Chapter 2

Linking Personal Accounting to Business Accounting

36

decrease in accounts receivable shows that the service provider received cash and is no longer owed

any amount from the customer (i.e. nothing is “receivable”).

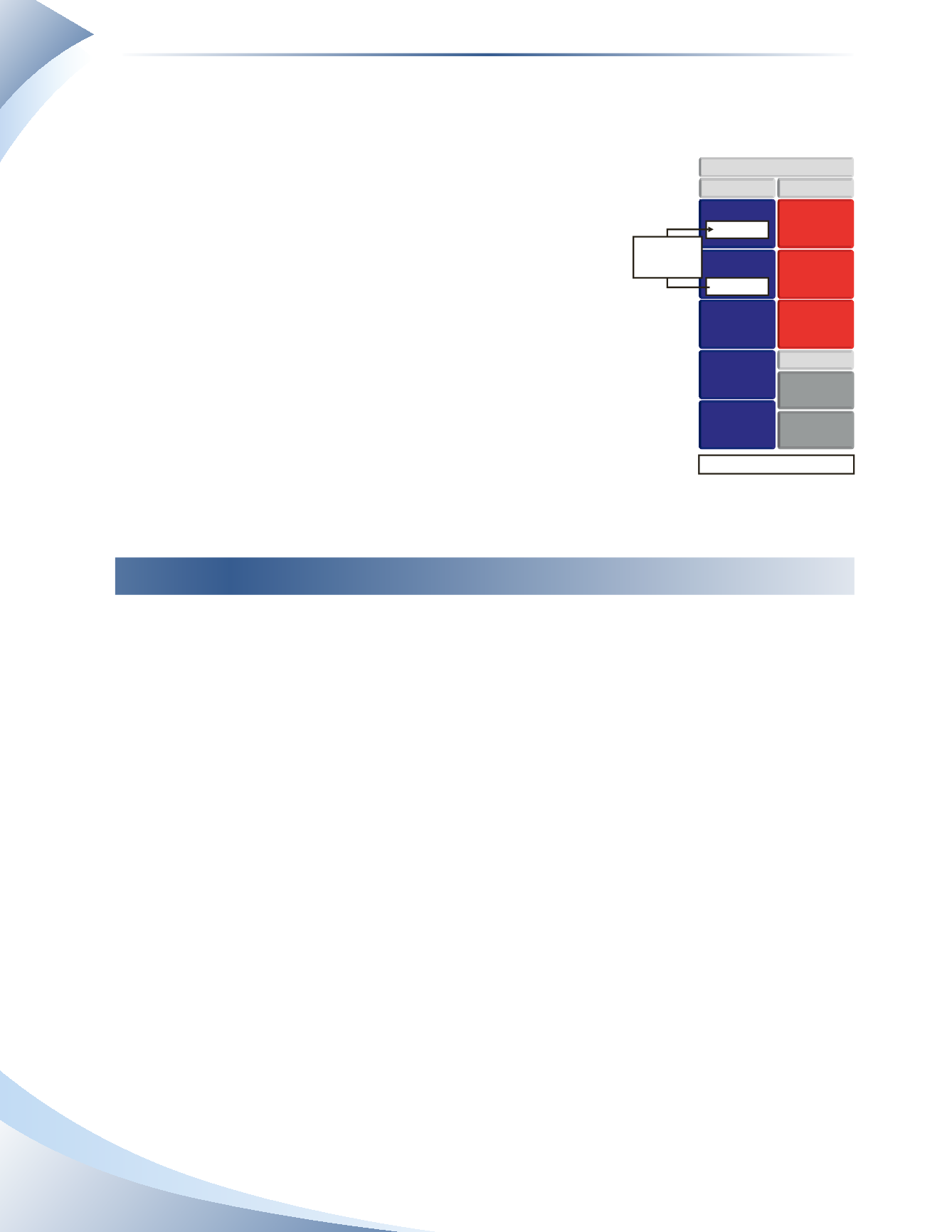

For example, suppose a business provides services valued at

$1,100 and has sent an invoice to the client.The client has prom-

ised to pay in one month. Even though this client is not paying

for the services immediately, equity increases and is recognized as

service revenue on the income statement.This causes net income

to increase. The amount is also recorded in accounts receivable,

an asset indicating the business expects to receive cash from the

client in the future.This is illustrated in Figure 2.11. Remember

that recognizing revenue results in an increase to equity.

