Chapter 10

Cash Controls

297

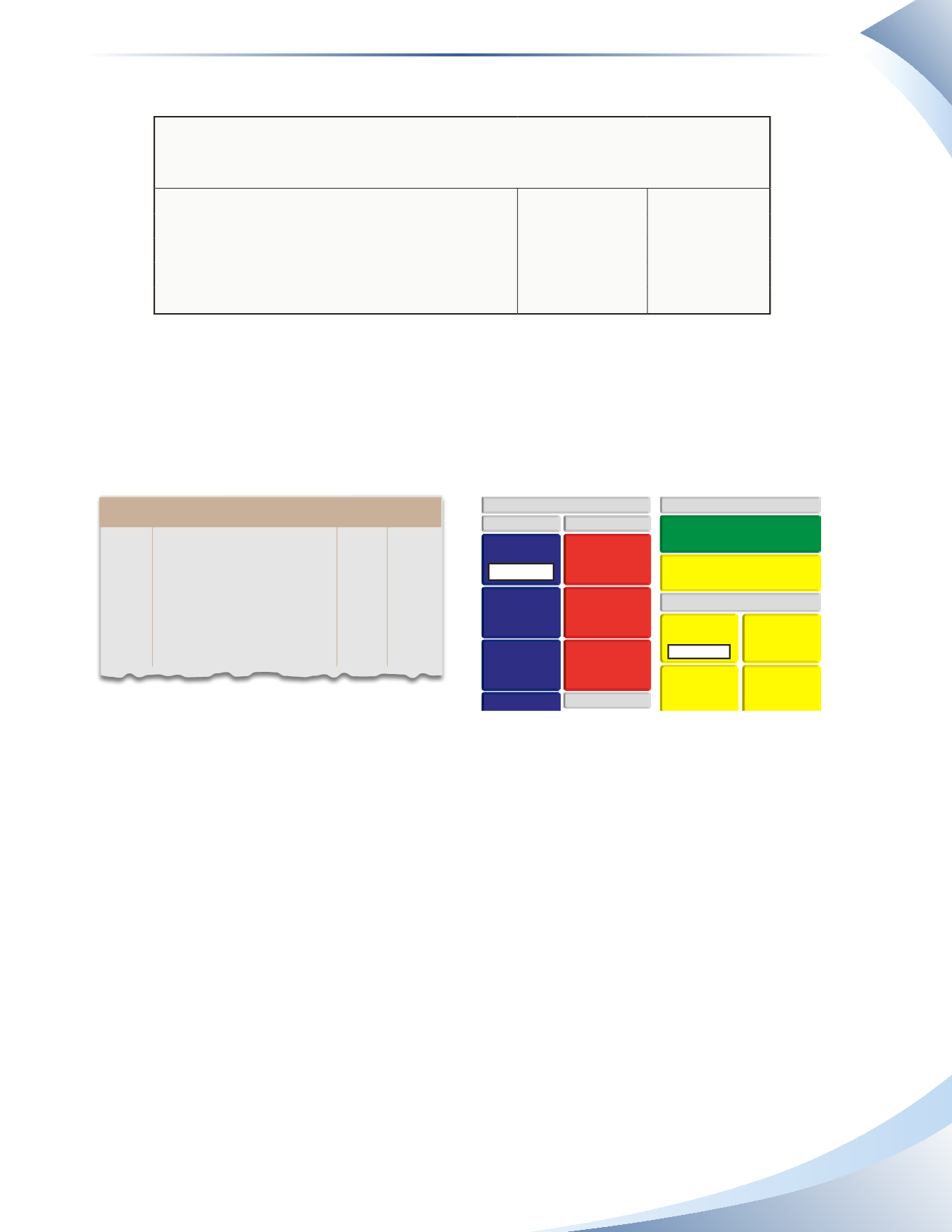

The bank reconciliation for this item is shown in Figure 10.9.

hr Clothing

Bank reconciliation

June 30, 2016

ledger

Bank

Balance as per records

$3,500

$3,450

Less: Unrecorded charges

Bank Charges June 30

(50)

