Chapter 2

Linking Personal Accounting to Business Accounting

37

Pay Cash before the Expense is Incurred

When a company pays before the expense has been incurred, this is a supplier prepayment. This

scenario requires increasing an asset account called a prepaid expense, which was discussed in the

context of personal accounting.These prepayments are not considered an expense at the time they

are paid because the service or the product has not been used.

For example, if a company pays its insurance premiums one year in advance, it is paying for services

not yet received. The premiums should only be expensed in the months to which they apply—

hence they are called prepaid expenses. Other common examples of prepaid expenses are rent and

office supplies, although any time a company pays for products or services in advance, they can be

considered prepaid expenses.

A business paid cash ahead of time to the insurance company for insurance coverage to be provided

for the upcoming year. At the time of the payment, cash decreases and a prepaid expense called

prepaid insurance increases.This prepaid expense is considered an asset because it could be turned

back into cash if the entire year of insurance is not used up (e.g. the policy is cancelled).

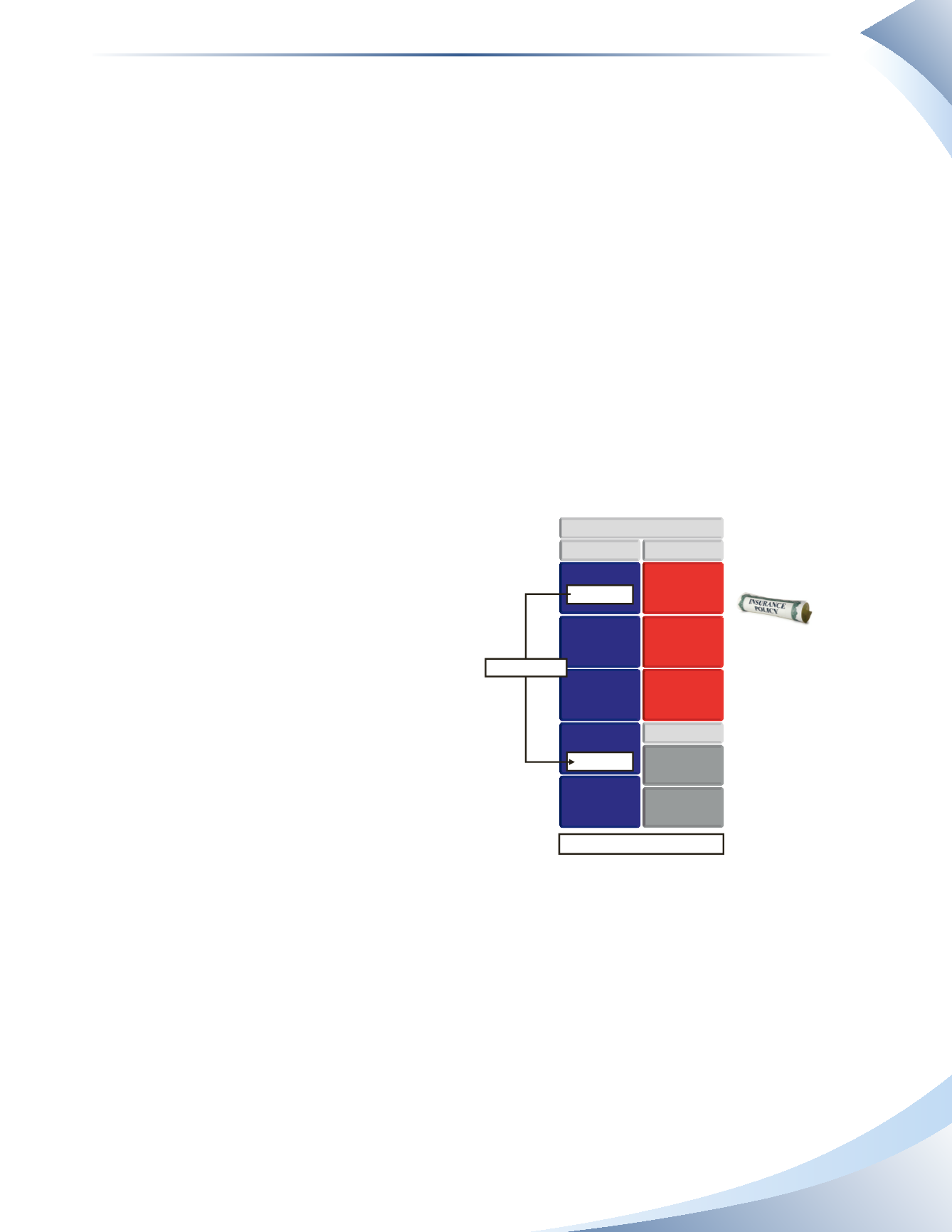

