Chapter 2

Linking Personal Accounting to Business Accounting

35

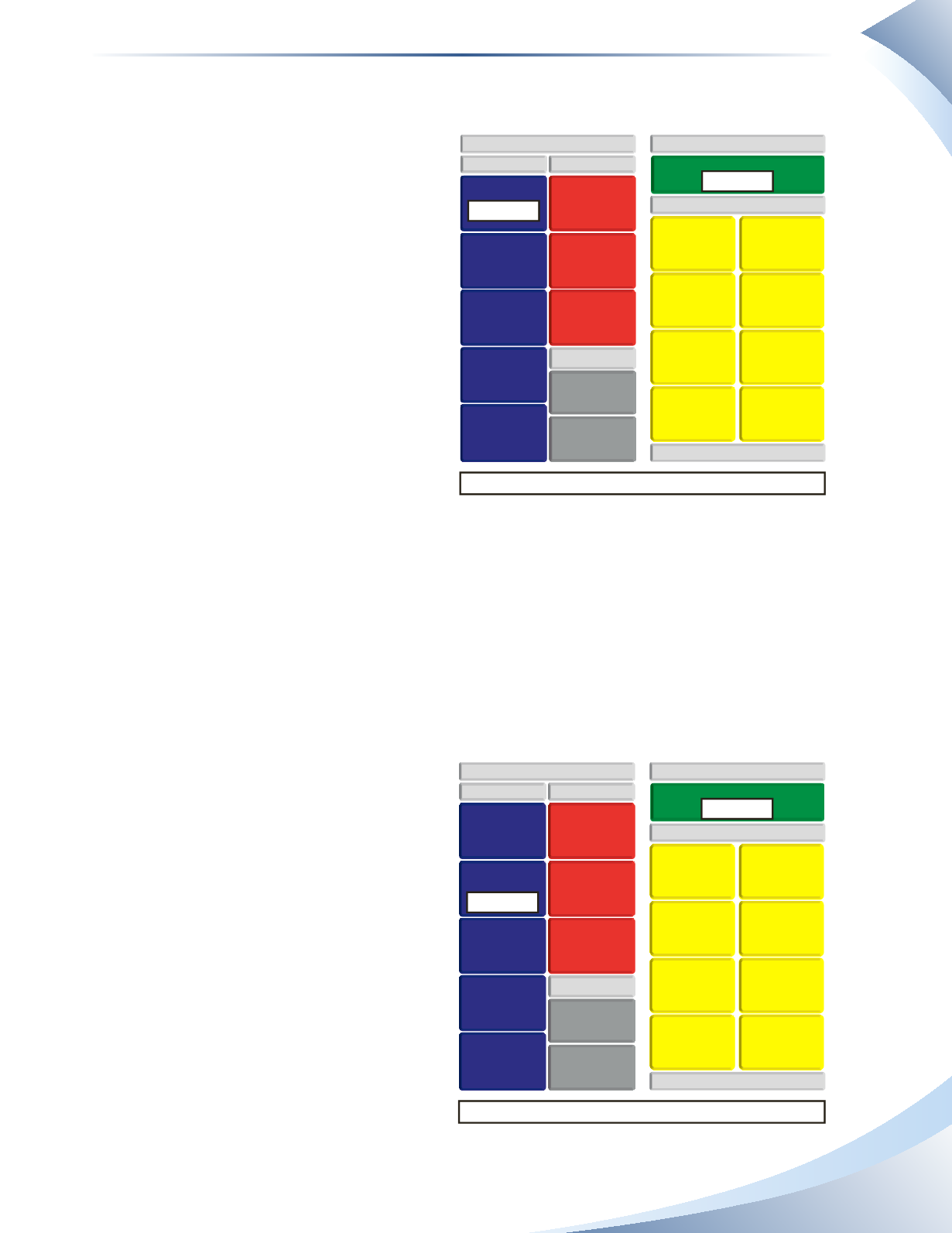

Cash Received when the Service is Performed

When a company performs a service and the

customer pays for it immediately, the trans-

action is fairly straightforward. From the

service provider’s perspective, cash increases

and equity increases. The increase in equity

is recognized as revenue and increases net

income.

If a client pays $1,100 cash immediately

when the business provides the service, then

cash and service revenue will be affected.The

impact on cash and service revenue is shown

in Figure 2.10. Remember that recognizing

revenue results in an increase to equity.