Reconciled balance

$3,450

$3,450

______________

FIGURE 10.9

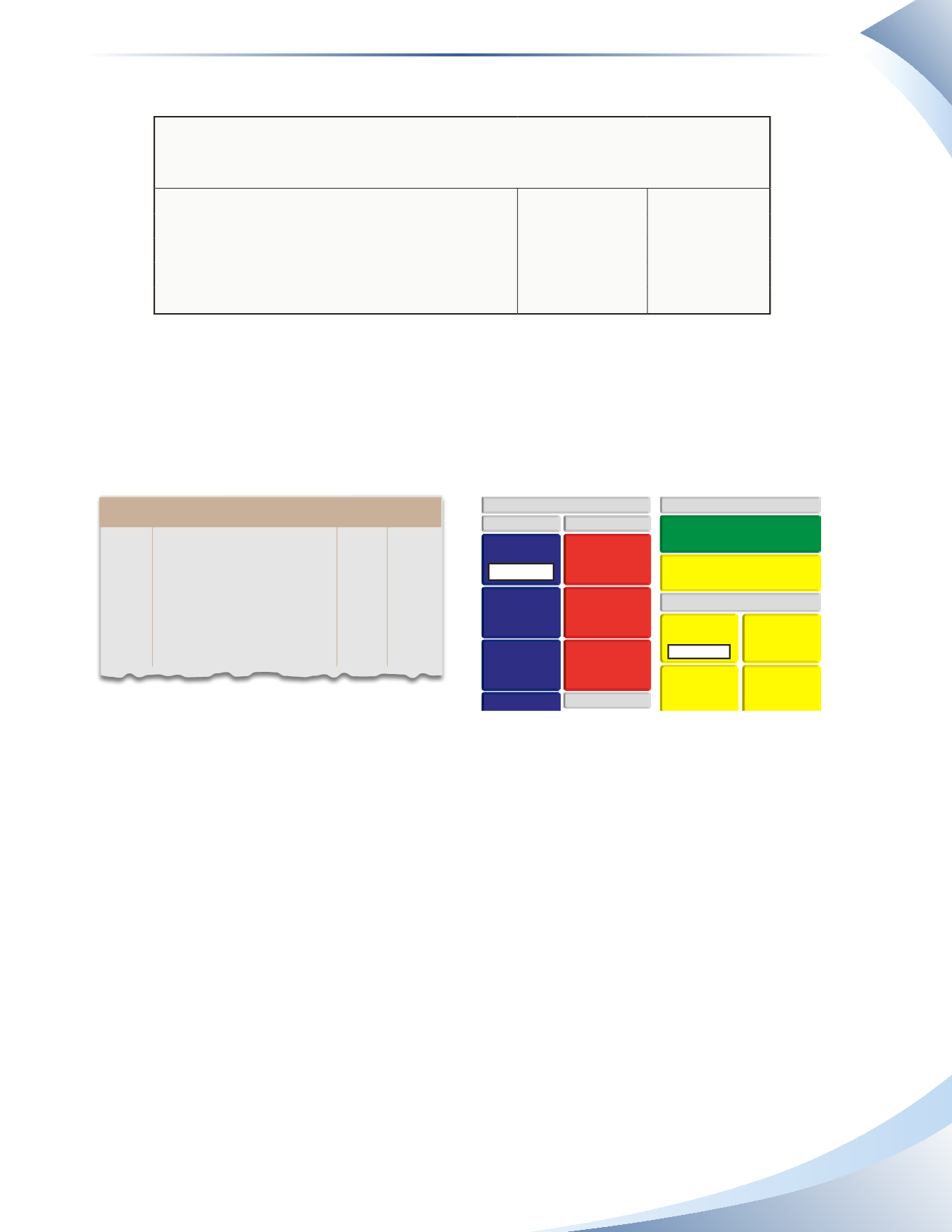

As with the unrecorded deposit shown previously, the adjustment is shown in the ledger column,

so it must be updated with a journal entry as shown in Figure 10.10. Notice that the journal entry

includes the account bank charges expense. On the Accounting Map, bank charges are listed under

operating expenses on the income statement.

Journal

Page 1

Date

account title and

explanation

Debit Credit

2016

Jun 30 Bank Charges Expense

50

Cash

50

Bank service charge

______________

FIGURE 10.10

ACCOUNTS

RECEIVABLE

INCOME STATEMENT

SALES REVENUE

COST OF GOODS SOLD

ACCOUNTS

PAYABLE

INVENTORY

ASSETS

BALANCE SHEET

LIABILITIES

CASH

OWNER’S EQUITY

UNEARNED

REVENUE

LOANS

PAYABLE

–

$50 CR

GROSS PROFIT

BANK

CHARGES

INSURANCE

RENT

SALARIES

+

$50 DR

The journal entry is recorded by debiting (increasing) bank charges expense and crediting

(decreasing) cash (an asset).

Another type of bank charge can occur as a result of

non-sufficient funds

(NSF)

cheques. NSF

cheques are payments made to the company by a customer who does not have sufficient funds in

their bank account to cover the amount of the cheque. If the customer does not have enough money

in their bank account to cover the cheque, their bank will charge them an NSF fee.The company’s

bank will also charge the company with an NSF fee. The fee is to cover the bank’s administrative

costs of dealing with the NSF cheque.

For example, HR Clothing receives a $400 cheque from a customer and deposits the cheque into the

company bank account on June 17. However, the bank cannot successfully collect the $400 from the

customer’s account because the customer does not have enough money in his account to support this

withdrawal. The bank would return the cheque to the company and charge an additional service fee.

These two transactions are illustrated in Figure 10.11 between the general ledger and the bank statement

respectively.