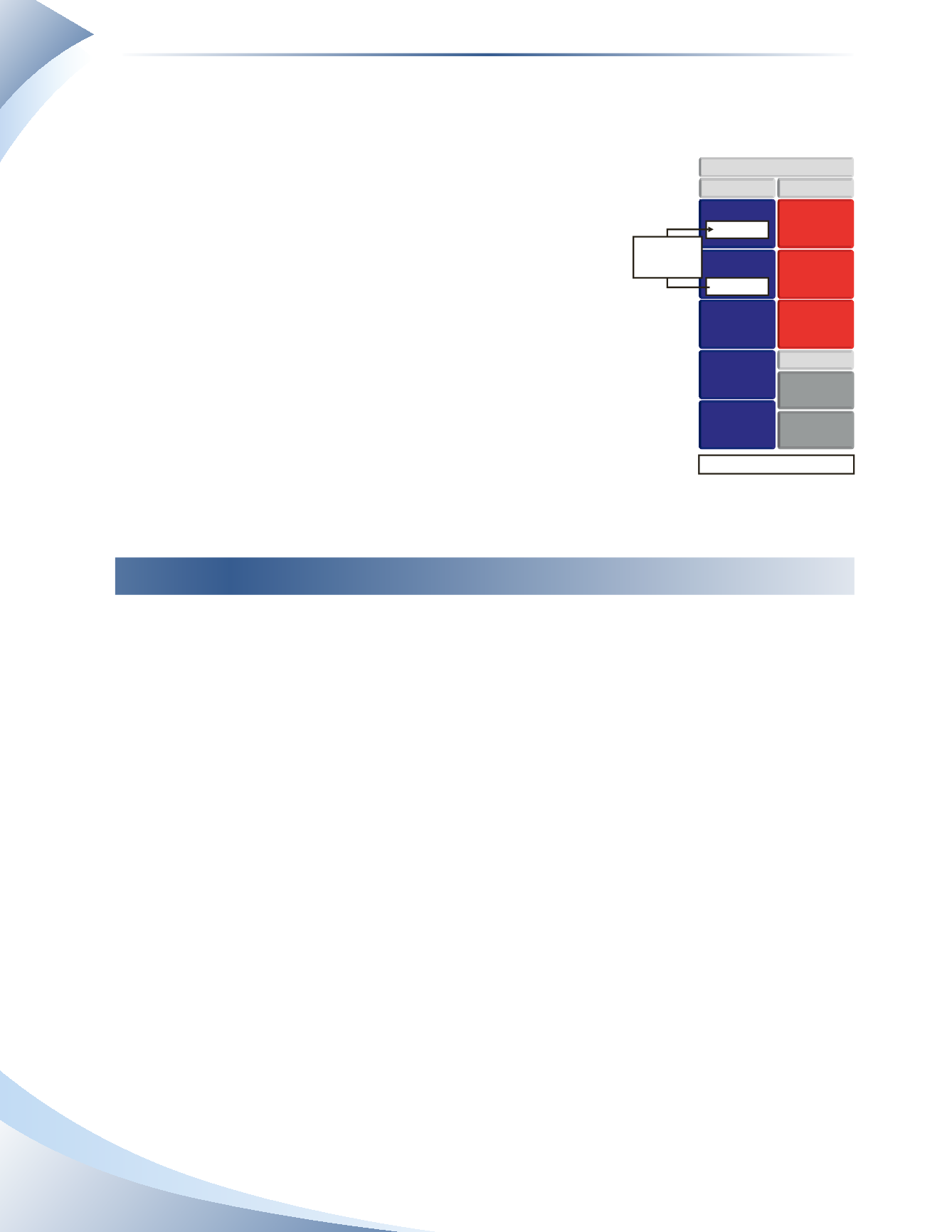

Now assume that one month has passed and the business receives

payment of $1,100 from the client. Figure 2.12 illustrates the

accounting impact of this transaction. This transaction is often

referred to as “receipt of account.” Equity does not change since

one asset is exchanged for another.

Recording Expenses

Expenses, similar to revenues, are recorded when they are incurred, not necessarily when they are

paid.This led to three different timings of the cash payments for expenses.

1. Pay before the expense is incurred

2. Pay when the expense is incurred

3. Pay after the expense is incurred

Notice we use the term “incurred” in all three scenarios. An expense is incurred by a company if

the activities related to the expense have been used or consumed. You may also see the term “recog-

nized” when it comes to expenses and revenue.

Recognizing

an expense or revenue simply means

recording the expense or revenue on the income statement. For example, if a company has hired a

lawn care service company to water the grass on its premises on August 16, the expense has been

incurred once the grass has actually been watered. The expense would be recognized at that time.

If a company pays for internet services, the internet expense for a given month has been incurred

once that month has ended (i.e. the internet services for one month have been used up). In all cases,

when an expense is recognized, this means that equity will decrease.

2

ASSETS

BALANCE SHEET

LIABILITIES

OWNER’S EQUITY

CASH

ACCOUNTS

RECEIVABLE

PROPERTY, PLANT

& EQUIPMENT

PREPAID

EXPENSES

OFFICE

SUPPLIES

ACCOUNTS

PAYABLE

UNEARNED

REVENUE

BANK

LOAN

OWNER’S

CAPITAL

OWNER’S

DRAWINGS

+ $1,100

- $1,100

No change in owner’s equity

Receive cash from

customer for

amount owed

______________

FIGURE 2.12