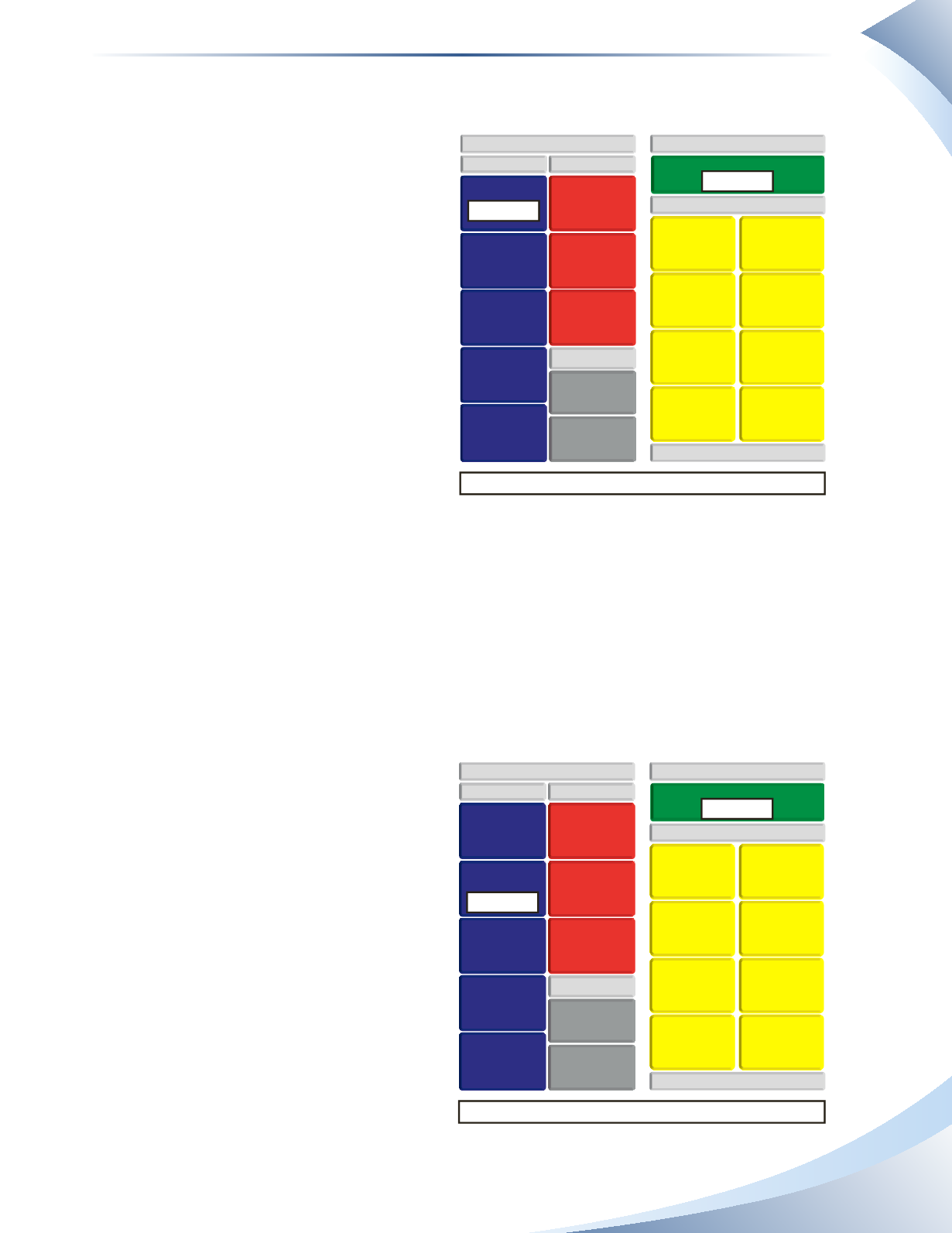

Cash Received after the Service is Performed

Most businesses provide customers with payment terms which allow customers to pay after they

have received the product or service (e.g. 30 days to pay the balance owing).This form of making

sales is sometimes referred to as “selling on account.” You may mistakenly think that the value of

equity would not change when selling with payment terms because no cash was received from the

sale. However, revenue must be recorded at the time the product is sold or the service is delivered,

regardless of when the payment is received.

When a company provides payment terms to

sell its products or services, the money owed

by its customers is recorded as an asset, called

accounts receivable.After a service is provided,

the seller issues an

invoice

to the buyer. The

invoice includes the details of the service

rendered and the agreed-upon price. This

indicates that the customer now owes the

balance and needs to pay the seller by the date

stated on the invoice. From the seller’s

perspective, this indicates an increase in

accounts receivable (an asset) and an increase

in equity (recognized as revenue). Later, when

the customer actually pays the outstanding

amount, the issuing company increases cash

and decreases accounts receivable. The

______________

FIGURE 2.10

INCOME STATEMENT

NET INCOME (LOSS)

EXPENSES

2

ASSETS

BALANCE SHEET

LIABILITIES

CASH

ACCOUNTS

RECEIVABLE

PROPERTY, PLANT

& EQUIPMENT

PREPAID

EXPENSES

OFFICE

SUPPLIES

ACCOUNTS

PAYABLE

UNEARNED

REVENUE

BANK

LOAN

+ $1,100

SERVICE REVENUE

DEPRECIATION

INTEREST

INSURANCE

SALARIES

RENT

TELEPHONE

TRAVEL

MAINTENANCE

Owner’s equity increases by $1,100

OWNER’S EQUITY

OWNER’S

CAPITAL

OWNER’S

DRAWINGS

+ $1,100

INCOME STATEMENT

NET INCOME (LOSS)

EXPENSES

2

ASSETS

BALANCE SHEET

LIABILITIES

CASH

ACCOUNTS

RECEIVABLE

PROPERTY, PLANT

& EQUIPMENT

PREPAID

EXPENSES

OFFICE

SUPPLIES

ACCOUNTS

PAYABLE

UNEARNED

REVENUE

BANK

LAON

+ $1,100

SERVICE REVENUE

DEPRECIATION

INTEREST

INSURANCE

SALARIES

RENT

TELEPHONE

TRAVEL

MAINTENANCE

Owner’s equity increases by $1,100

OWNER’S EQUITY

OWNER’S

CAPITAL

OWNER’S

DRAWINGS

+ $1,100

______________

FIGURE 2.11