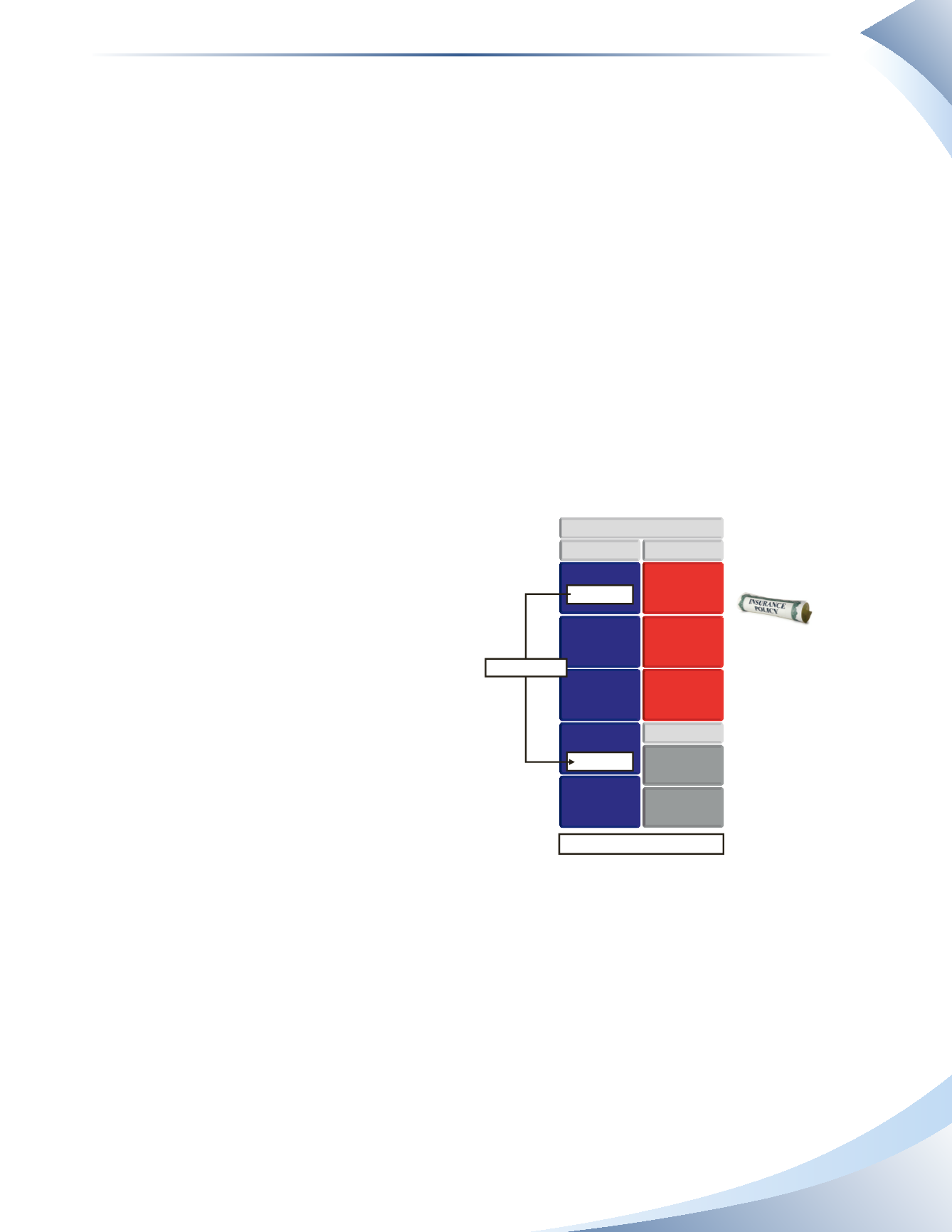

The business paid$3,600 for insurance on January

1, 2016 for insurance coverage throughout 2016.

On January 1, 2016, when the payment is made,

the business’ cash (an asset) decreases by $3,600

and prepaid insurance (another asset) increases

by $3,600. At this point, equity is not affected.

One asset was exchanged for another asset.This

is shown in Figure 2.13.

Notice that expenses, and thus equity, have not

been affected yet. Only as the asset is used up

will an expense be recorded. If the insurance

company fails to provide the services, or the busi-

ness cancels the policy, the insurance company

would have to return cash to the business for the

unused portion of the policy. In this example, as

each month passes, the prepaid insurance will

gradually become an expense.The details for this

transaction will be covered in a later chapter.

2

ASSETS

BALANCE SHEET

LIABILITIES

OWNER’S EQUITY

CASH

ACCOUNTS

RECEIVABLE

PROPERTY, PLANT

& EQUIPMENT

PREPAID

INSURANCE

OFFICE

SUPPLIES

ACCOUNTS

PAYABLE

UNEARNED

REVENUE

BANK

LOAN

OWNER’S

CAPITAL

OWNER’S

DRAWINGS

- $3,600

+ $3,600

The company now owns a

one year insurance policy

No change in owner’s equity

Prepay an expense

______________

FIGURE 2.13