Chapter 10

Cash Controls

298

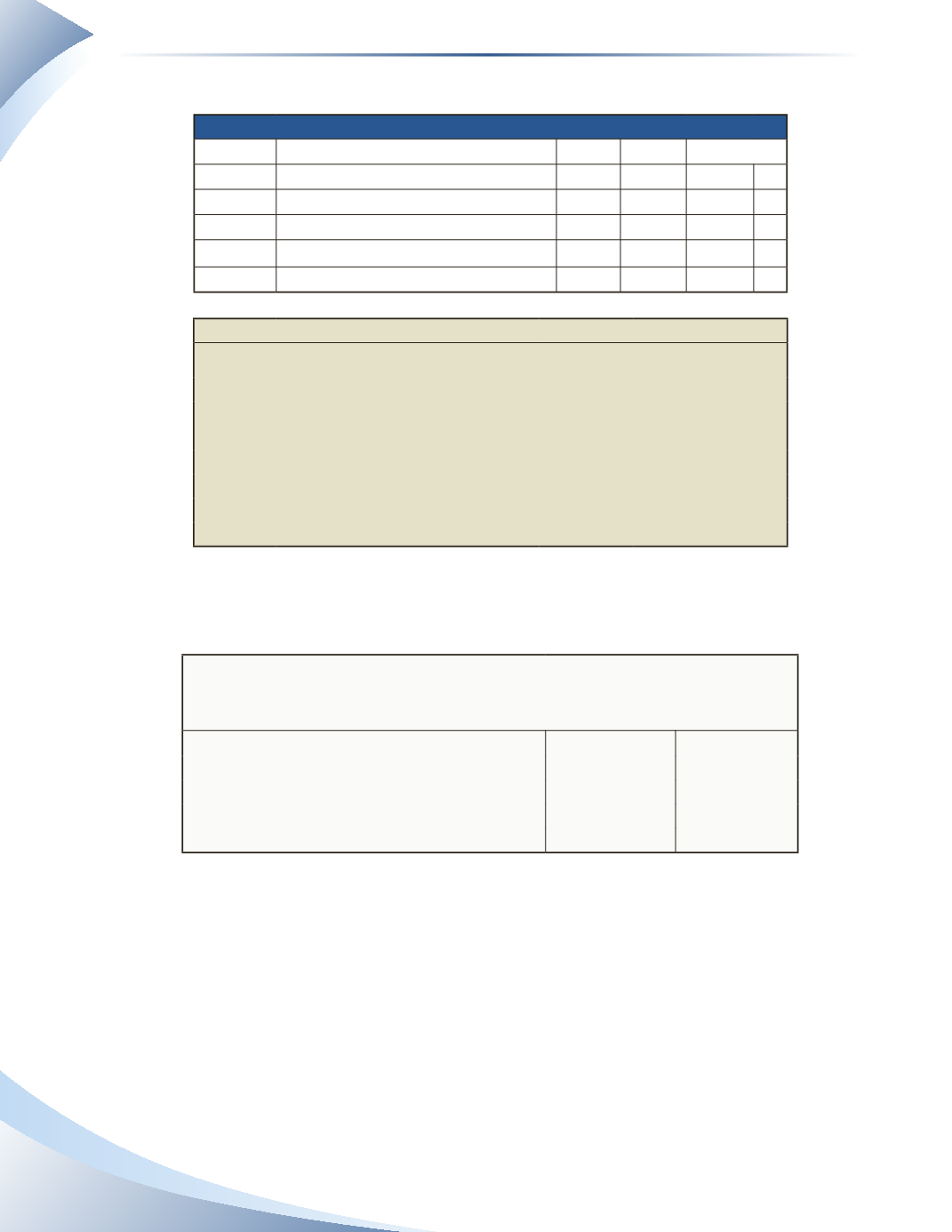

GENERAL LEDGER

Account: Cash

GL. No. 101

Date

Description

DR CR

Balance

Jun 1 Opening Balance

5,000 DR

Jun 2 Cheque #1

300 4,700 DR

Jun 3 Cheque #2

500 4,200 DR

Jun 10 Cheque #3

700 3,500 DR

Jun 17 Deposit

400

3,900 DR

Bank Statement

June 1–June 30, 2016

Date

Description

Withdrawal Deposit Balance

Jun 1 Opening Balance

5,000

Jun 2 Cheque #1

300

4,700

Jun 3 Cheque #2

500

4,200

Jun 10 Cheque #3

700

3,500

Jun 17 Deposit

400

3,900

Jun 19 NSF Cheque

400

3,500

Jun 19 NSF Charge

10

3,490

______________

Figure 10.11

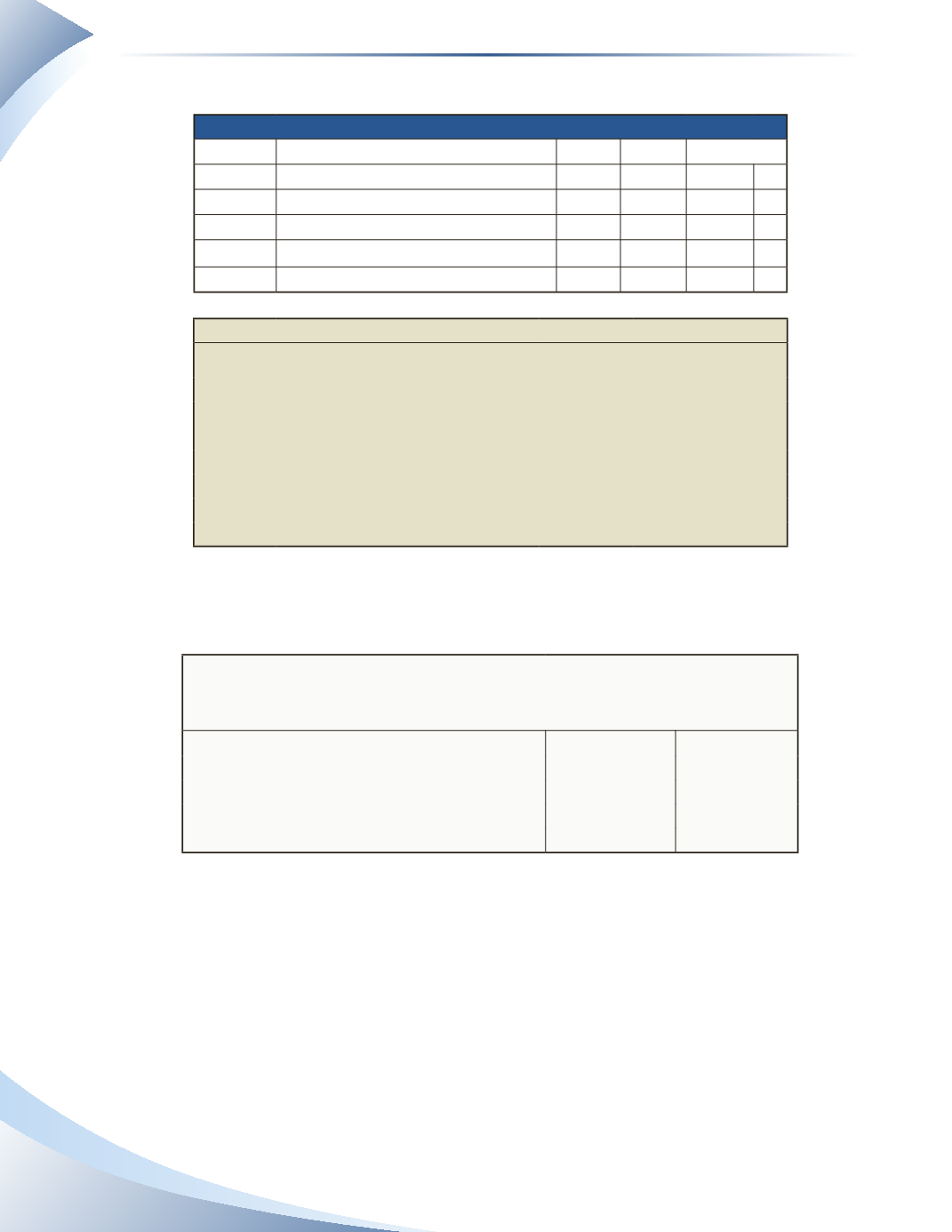

The bank reconciliation for this item is shown in Figure 10.12.

HR Clothing

Bank Reconciliation

June 30, 2016

Ledger

Bank

Balance as per records

$3,900

$3,490

Less:

NSF Cheque

(400)

Charges for NSF Cheque

(10)

Reconciled balance

$3,490

$3,490

______________

Figure 10.12

This adjustment should also be recorded in the journal and updated in the ledger. Since an NSF

cheque represents the amount of cash receipts unsuccessfully collected, this amount should be

added to the company’s accounts receivable account. In addition, the bank charge associated with

the NSF cheque should also be recorded.The journal entries are shown in Figure 10.13. To keep

the charges separate from the other bank charges, an account called NSF charges expense is used.