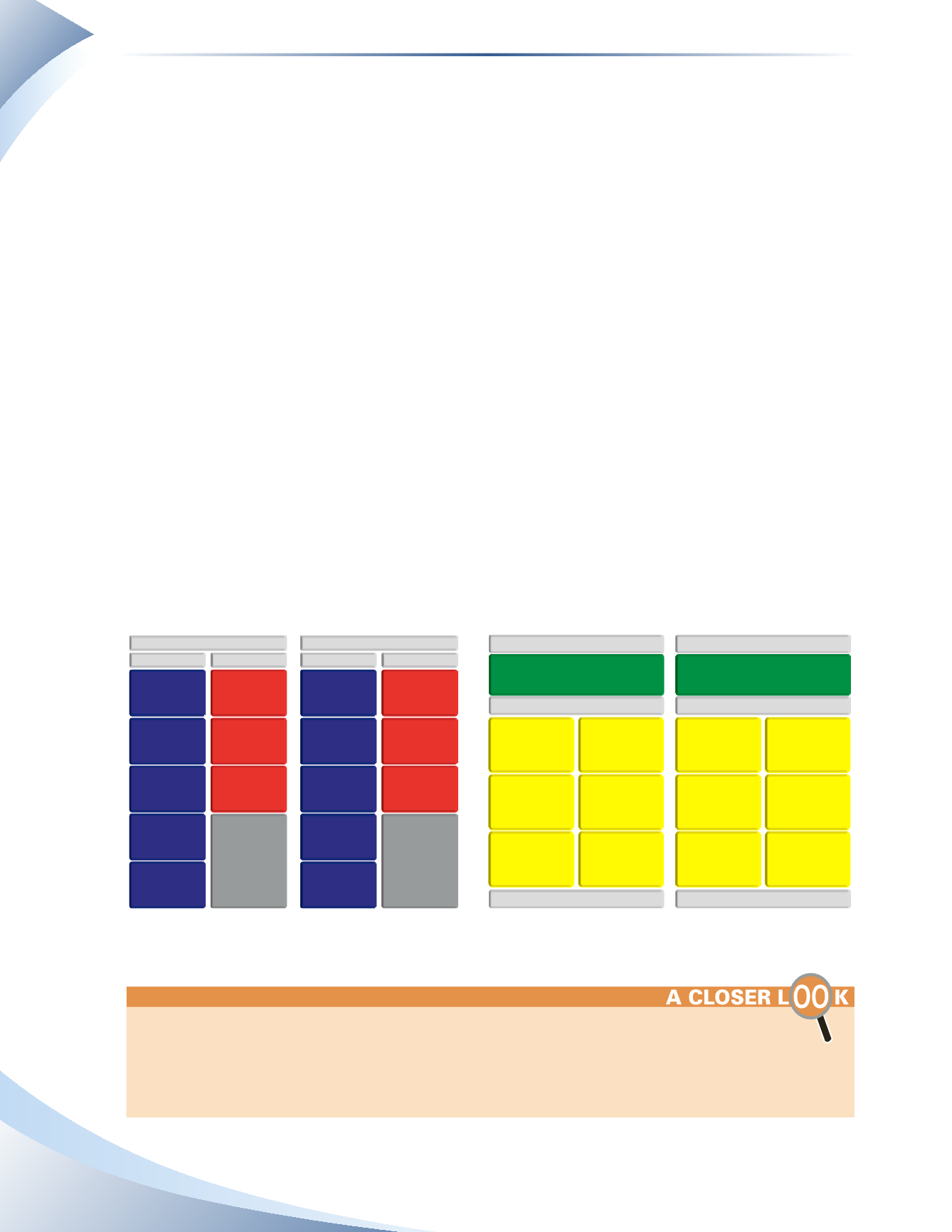

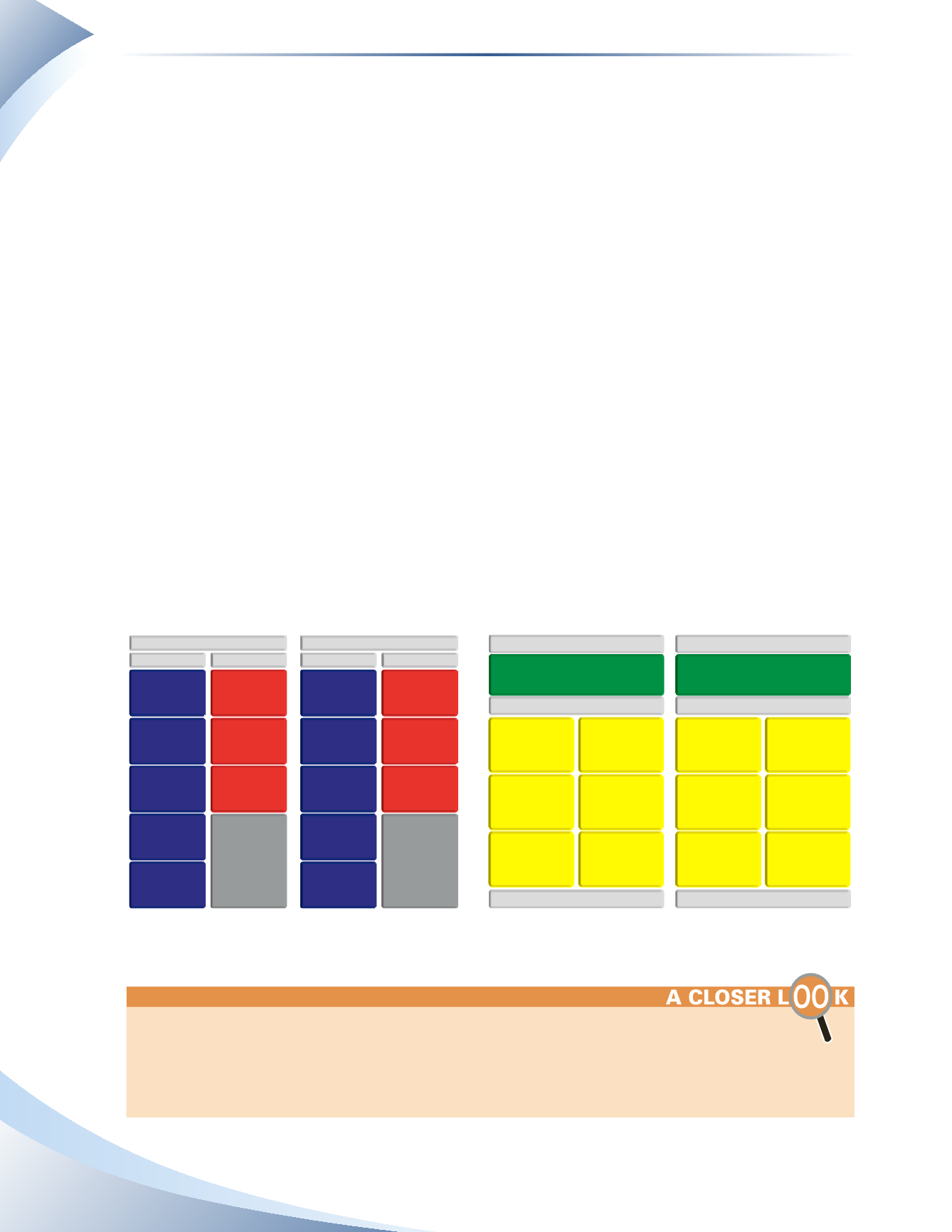

Figure 2.1 shows the comparison between the personal balance sheet and the business balance

sheet, and between the personal income statement and the business income statement.

The list of accounts shown here is a small sample of common accounts used. Large companies will

usually have dozens of asset and liability accounts to track these items. The income statement will

usually have multiple types of revenue accounts and hundreds of different expense accounts. As we

progress through this textbook, we will introduce more accounts as needed, indicating whether they are

asset, liability, equity, revenue or expense accounts.

PERSONAL BALANCE SHEET

BALANCE SHEET

ASSETS

CASH

PREPAID

EXPENSES

HOUSE

AUTOMOBILE

CONTENTS OF

HOME

ASSETS

CASH

ACCOUNTS

RECEIVABLE

PREPAID

EXPENSES

INVENTORY

PROPERTY, PLANT

& EQUIPMENT

LIABILITIES

UNPAID

ACCOUNTS

MORTGAGE

LOANS

NETWORTH

LIABILITIES

ACCOUNTS

PAYABLE

UNEARNED

REVENUE

BANK LOAN

EQUITY

PERSONAL

PERSONAL

BUSINESS

BUSINESS

PERSONAL INCOME STATEMENT

INCOME STATEMENT

SURPLUS (DEFICIT)

NET INCOME (LOSS)

EXPENSES

EXPENSES

REVENUE

SERVICE REVENUE

ENTERTAINMENT

DEPRECIATION

INSURANCE

INTEREST

FOOD

INSURANCE

INTEREST

RENT

MAINTENANCE

SUPPLIES

UTILITIES

UTILITIES

______________

FIGURE 2.1