Chapter 2

Linking Personal Accounting to Business Accounting

34

Recording Revenue

In business accounting, as in personal accounting, accrual-based accounting is used to record

transactions. Revenues are recorded or recognized when they are earned regardless of when cash

payment is received from the customer. Cash received for selling services or products is a timing

issue, and cash for revenue can be received from customers at three different times.

1. Received before services are performed

2. Received when services are performed

3. Received after services are performed

In all cases, equity will increase when revenue is recognized.

Cash Received before the Service is Performed

When a customer pays a business for services before they are performed, it is known as a

customer

deposit

. A number of different types of businesses require deposits or prepayments for their

services. Examples include banquet halls (hall rental fees), health clubs (memberships), magazine

publishers (subscription dues) and insurance companies (insurance premiums). In each case, the

business receives cash up front and provides a service at a later date.

Since services have not been performed at the time the cash

is received, service revenue cannot be affected. Instead, the

business has an obligation to provide services in the future.

You will recall that an obligation of a business is a liability.

Thus, a new liability account known as unearned revenue

must be used.

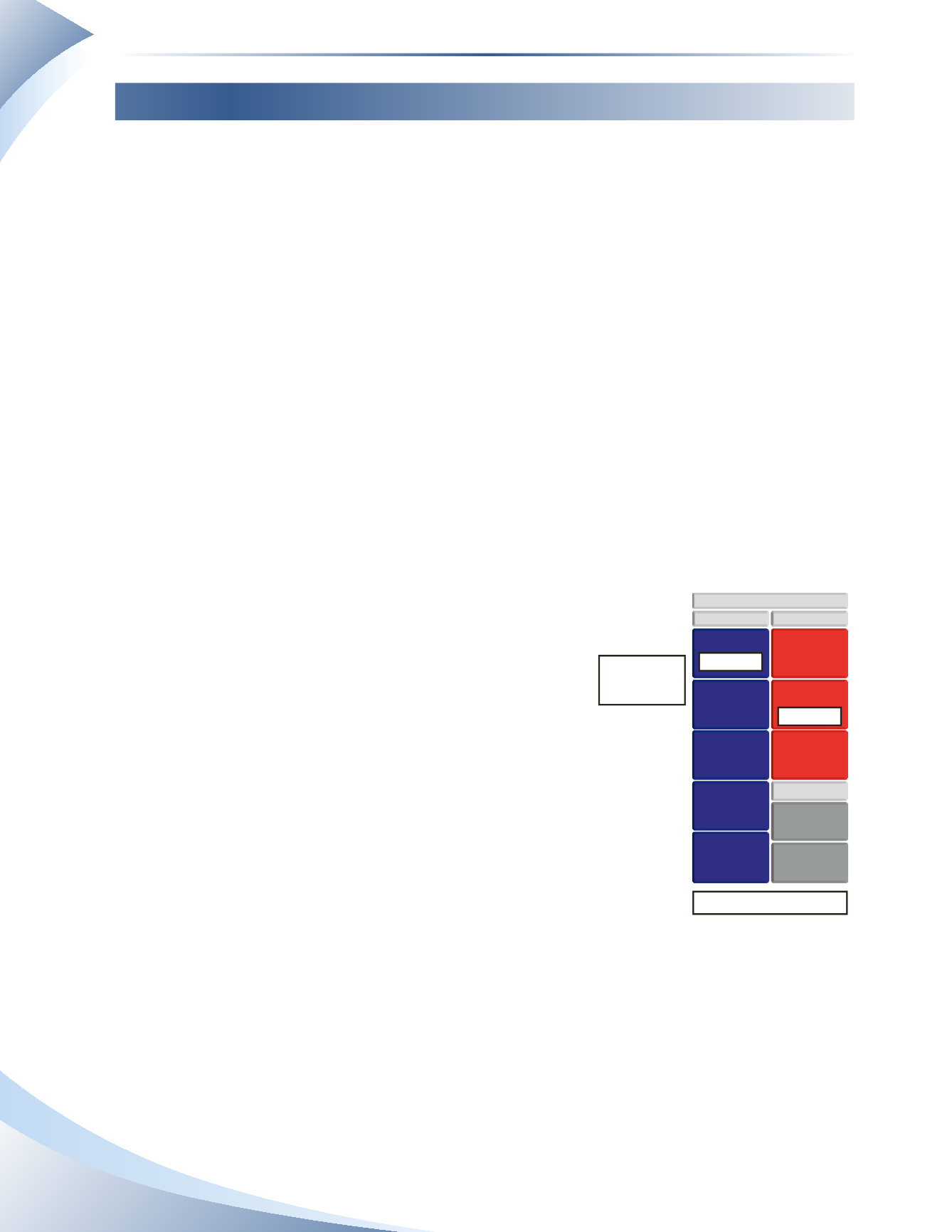

Suppose a business receives a deposit of $1,100 from a

customer one month before services must be provided.

Figure 2.9 illustrates the impact on the accounts of the

business at the time the customer paid for the services (one

month in advance). The prepayment by the customer is a

liability for the business (unearned revenue) because the

business now has an obligation to provide services to the

customer.The payment is essentially held in trust on behalf

of the customer. At this point, there is no impact on equity

because even though cash is received, revenue is not recognized since no work has been completed.

If the business fails to provide the services, they must return the deposit to the customer.

It is only when work is completed in the next month that revenue can be recognized.The transac-

tion to record this will be covered in a later chapter.

2

ASSETS

BALANCE SHEET

LIABILITIES

CASH

ACCOUNTS

RECEIVABLE

PROPERTY, PLANT

& EQUIPMENT

PREPAID

EXPENSES

OFFICE

SUPPLIES

ACCOUNTS

PAYABLE

UNEARNED

REVENUE

BANK

LOAN

+ $1,100

+ $1,100

OWNER’S EQUITY

OWNER’S

CAPITAL

OWNER’S

DRAWINGS

No change in owner’s equity

Receive

prepayment

from customer

______________

FIGURE 2.9